Business Idea

- Brand : PortfolioSync

- Problem : Freelancers and creators struggle to build and maintain a professional online portfolio.

- Solution : A SaaS platform that automatically generates and updates a portfolio based on users’ work history, social posts, and projects.

- Differentiation : Unlike simple website builders, it continuously pulls new achievements and organizes them into a dynamic, living portfolio.

- Customer : Freelancers, digital creators, job seekers, and small business owners building personal brands.

- Business Model : Freemium with premium plans offering custom domains, analytics, and advanced customization.

- Service Region : Global

1. Business Overview

1.1 Core Idea Summary

PortfolioSync is an innovative SaaS platform that automatically generates, updates, and maintains professional online portfolios for freelancers and digital creators by intelligently aggregating their work history, social media posts, and completed projects into a cohesive digital presence.

This service addresses the significant time investment and technical barriers freelancers face when building their professional online presence by leveraging AI-driven content aggregation and organization to deliver a continuously updated, visually appealing portfolio that effectively showcases their skills, experience, and accomplishments.

[swpm_protected for=”4″ custom_msg=’This report is available to Harvest members. Log in to read.‘]

1.2 Mission and Vision

Mission: To empower freelancers and creators to showcase their professional accomplishments effortlessly through automated, always-current portfolio solutions.

Vision: To become the global standard for digital professional presence, where every independent professional can present their best work without technical or time barriers.

We aim to transform how freelancers and creators present themselves professionally by automating the portfolio creation and maintenance process, thereby allowing them to focus on their craft while maintaining an impressive, current digital presence that attracts new opportunities.

1.3 Main Products/Services Description

PortfolioSync offers the following core products/services:

- Automated Portfolio Generation: AI-powered system that pulls from multiple sources (LinkedIn, GitHub, Behance, Instagram, etc.) to create a comprehensive portfolio website that reflects users’ professional history and creative work.

- Dynamic Content Updating: Continuous monitoring of connected accounts and work platforms to automatically incorporate new projects, posts, and accomplishments into the portfolio without manual intervention.

- Customizable Portfolio Templates: Professional, responsive design templates optimized for different industries (design, development, writing, photography, etc.) with personalization options for colors, layout, and organization.

- Analytics Dashboard: Insights into portfolio performance, including visitor demographics, time spent on different sections, and interaction metrics to help users optimize their professional presentation.

- SEO Optimization: Built-in tools to improve discoverability of portfolios in search engines, including metadata management, structured data implementation, and keyword optimization specific to users’ skills and industry.

These products/services differentiate PortfolioSync by focusing on automation and continuous relevance rather than just initial portfolio creation, addressing the critical but often neglected aspect of portfolio maintenance that most freelancers struggle with due to time constraints.

2. Market Analysis

2.1 Problem Definition

Currently, freelancers and digital creators face these significant challenges:

- Time-consuming portfolio maintenance: According to research by Upwork, freelancers spend an average of 7-12 hours per month managing their professional presence, with portfolio updates often delayed or neglected entirely due to client work priorities. This represents approximately $400-700 in lost billable hours monthly.

- Technical barriers to professional presentation: A 2022 survey by Fiverr found that 68% of freelancers feel they lack the technical skills to create an impressive portfolio website, with 41% using suboptimal free services that limit their professional image.

- Fragmented professional identity: With work spread across multiple platforms, 74% of freelancers report difficulty in presenting a cohesive professional narrative, causing potential clients to miss significant portions of their experience and capabilities.

- High abandonment rate: Data from website builders shows that 82% of freelancer portfolios are abandoned within 6 months of creation, becoming quickly outdated and potentially damaging professional reputation rather than enhancing it.

- Lost opportunities: Research by The Freelancer Club indicates that 53% of independent professionals have lost client opportunities due to outdated portfolios that don’t showcase their most recent and relevant work.

These problems result in reduced earning potential, impaired professional credibility, and significant opportunity costs. PortfolioSync addresses these issues by automating the entire portfolio creation and maintenance process, keeping freelancers’ professional presence current without requiring technical skills or ongoing time investment.

2.2 TAM/SAM/SOM Analysis

Total Addressable Market (TAM): The global freelancer market includes approximately 1.57 billion freelancers worldwide (World Economic Forum, 2023), with an estimated 70% requiring some form of portfolio presence. At an average potential spend of $120/year for portfolio tools, this represents a $131.9 billion annual market.

Serviceable Available Market (SAM): Focusing on digitally active freelancers in creative, technical, and professional service fields across North America, Europe, and developed APAC regions, we identify approximately 87 million potential users with both the need and financial capacity to adopt our solution, representing a $10.4 billion annual market.

Serviceable Obtainable Market (SOM): With our go-to-market strategy and operational capacity, we project capturing 0.15% of SAM in Year 1 ($15.6 million), growing to 1.2% by Year 3 ($124.8 million) and 3.5% by Year 5 ($364 million) through targeted expansion in high-value creative and technical freelance segments.

These market size estimates are based on data from Upwork’s Freelancer Income Report, Fiverr’s Global Freelance Index, LinkedIn’s Workforce Report, and specialized market research by Technavio and IBISWorld. Our market entry and expansion strategy follows a deliberate focus on high-value, high-growth freelance segments with strong portfolio needs, beginning with digital creative professionals and gradually expanding to adjacent sectors.

2.3 Market Trends

Key market trends affecting PortfolioSync’s growth include:

- Exponential freelance workforce growth: The freelance economy is growing at 15% year-over-year globally, significantly outpacing traditional employment (McKinsey, 2023). This rapid expansion creates a constantly increasing base of potential users needing portfolio solutions.

- Increasing specialization and competition: As freelance markets mature, 67% of independent professionals report increasing competition in their niche, driving the need for more sophisticated professional presentation to stand out (Freelancers Union, 2023).

- Platform fragmentation: The average freelancer now works across 4.3 different platforms or marketplaces, up from 2.1 in 2018, creating greater need for unified professional presentation (Payoneer Global Freelancer Income Report).

- Client expectations evolution: 83% of clients now expect to see current, relevant portfolio examples before hiring, with 62% reporting they reject candidates with outdated or incomplete portfolios without further consideration (Clutch Client Survey, 2022).

- Shift toward personal branding: 91% of successful freelancers attribute at least 30% of their premium rates to strong personal branding, with portfolios being the primary brand asset (Creative Boom Freelancer Survey).

- AI adoption in creative tools: AI-enhanced creative and productivity tools have seen 340% growth in adoption among freelancers over the past 24 months, indicating high receptivity to intelligent automation solutions (Adobe Creative Cloud Report).

These trends present substantial opportunities for PortfolioSync by creating both increasing demand for portfolio solutions and growing receptivity to automated, AI-driven tools that solve persistent professional challenges for independent workers.

2.4 Regulatory and Legal Considerations

Key regulatory and legal considerations affecting PortfolioSync’s operations include:

- Data privacy regulations: GDPR in Europe, CCPA/CPRA in California, and similar emerging frameworks globally impact how we collect, process, and store user data from various platforms. Compliance requires implementing robust data protection measures, clear consent mechanisms, and documented data processing activities.

- API usage policies: Our automated portfolio generation relies on accessing data from platforms like LinkedIn, GitHub, Behance, and others through their APIs, each with specific terms of service and rate limitations. Changes to these policies could affect service functionality and require technical adaptations.

- Copyright and intellectual property: Portfolio generation involves displaying users’ creative works, raising copyright considerations. Our platform must implement clear attribution, respect copyright restrictions, and provide mechanisms for users to control what work is displayed and how.

- Terms of service compliance: Aggregating content from multiple platforms requires adherence to each platform’s terms of service. Changes to these terms could impact our ability to access and display certain content types or from specific sources.

- Consumer protection laws: As a subscription service operating globally, PortfolioSync must navigate varied consumer protection regulations regarding billing practices, cancellation policies, and service guarantees across different jurisdictions.

To address this regulatory environment, we will implement a compliance-by-design approach, with regular legal reviews of platform functionality, clear user agreements specifying data handling practices, and a flexible technical architecture that can adapt to evolving regulatory requirements across jurisdictions. We will also maintain a compliance calendar to track upcoming regulatory changes in key markets.

3. Customer Analysis

3.1 Persona Definition

PortfolioSync’s key customer personas are:

Persona 1: Creative Cathy

- Demographics: 28-35 years old, female, graphic designer/illustrator, $65,000-85,000 annual income, bachelor’s degree in design or related field

- Characteristics: Visually oriented, moderately tech-savvy but not a coder, values aesthetics highly, active on Instagram and Behance

- Pain points: Struggles to keep portfolio current while managing client work, finds existing portfolio tools either too basic or too technical, work is scattered across multiple platforms, loses track of older projects that might be relevant to new clients, feels her current portfolio doesn’t fully represent her skills

- Goals: Attract higher-paying clients, develop a distinctive personal brand, showcase versatility while maintaining a cohesive style

- Purchase decision factors: Visual quality of templates, ease of customization without coding, ability to import from design platforms she already uses

Persona 2: Developer Dan

- Demographics: 25-40 years old, male, software developer/engineer, $90,000-120,000 annual income, self-taught or computer science degree

- Characteristics: Highly technical, values efficiency and function over form, active on GitHub and Stack Overflow, busy with multiple concurrent projects

- Pain points: Has no time to build and maintain a portfolio despite having technical skills to do so, struggles to translate technical accomplishments into understandable client benefits, has a graveyard of half-built portfolio sites

- Goals: Showcase technical expertise to potential clients without extensive time investment, highlight problem-solving abilities, document project history for future reference

- Purchase decision factors: GitHub integration quality, technical SEO features, performance metrics of generated sites, automation capabilities

Persona 3: Content Creator Carlos

- Demographics: 22-32 years old, non-binary, content writer/social media manager, $45,000-70,000 annual income, various educational backgrounds

- Characteristics: Word-oriented, moderately tech-savvy, active across multiple social platforms, juggles many small clients

- Pain points: Content created for clients is often published without bylines making it hard to claim, work is extremely fragmented across dozens of clients and platforms, struggles to organize and present diverse content types coherently

- Goals: Demonstrate versatility across industries and content formats, build a personal brand separate from client work, establish expertise in specific niches

- Purchase decision factors: Social media integration capabilities, content categorization features, analytics to show content performance, ease of maintaining separate portfolios for different target clients

3.2 Customer Journey Map

The journey of a typical PortfolioSync customer can be analyzed in these stages:

Awareness Stage:

- Customer Behavior: Realizes their outdated or non-existent portfolio is costing them opportunities; searches for portfolio solutions or sees peers with impressive portfolios; may discover us through social media, freelance forums, or content marketing

- Touchpoints: Blog content on portfolio best practices, targeted ads on freelance platforms, social proof from other users, industry newsletters

- Emotional State: Frustrated with missed opportunities, anxious about time investment needed, guilty about neglecting professional presentation

- Opportunity: Emphasize time-saving automation and continuous updating as key differentiation; provide free portfolio assessment tool to highlight gaps

Consideration Stage:

- Customer Behavior: Compares PortfolioSync with traditional website builders, manual portfolio creation, and competitor solutions; researches features, reads reviews, and calculates ROI

- Touchpoints: Feature comparison pages, case studies from similar professionals, free trial offer, integration list with platforms they use

- Emotional State: Cautiously optimistic but skeptical about automation claims; concerned about quality and customization

- Opportunity: Provide interactive demos with their actual content pulled from connected accounts; showcase before/after portfolios for similar professionals

Decision Stage:

- Customer Behavior: Evaluates free trial results; considers pricing against perceived time savings; may consult peers; decides whether to commit to paid plan

- Touchpoints: Onboarding experience, initial portfolio generation results, pricing page, subscription process

- Emotional State: Excited by initial results but concerned about long-term value; evaluating if the subscription cost justifies benefits

- Opportunity: Offer first-month guarantee; provide clear ROI calculator showing time/money saved; showcase additional premium features

Usage Stage:

- Customer Behavior: Customizes generated portfolio; shares with potential clients; monitors analytics; connects additional content sources

- Touchpoints: Dashboard interface, email notifications about updates, support resources, feature tutorials

- Emotional State: Initially delighted with time savings; may experience friction with specific customization needs

- Opportunity: Proactively suggest portfolio improvements; highlight automatically added new content; provide tailored tips based on industry and usage patterns

Loyalty Building:

- Customer Behavior: Renews subscription; recommends to peers; possibly upgrades to higher tier; provides feedback for improvements

- Touchpoints: Success stories featuring their portfolio; renewal communications; referral program; feedback channels

- Emotional State: Proud of professional presentation; relieved about ongoing automation; invested in platform improvements

- Opportunity: Implement loyalty rewards; provide exclusive templates/features; create community for freelancers to share tips and opportunities

3.3 Initial Customer Interview Results

Key insights from our initial customer interviews for developing PortfolioSync’s products/services include:

- Interview Subjects: 42 freelancers and creators across design, development, writing, photography, and marketing fields, varying in experience from 1-15+ years

- Key Finding 1: 87% of interviewees admitted their portfolios were outdated by 6+ months, with 34% not having updated in over a year despite completing significant new projects

- Key Finding 2: The primary barrier to portfolio maintenance wasn’t lack of interest but competition with billable work—participants valued updating their portfolios but consistently prioritized client deadlines

- Key Finding 3: Creative professionals showed strong resistance to fully automated solutions that might compromise aesthetic control; they preferred a hybrid approach with automation handling content aggregation but allowing manual design adjustments

- Key Finding 4: Technical professionals were primarily concerned with accurately representing project complexity and their specific contributions to team projects—they needed contextual information preserved alongside code samples

- Key Finding 5: 76% expressed frustration with existing solutions requiring manual content copying from original platforms, leading to duplicate effort and inconsistencies between original work and portfolio representations

- Key Finding 6: Interviewees reported spending 4-15 hours creating an initial portfolio but then struggling to maintain it, creating a cycle of complete rebuilds every 12-18 months rather than continuous updates

Based on these insights, we’ve refined our product development to focus on a tiered automation approach that handles the most time-consuming aspects (content aggregation and organization) while providing customization controls for visual presentation. We’ve also prioritized platform integrations based on user preference data, with GitHub, Behance, Instagram, and LinkedIn identified as the highest-priority content sources.

4. Competitive Analysis

4.1 Direct Competitor Analysis

PortfolioSync faces several established competitors in the portfolio creation space:

Competitor 1: Behance (https://www.behance.net)

- Strengths: Massive creative community, Adobe integration, discovery features, established reputation

- Weaknesses: Not fully automated, requires manual uploads, limited customization without premium, steep learning curve

- Pricing: Free basic membership, Adobe Creative Cloud subscription for premium features ($52.99/month)

- Differentiation: Behance is a showcase platform requiring manual updates, while PortfolioSync automatically aggregates and organizes content

Competitor 2: Wix (https://www.wix.com)

- Strengths: Intuitive drag-and-drop interface, extensive template library, strong SEO tools, comprehensive website builder

- Weaknesses: No automatic content aggregation, requires technical skills for advanced customization, becomes expensive with premium features

- Pricing: Limited free plan, Premium plans $16-45/month

- Differentiation: Wix is a general website builder requiring manual updates, while PortfolioSync focuses specifically on automated portfolio creation

Competitor 3: Squarespace (https://www.squarespace.com)

- Strengths: Premium design aesthetics, professional templates, all-in-one platform with e-commerce, comprehensive analytics

- Weaknesses: Higher pricing, steeper learning curve, limited flexibility outside templates, manual content management

- Pricing: Personal plan $16/month, Business plan $26/month

- Differentiation: Squarespace offers polished templates but lacks automation; PortfolioSync dynamically updates with minimal user intervention

4.2 Indirect Competitor Analysis

PortfolioSync also competes with alternative solutions that freelancers use to showcase their work:

Alternative Solution 1: Social Media Profiles

- Representative Platforms: LinkedIn, Instagram Professional, Twitter

- Value Proposition: Free accessibility, wide audience reach, built-in engagement metrics, network effects

- Limitations: Limited customization, platform-dependent, mixed professional/personal content, lack of portfolio-specific features

- Price Range: Free with optional premium features ($0-30/month)

Alternative Solution 2: DIY Website Builders

- Representative Companies: WordPress, Webflow, Carrd

- Value Proposition: Full customization freedom, one-time setup cost option, complete ownership

- Limitations: Significant technical knowledge required, time-intensive maintenance, manual updates needed

- Price Range: Free to $50/month depending on features

Alternative Solution 3: PDF Portfolios and Resume Services

- Representative Companies: Canva, Novoresume, VisualCV

- Value Proposition: Simple creation, downloadable formats, traditional industry acceptance

- Limitations: Static content, limited interactivity, manual updates required, reduced analytics

- Price Range: Free to $20/month for premium features

4.3 SWOT Analysis and Strategy Development

Strengths

- Automated content aggregation from multiple sources without manual uploading

- Dynamic, continuously updating portfolio that stays current with minimal effort

- Intelligent organization and categorization of professional work

- Cross-platform integration capabilities

Weaknesses

- New market entrant without established reputation or user base

- Limited templates and customization options at launch compared to established platforms

- Dependency on API access to third-party platforms

- Initial development costs with uncertain market validation

Opportunities

- Growing freelance economy (projected 90 million freelancers in the US by 2028)

- Increasing demand for digital presence across professional fields

- Remote work trend driving need for strong online portfolios

- Gap in market for truly automated portfolio solutions

Threats

- Established competitors with strong market presence and resources

- Potential API limitations or changes from integrated platforms

- Low switching costs for users if competitors copy automation features

- Privacy regulations affecting data collection capabilities

SO Strategies (Strengths+Opportunities)

- Target growing freelance market with messaging focused on time-saving automation

- Develop integrations with remote work platforms to capture emerging market

- Create educational content highlighting portfolio automation as essential for modern professionals

WO Strategies (Weaknesses+Opportunities)

- Partner with freelancer communities and platforms to build credibility and user base

- Prioritize development of most-requested templates based on user feedback

- Leverage open APIs and create alternative data sources to reduce platform dependencies

ST Strategies (Strengths+Threats)

- Patent key automation technologies to create barriers to imitation

- Build redundant integration options to minimize impact of API changes

- Emphasize data privacy as a core value proposition and competitive advantage

WT Strategies (Weaknesses+Threats)

- Develop a freemium model with clear upgrade path to accelerate user acquisition

- Create a robust offline mode that reduces dependency on third-party services

- Establish a transparent privacy framework that exceeds regulatory requirements

4.4 Competitive Positioning Map

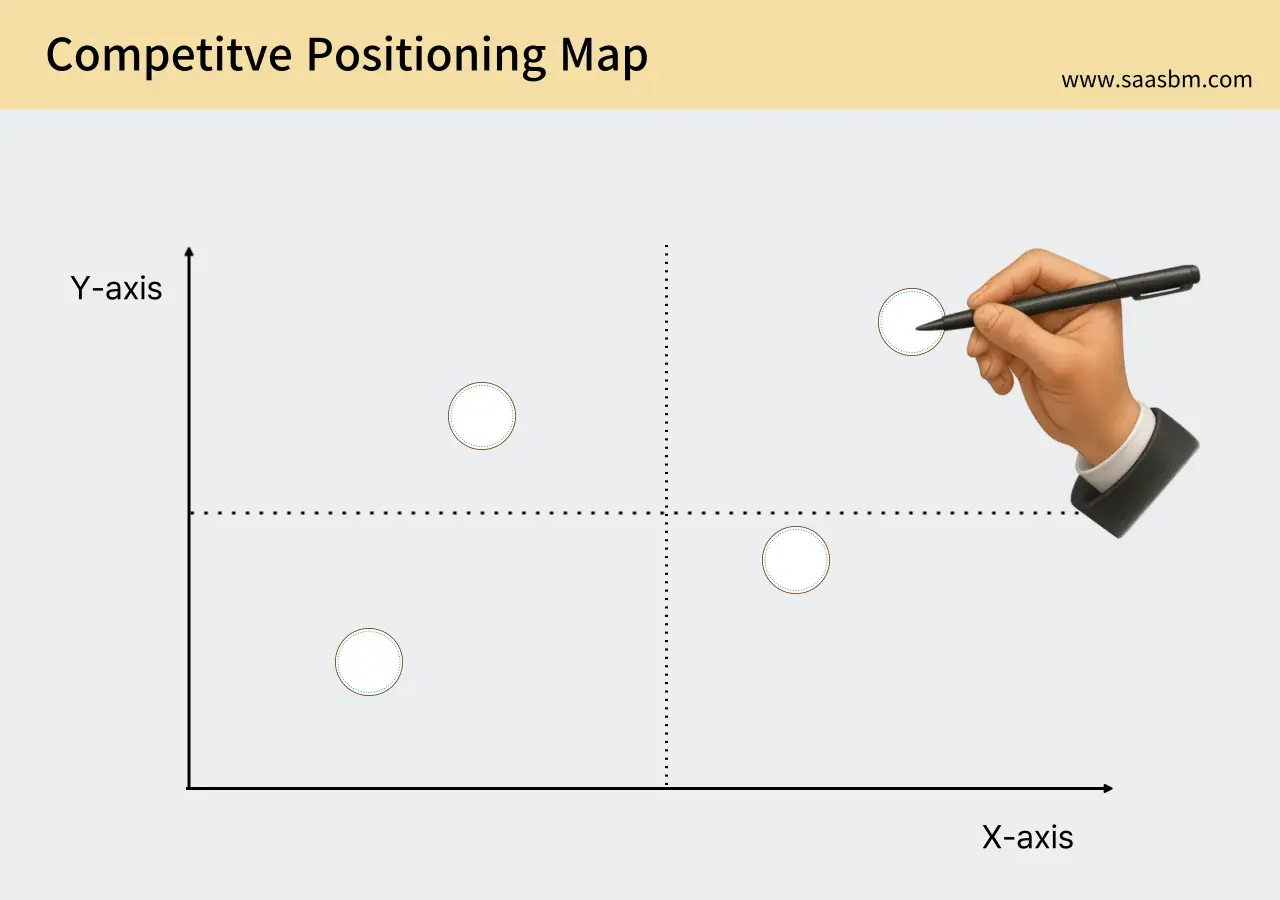

The following competitive positioning map helps visualize PortfolioSync’s place in the market relative to key competitors:

X-axis: Manual Effort vs. Automation (left to right indicates increasing automation)

Y-axis: General Purpose vs. Portfolio Specialization (bottom to top indicates increasing portfolio specialization)

On this positioning map:

- PortfolioSync: High automation, high portfolio specialization (top-right quadrant) – occupying a unique position as the most automated and portfolio-focused solution

- Behance: Medium automation, high portfolio specialization – strong in portfolio features but requires significant manual work

- Wix: Low automation, low-medium portfolio specialization – general website builder requiring manual updates

- Squarespace: Low automation, medium portfolio specialization – design-focused but lacks automated content management

- LinkedIn: Medium automation, low portfolio specialization – some automatic updates but not portfolio-centric

- WordPress: Very low automation, variable specialization – highly flexible but requires technical knowledge and manual management

This positioning map reveals PortfolioSync’s unique value proposition in the top-right quadrant – high automation combined with portfolio specialization – which is currently underserved in the market. This position allows us to target professionals who need comprehensive portfolios but lack time for constant manual updates.

5. Product/Service Details

5.1 Core Features and Characteristics

PortfolioSync offers the following core features designed to automate portfolio creation and management:

Core Feature 1: Integrated Content Aggregation

PortfolioSync automatically collects and imports professional content from multiple platforms including social media, project management tools, code repositories, creative platforms, and professional networks. This eliminates manual uploading and ensures portfolios stay current.

- Platform Connectors: Pre-built integrations with LinkedIn, Behance, GitHub, Dribbble, Medium, and 15+ other platforms

- Smart Content Filtering: AI-based filtering to identify and import only professional content

- Scheduled Syncing: Automated content retrieval at customizable intervals (hourly to monthly)

Core Feature 2: Intelligent Content Organization

The platform automatically categorizes and organizes imported content by project type, skills demonstrated, industry relevance, and chronology, creating a coherent portfolio structure without manual intervention.

- AI Categorization: Machine learning algorithms that understand content context and purpose

- Smart Tagging: Automatic skill and keyword tagging for improved searchability

- Project Grouping: Related content automatically clustered into cohesive projects

Core Feature 3: Dynamic Portfolio Generation

PortfolioSync transforms aggregated content into responsive, professional portfolios that update automatically when new content is detected across connected platforms.

- Template Library: Industry-specific templates optimized for different professions (design, development, writing, etc.)

- Responsive Design: Automatically adapts to all devices and screen sizes

- Dynamic Updates: Real-time portfolio refreshes when new work is published on connected platforms

Core Feature 4: Customization and Branding

While automation is central to PortfolioSync, users maintain control over their portfolio’s appearance, organization, and emphasis to reflect their personal brand.

- Visual Customization: Color schemes, typography, layouts, and visual elements

- Content Prioritization: Ability to highlight specific projects or skills

- Custom Domain: Premium feature allowing personal domain connection

Core Feature 5: Analytics and Optimization

PortfolioSync provides insights into portfolio performance and visitor engagement, helping users optimize their professional presentation.

- Visitor Analytics: Detailed metrics on views, time spent, and engagement patterns

- Portfolio Strength Analysis: AI-driven assessment of portfolio completeness and impact

- Optimization Suggestions: Personalized recommendations to improve portfolio effectiveness

- Engagement Tracking: Monitoring of visitor interactions with specific projects or sections

5.2 Technical Stack/Implementation Approach

PortfolioSync’s technical implementation balances cutting-edge technology with reliability and scalability.

1. System Architecture

PortfolioSync employs a microservices architecture that separates the application into logical components, each handling specific functionality. This approach enables independent scaling, faster development cycles, and improved fault isolation.

The system comprises four main components: the Data Collection Layer, Processing Engine, Portfolio Generator, and User Interface, all connected through secure APIs and supported by cloud infrastructure.

2. Frontend Development

The user interface prioritizes intuitive design and responsive performance across devices.

- React.js: Component-based JavaScript library for building the interactive user interface, chosen for its performance and reusability

- Next.js: React framework providing server-side rendering for improved SEO and initial load performance

- Tailwind CSS: Utility-first CSS framework enabling rapid UI development and consistent styling

3. Backend Development

The backend manages content retrieval, processing, authentication, and portfolio generation.

- Node.js: JavaScript runtime for building the API layer, chosen for its non-blocking I/O model and vast ecosystem

- Express.js: Web application framework providing robust routing and middleware

- Python: Powers the AI/ML components for content analysis and categorization

- Docker: Containerization for consistent environments across development and production

4. Database and Data Processing

PortfolioSync’s data architecture balances performance, scalability, and analytical capabilities.

- MongoDB: NoSQL database storing user profiles and portfolio content, chosen for flexibility with unstructured data

- PostgreSQL: Relational database for structured data requiring complex queries

- Redis: In-memory data store for caching and improving application performance

5. Security and Compliance

Security is built into every layer of the application architecture.

- OAuth 2.0: Industry-standard protocol for authorization, enabling secure access to user accounts on third-party services

- End-to-end encryption: Protecting sensitive user data both in transit and at rest

- GDPR compliance framework: Comprehensive data protection measures ensuring regulatory compliance

- Regular security audits: Proactive identification and remediation of potential vulnerabilities

6. Scalability and Performance

The platform is designed to scale efficiently as user numbers grow.

- Serverless functions: Used for event-driven processes to optimize resource utilization

- Content Delivery Network (CDN): Distributing static assets globally for faster loading times

- Asynchronous processing: Handling resource-intensive tasks like content analysis in the background

- Horizontal scaling: Architecture designed to add computing resources as demand increases

6. Business Model

6.1 Revenue Model

PortfolioStream implements a freemium business model to build a sustainable revenue stream while maximizing user acquisition:

Freemium Model

We offer a free tier to attract users and build our user base, with premium features available through paid subscription plans. This approach allows freelancers and creators to experience the core value of our platform before committing financially.

Subscription Plans:

- Free Tier: $0/month

- Basic portfolio generation from connected accounts

- Standard portfolio templates (3 designs)

- Limited analytics dashboard

- PortfolioStream subdomain (username.portfoliostream.com)

- Target: Students, early-career freelancers, and professionals testing the platform

- Creator Plan: $12/month

- Advanced portfolio generation with enhanced customization

- Access to all 15+ professional templates

- Basic analytics and visitor insights

- Custom domain connection

- Priority email support

- Target: Established freelancers and digital creators

- Professional Plan: $29/month

- Everything in Creator plus advanced customization options

- Detailed analytics with conversion tracking

- Client management tools and project showcasing

- SEO optimization tools

- Priority support with 24-hour response time

- Target: Professional freelancers, small agencies, and serious job seekers

- Enterprise Plan: Custom pricing

- White-label solution

- Team management features

- API access for deeper integration

- Dedicated account manager

- Custom onboarding and training

- Target: Design agencies, staffing firms, and enterprise HR departments

Additional Revenue Streams:

- Template Marketplace: Commission on premium templates created by third-party designers (70/30 revenue split)

- Integration Partnerships: Revenue-sharing with premium tool integrations and API partners

- Professional Services: Premium setup, customization, and portfolio review services for enterprise clients

This revenue model provides sustainable growth by creating a clear upgrade path for users as their careers advance and their portfolio needs become more sophisticated. The freemium approach allows us to build a large community while monetizing users who derive the most value from the platform.

6.2 Sales Approach

PortfolioStream will implement the following sales channels and strategies to reach our target market:

1. Self-Service Acquisition

- Channel Description: Primary acquisition through our website with automated onboarding and subscription management

- Target Customers: Individual freelancers, creators, and small business owners

- Conversion Strategy: Free tier to paid conversion through feature limitations, in-app prompts, and email nurture campaigns highlighting premium benefits

- Expected Share: 80% of total customer acquisition initially, reducing to 65% as enterprise sales grow

2. Partnership Sales

- Channel Description: Strategic partnerships with creative platforms, freelance marketplaces, and educational institutions

- Key Partners: Design tool companies, creative marketplaces, coding bootcamps, and creative industry associations

- Revenue Sharing: 15-20% affiliate commission for partners who refer paying customers

- Expected Share: 15% of customer acquisition in year one, growing to 25% by year three

3. Enterprise Sales

- Channel Description: Direct sales approach targeting design agencies, staffing firms, and educational institutions

- Sales Cycle: 1-3 months from initial contact to close, with demos, pilot programs, and customized implementation

- Key Strategy: Demonstrating ROI through case studies, white-labeled solutions, and team management capabilities

- Expected Share: 5% of revenue in year one, growing to 20% by year three as we expand the enterprise offering

Initially, we will focus on self-service acquisition to build our user base quickly and validate the product-market fit. As we establish credibility and gather case studies, we’ll incrementally shift resources toward partnership and enterprise sales channels to drive more predictable revenue growth and larger contract values.

6.3 Cost Structure

PortfolioStream’s primary cost structure is as follows:

Fixed Costs:

- Personnel: Monthly $28,000 (2 full-stack developers, 1 designer, 1 marketing specialist, 1 customer success specialist)

- Technical Infrastructure: Monthly $3,500 (AWS cloud services, CDN, security, database management)

- SaaS Tools: Monthly $1,200 (Design software, analytics tools, CRM, customer support platform)

- Office/Remote Work: Monthly $1,000 (Co-working space memberships, remote work stipends)

- Legal & Accounting: Monthly $800 (Legal retainer, accounting services, compliance)

- Total Monthly Fixed Costs: Approximately $34,500

Variable Costs:

- Payment Processing: 2.9% + $0.30 per transaction (estimated $0.67 per subscriber per month)

- Server Resources: Additional computing resources based on user growth (estimated $0.15 per active user)

- Customer Acquisition: Marketing spend per customer depending on channel (target CAC: $35-50)

- Customer Support: Additional support resources based on ticket volume (estimated $2 per paying customer per month)

Cost Optimization Strategies:

- Infrastructure Optimization: Implementing auto-scaling to ensure we only pay for resources we need during peak usage

- Strategic Hiring: Using contractors for specialized roles before committing to full-time hires

- Self-Service Support: Building a comprehensive knowledge base and community forum to reduce support tickets

As we scale, we expect to achieve significant economies of scale, particularly in infrastructure costs and customer acquisition. Our target is to reduce per-user costs by approximately 30% by year three through technical optimizations, improved conversion rates, and more efficient support processes.

6.4 Profitability Metrics

The following key financial metrics will be used to measure PortfolioStream’s performance:

Key Financial Metrics:

- Unit Economics: Contribution margin per customer of $8-10/month for Creator plan, $20-22/month for Professional plan

- Customer Lifetime Value (LTV): $230-280 (based on $19 average monthly revenue per user and 12-15 month average retention)

- Customer Acquisition Cost (CAC): Target of $35-45 per paying customer

- LTV/CAC Ratio: Target of 5:1 or higher within 18 months of operation

- Monthly Recurring Revenue (MRR): Targeting 20% month-over-month growth in first year, stabilizing to 8-10% in year two

- Total Contract Value (TCV): For enterprise accounts, averaging $5,000-$15,000 per annual contract

- Break-even Point: Projected at month 14 with approximately 2,500 paying customers

Key Business Metrics:

- Conversion Rate: Target of 3-5% free-to-paid user conversion

- Churn Rate: Target of 5-7% monthly churn for individual plans, 3-4% for enterprise

- Upsell Rate: Target of 10-15% of Creator plan users upgrading to Professional within 6 months

- Average Usage: Target of 3+ portfolio updates per month per active user

- Expansion Revenue: Target of 10% annual revenue growth from existing customers (through upgrades and add-ons)

We will track these metrics through our analytics dashboard with weekly reviews by the management team. Monthly deep-dive analysis sessions will examine trends and identify opportunities for optimization. Quarterly strategic reviews will align these metrics with our product roadmap and marketing initiatives to ensure we’re investing in areas that drive sustainable growth and profitability.

7. Marketing and Go-to-Market Strategy

7.1 Initial Customer Acquisition Strategy

PortfolioStream’s strategy to acquire initial customers focuses on targeted outreach to our core user segments:

Content Marketing:

- Portfolio Case Studies: Showcasing transformations from basic resumes to dynamic portfolios, distributed via Medium, our blog, and creative industry publications

- Ultimate Guides: Comprehensive guides on portfolio building for different creative professions, optimized for SEO and lead generation

- Video Tutorials: Step-by-step walkthroughs showing the portfolio creation process, shared on YouTube and embedded on our site

- Templates Showcase: Visual galleries highlighting template options and customization possibilities, promoted on Pinterest and Instagram

Digital Marketing:

- SEO: Targeting keywords like “freelance portfolio builder,” “automatic portfolio generation,” and profession-specific terms with monthly search volume of 5,000+

- SEM/PPC: Google Ads and Bing Ads with $3,000 monthly budget, targeting high-intent keywords with conversion-focused landing pages

- Social Media: Focusing on Instagram, LinkedIn, and Twitter with before/after portfolio transformations and user success stories

- Email Marketing: Lead magnets offering portfolio templates and guides, followed by educational sequences and conversion-focused campaigns

Community and Relationship Building:

- Subreddit Engagement: Active participation in r/freelance, r/design, r/webdev and other relevant communities with helpful advice (not promotional content)

- Online Creative Communities: Engagement in Behance, Dribbble, and GitHub communities to identify and connect with potential users

- Virtual Events: Hosting webinars on portfolio building and career advancement for creative professionals

Partnerships and Affiliations:

- Creative Tool Integrations: Partnerships with design tools and platforms to offer our service as a complementary solution

- Educational Partnerships: Collaborations with design schools and coding bootcamps to provide student discounts and special features

- Influencer Collaborations: Working with mid-tier creative influencers (10K-50K followers) for authentic product demonstrations

- Freelance Marketplace Partnerships: Integrations with platforms where freelancers find work to streamline portfolio sharing

These strategies will be implemented in phases, beginning with content marketing and community building in months 1-3, followed by paid acquisition and partnerships in months 4-8. We’ll continuously evaluate performance to optimize our channel mix based on customer acquisition costs and conversion rates.

7.2 Low-Budget Marketing Tactics

To maximize our limited initial marketing budget, we’ll implement the following cost-effective strategies:

Growth Hacking Approaches:

- Referral Program: Implementing a two-sided referral system where users get a free month of Premium for each paying user they refer, targeting a 15-20% participation rate

- Product Hunt Launch: Orchestrating a well-planned Product Hunt launch with early supporter engagement and upvote strategy to reach top 5 products of the day

- Viral Portfolio Badge: Including an unobtrusive “Created with PortfolioStream” badge on free tier portfolios with referral link embedded

- Email Signature Campaign: Encouraging team members and early users to include portfolio links in email signatures with tracking parameters

- Limited-Time Templates: Creating FOMO with exclusive template designs available only for early adopters

Community-Centered Strategies:

- Creator Success Stories: Documenting and sharing stories of early users who secured jobs or clients through their PortfolioStream portfolios

- Free Portfolio Reviews: Offering limited free portfolio critiques by our design team to generate buzz and demonstrate our expertise

- Co-creation Sessions: Involving early users in template design sessions to increase ownership and word-of-mouth marketing

- User-generated Content Campaign: Encouraging users to share their portfolio transformations with the hashtag #PortfolioReveal

Strategic Free Offerings:

- Free Template of the Month: Releasing one premium template for free each month to drive sign-ups and social sharing

- Industry-specific Portfolio Guides: Creating downloadable guides for different creative professions in exchange for email addresses

- Portfolio Checklist Tool: Offering a free assessment tool that evaluates portfolio completeness and suggests improvements

These low-budget tactics will be implemented within our initial $5,000 monthly marketing budget with an expected ROI of 2-3x in terms of user acquisition. We’ll validate each approach by testing with small segments before scaling successful tactics, always measuring against our target CAC of $35-45 per paying customer.

7.3 Performance Measurement KPIs

PortfolioStream will track the following KPIs to measure marketing and customer acquisition performance:

Marketing Efficiency Metrics:

- Cost Per Acquisition (CPA): Tracking cost per new user signup by channel, targeting <$5 for free users and <$40 for paid conversions

- Channel ROI: Measuring return on investment for each marketing channel, with a target minimum 200% ROI

- Conversion Rate by Channel: Tracking which channels deliver users most likely to convert to paid plans, optimizing for channels with >5% conversion

- Campaign Performance: Evaluating individual campaign effectiveness with A/B testing and conversion tracking

- Content Engagement: Tracking content consumption patterns and correlation to conversion, focusing on content with >3% conversion rate

Product Engagement Metrics:

- Activation Rate: Percentage of new users who complete key actions (connecting accounts, customizing templates), targeting >60%

- Time to Value: Measuring how quickly users create their first complete portfolio, targeting <15 minutes

- Feature Adoption: Tracking which features drive engagement and retention, guiding product development

- Portfolio Update Frequency: Monitoring how often users refresh their portfolios, targeting 3+ updates monthly

- Share Rate: Tracking how often users share their portfolios externally, indicating perceived value

Financial Related Metrics:

- Free-to-Paid Conversion: Percentage of free users upgrading to paid plans, targeting 3-5% after 30 days

- Average Revenue Per User (ARPU): Tracking revenue generation per user, targeting $15+ monthly

- Churn Prediction Indicators: Identifying behavioral patterns that predict potential churn to enable proactive retention efforts

- Expansion Revenue: Measuring additional revenue from existing customers through plan upgrades, aiming for 10% annual expansion

- CAC Payback Period: Time to recover customer acquisition costs, targeting <6 months

We’ll track these KPIs through a combination of Google Analytics, Mixpanel, and our internal dashboard with weekly reviews. Automated reports will highlight variances from targets, allowing for rapid optimization. Quarterly deep dives will connect marketing performance to financial outcomes, ensuring alignment with business objectives and informing budget allocation decisions.

7.4 Customer Retention Strategy

To maximize customer satisfaction and build long-term relationships, we’ll implement the following retention strategies:

Product-Centered Retention Strategies:

- Continuous Template Refreshes: Releasing new template designs monthly to maintain excitement and relevance for different creative fields

- Feature Advancement Notifications: Alerting users to new features that align with their usage patterns, encouraging deeper platform engagement

- Portfolio Health Score: Providing a dynamic score with actionable recommendations to improve portfolio completeness and effectiveness

- Usage-Based Customization: Adapting the user experience based on individual usage patterns and preferences to increase stickiness

Education and Value Delivery:

- Portfolio Success Academy: Offering exclusive webinars and tutorials to paying customers on portfolio optimization and client acquisition

- Industry Trend Reports: Providing quarterly reports on portfolio trends specific to different creative industries

- Personalized Portfolio Reviews: Offering professional portfolio reviews for Premium and Enterprise customers every six months

- Career Resources Library: Building a growing collection of templates, guides, and resources exclusively for subscribers

Community and Relationship Building:

- Private Community Access: Creating an exclusive Slack community for paying customers to network and share opportunities

- Creator Spotlights: Featuring exceptional user portfolios in our newsletter and social media, providing valuable exposure

- Feedback Implementation Program: Actively soliciting and visibly implementing user suggestions to build loyalty

- Milestone Celebrations: Recognizing user achievements (job offers, client acquisitions, portfolio milestones) with personalized congratulations

Incentives and Rewards:

- Loyalty Pricing: Offering permanent discounts for users who maintain continuous subscriptions (5% after 6 months, 10% after 12 months)

- Anniversary Bonuses: Providing additional features or temporary tier upgrades on subscription anniversaries

- Early Access Program: Giving long-term customers priority access to new features and templates before general release

- Referral Rewards: Implementing a tiered reward system where benefits increase with the number of successful referrals

Through these retention strategies, we aim to reduce monthly churn from an industry average of 8-10% to under 5%, and increase the average customer lifetime from 12 months to 18+ months. This would translate to a 50% increase in customer lifetime value, significantly improving unit economics and overall business sustainability.

8. Operations Plan

8.1 Required Personnel and Roles

PortfolioSync requires the following personnel structure for successful operation and growth:

Initial Founding Team (Pre-launch):

- Full-stack Developer/CTO: Responsible for platform architecture, integration development, and technical implementation. Requires experience with API integrations, web development, and automated data processing. Must be hired immediately.

- UX/UI Designer: Responsible for creating intuitive portfolio templates and user interfaces. Requires portfolio design experience and understanding of freelancer needs. Must be hired within first month.

- Product Manager: Responsible for product roadmap, feature prioritization, and user research. Requires SaaS product experience and understanding of creator economy. Must be hired within first two months.

- Marketing Specialist: Responsible for launch strategy, content creation, and social media management. Requires experience marketing to freelancers and digital creators. Part-time initially, to be hired within three months of development.

Personnel Needed Within First Year Post-Launch:

- Customer Success Manager: Responsible for onboarding, user retention, and support. Hire after reaching 1,000 active users.

- Backend Developer: Responsible for scaling infrastructure and implementing advanced features. Hire after reaching 5,000 active users.

- Frontend Developer: Responsible for implementing new UI features and portfolio templates. Hire after reaching 5,000 active users.

- Content Marketing Specialist: Responsible for creating educational content and SEO implementation. Hire after reaching 10,000 active users.

- Business Development Manager: Responsible for strategic partnerships with freelance platforms and creative tools. Hire after reaching 15,000 active users.

- Data Analyst: Responsible for user behavior analysis and performance metrics. Hire after reaching 20,000 active users.

Additional Personnel After Second Year:

- International Growth Manager: Responsible for expansion into non-English markets. Hire when international users reach 15% of total user base.

- Enterprise Sales Representative: Responsible for selling to agencies and companies with multiple freelancers. Hire when reaching $1M ARR.

- AI/ML Engineer: Responsible for implementing advanced portfolio recommendation features. Hire when reaching 50,000 active users.

- QA Engineer: Responsible for ensuring platform reliability across integrations. Hire when reaching 75,000 active users.

- Community Manager: Responsible for building user community and facilitating peer learning. Hire when reaching 100,000 active users.

Our hiring timeline is directly tied to user growth metrics and revenue milestones. We will prioritize technical and customer-facing roles in early stages, with specialized roles added as our user base grows and product complexity increases.

8.2 Key Partners and Suppliers

PortfolioSync requires the following partnerships and collaborations for effective operation:

Technology Partners:

- Cloud Infrastructure Provider: Essential for reliable hosting and scaling. Potential partners include AWS, Google Cloud, or Microsoft Azure. Will negotiate startup credits and implement infrastructure-as-code practices.

- API Integration Partners: Critical for portfolio data collection. Potential partners include LinkedIn, Behance, GitHub, Medium, Dribbble, and other content platforms. Will develop official integrations with their APIs.

- Website Hosting Services: Necessary for custom domain portfolio hosting. Potential partners include Netlify, Vercel, or DigitalOcean. Will negotiate bulk pricing for our customers’ published portfolios.

- Payment Processor: Required for subscription billing. Potential partners include Stripe, PayPal, or Paddle. Will implement with recurring billing and international payment support.

Channel Partners:

- Freelance Marketplaces: Key distribution channels to reach freelancers. Potential partners include Upwork, Fiverr, and Freelancer.com. Will develop portfolio import/export functionality and possible referral programs.

- Creative Software Providers: Access to design and creative professionals. Potential partners include Adobe, Canva, and Figma. Will develop plugins or integrations with their ecosystems.

- Professional Associations: Access to established professional networks. Potential partners include design associations, freelancer guilds, and creative industry groups. Will offer group discounts and co-marketing opportunities.

Content and Data Partners:

- Portfolio Template Designers: Supply high-quality portfolio templates. Will work with independent designers and design studios to create exclusive templates.

- SEO and Discoverability Tools: Enhance portfolio visibility. Potential partners include SEO tools and freelancer search engines. Will integrate their analytics and optimization recommendations.

- Career Development Resources: Provide added value to users. Potential partners include online learning platforms and skills assessment tools. Will offer bundled services.

Strategic Alliances:

- Coworking Space Networks: Physical presence and workshop opportunities. Potential partners include WeWork, Impact Hub, and regional coworking chains. Will offer member benefits and host portfolio review events.

- Professional Development Platforms: Expand service value proposition. Potential partners include LinkedIn Learning and Skillshare. Will create educational content about portfolio development.

- Recruitment Platforms: Additional distribution channel. Potential partners include Indeed, ZipRecruiter, and industry-specific job boards. Will develop portfolio sharing features for job applications.

We will prioritize API integration partnerships in the first six months, followed by freelance marketplace partnerships by month nine. Our partnership strategy focuses on creating mutual value through technical integrations rather than just marketing alliances, ensuring each partnership directly enhances our product capabilities.

8.3 Core Processes and Operational Structure

PortfolioSync’s core processes and operational structure are designed for scalability and efficiency:

Product Development Process:

- Research and Discovery: Two-week sprints for user interviews, competitive analysis, and feature identification. Led by Product Manager, outputs include prioritized feature backlog and user stories.

- Design and Prototyping: One-week sprints for wireframing, UI design, and interactive prototyping. Led by UX/UI Designer, outputs include Figma prototypes and design specifications.

- Development and Testing: Two-week development sprints following agile methodology. Led by Technical Lead, outputs include functional code and test reports.

- Beta Testing and Refinement: One to two weeks of beta testing with select users, incorporating feedback. Team effort coordinated by Product Manager, outputs include bug reports and feature enhancement lists.

Customer Acquisition and Onboarding:

- Discovery: Initial user touchpoint through marketing channels or partnerships. Led by Marketing Specialist, measured by impression-to-signup conversion rates.

- Registration: User creates account and selects plan. Engineering team manages this process, optimized for completion rate.

- Platform Integration: User connects social and portfolio accounts. Engineering team handles APIs, measured by successful connection rate.

- Initial Portfolio Generation: System automatically creates first portfolio draft. Automated process with technical monitoring, measured by completion speed and accuracy.

- Customization: User refines generated portfolio. Customer Success provides guidance, measured by time-to-publish metrics.

Customer Support Process:

- Self-Service Resources: Knowledge base, video tutorials, and FAQs. Content team creates and maintains, measured by resource utilization and resolution rates.

- Ticket-Based Support: Email and in-app support for specific issues. Customer Success team handles, measured by response time and resolution rates.

- Account Review: Personalized portfolio review for premium users. Customer Success conducts, measured by satisfaction scores.

- Feature Request Processing: Collection and prioritization of user suggestions. Product Manager evaluates and incorporates into roadmap, tracked by implementation rate.

Data and Insights Process:

- Data Collection: Continuous collection of user behavior and portfolio performance. Engineering team implements tracking, ensuring privacy compliance.

- Analysis: Weekly analysis of key metrics and trends. Data Analyst (eventually) performs, producing actionable reports.

- Insight Distribution: Regular sharing of insights with appropriate teams. Product Manager coordinates, ensuring insights influence product decisions.

- Experimentation: A/B testing of features and design changes. Cross-functional team effort, measured by experiment velocity and impact.

These processes will be managed using a combination of Jira for product development, HelpScout for customer support, Mixpanel for analytics, and Slack for internal communication. We’ll implement continuous improvement through bi-weekly retrospectives and quarterly process reviews based on performance metrics and team feedback.

8.4 Scalability Plan

PortfolioSync’s scalability plan outlines how we’ll grow the business alongside increasing user demand:

Geographic Expansion:

- Months 1-12: Focus on English-speaking markets (US, UK, Canada, Australia). Initial strategy using global digital marketing without region-specific customization.

- Months 13-24: Expand to Western Europe (Germany, France, Netherlands) with localized interfaces and templates. Requires localization resources and regional customer support.

- Months 25-36: Enter Asian markets with focus on India, Singapore, and Japan. Strategy includes region-specific templates and partnerships. Requires cultural adaptation and local marketing expertise.

- Months 37-48: Launch in Latin America, focusing on Brazil and Mexico. Will implement Spanish and Portuguese interfaces and region-specific portfolio standards.

Product Expansion:

- Months 1-6: Core automatic portfolio generation and social media integration. Foundation of our MVP.

- Months 7-12: Analytics dashboard showing portfolio visits and engagement. Requires building tracking infrastructure and visualization tools.

- Months 13-18: AI-powered improvement suggestions and SEO optimization. Requires investment in machine learning capabilities.

- Months 19-24: Client management and project tracking features. Transforms product from portfolio tool to business management platform.

- Months 25-36: Marketplace for freelancers to offer services directly through portfolios. Requires payment processing infrastructure and service quality management systems.

Market Segment Expansion:

- Months 1-12: Focus on individual freelance designers and developers. Direct-to-user marketing strategy through relevant communities.

- Months 13-24: Expand to creative agencies and small studios with team portfolio features. Requires developing multi-user account management and collaborative tools.

- Months 25-36: Target educational institutions for student portfolios. Requires developing institutional billing and student management features.

Team Expansion Plan:

- Engineering Team: Start with 2-3 engineers, scale to 8-10 by year two, and 15-20 by year three. Structure will evolve from generalists to specialized front-end, back-end, data, and AI teams.

- Product Team: Begin with 1 product manager, add 1-2 product designers by year two, and build to 5-7 person team by year three with specialized product owners for different features.

- Marketing Team: Start with 1 marketing specialist, grow to 3-4 by year two, and 6-8 by year three with specialists in content, SEO, paid acquisition, and community.

- Customer Success: Begin with founder handling support, add 2-3 team members by year two, and scale to 8-10 by year three with tiered support structure and dedicated enterprise account managers.

These expansion plans will be triggered by specific performance indicators, including reaching 25,000 active users for European expansion, achieving 80% user retention rate for premium features, and securing $2M ARR for marketplace development. Key risks include API dependency changes, international data regulations, and scaling infrastructure costs, which we’ll mitigate through diversified integrations, legal consultation, and cloud architecture optimization.

9. Financial Plan

9.1 Initial Investment Requirements

PortfolioSync requires the following initial investment to launch and sustain early operations:

Development Costs:

- Platform Development: $85,000 (Core functionality including automated portfolio generation and integrations)

- UX/UI Design: $30,000 (Portfolio templates, user interface, and design system)

- Testing and QA: $15,000 (Cross-browser testing, integration testing, security audits)

- Technical Documentation: $5,000 (API documentation, developer guides, knowledge base)

- Development Tools and Licenses: $5,000 (Software subscriptions, development environments, testing tools)

- Development Costs Total: $140,000

Initial Operating Costs:

- Cloud Infrastructure: $12,000 (Six months of anticipated server costs, databases, storage)

- API Access Fees: $9,000 (Six months of premium API access to social platforms and creative services)

- Legal and Compliance: $15,000 (Terms of service, privacy policy, GDPR compliance, contracts)

- Insurance: $4,000 (General liability and cyber insurance for one year)

- Administrative Costs: $5,000 (Accounting software, office supplies, subscriptions)

- Initial Operating Costs Total: $45,000

Marketing and Customer Acquisition Costs:

- Brand Development: $10,000 (Logo, brand guidelines, messaging framework)

- Website and Content: $15,000 (Marketing site, blog content, demo videos)

- Launch Campaign: $20,000 (Social media ads, sponsored content, influencer partnerships)

- PR and Community Building: $10,000 (Press releases, community engagement, early adopter programs)

- Marketing Costs Total: $55,000

Total Initial Investment Required: $240,000

This initial investment is designed to support operations for the first six months, including development, launch, and initial customer acquisition. Our estimates are based on industry standard rates for technical talent, cloud services scaled for initial user loads of up to 10,000 active accounts, and efficient marketing spend focusing on digital channels most relevant to our target audience.

9.2 Monthly Profit and Loss Projections

Here are the projected profit and loss figures for the first 12 months after launch:

Revenue Projections:

- Months 1-3: $5,000-12,000 monthly (500-1,200 free users, 50-120 premium users at $9.99/month)

- Months 4-6: $15,000-30,000 monthly (2,000-4,000 free users, 300-600 premium users, introducing $24.99 professional tier)

- Months 7-9: $40,000-70,000 monthly (5,000-8,000 free users, 800-1,400 premium users, 5% conversion to professional tier)

- Months 10-12: $80,000-120,000 monthly (10,000-15,000 free users, 1,600-2,400 premium users, 10% conversion to professional tier)

- Projected Monthly Revenue at Year 1 End: $120,000 (15,000 free users, 2,500 premium users, 250 professional tier users)

Expense Projections:

- Months 1-3: $35,000-40,000 monthly (Core team salaries, cloud infrastructure, marketing campaign)

- Months 4-6: $45,000-55,000 monthly (Additional developer hire, increased server costs, ongoing marketing)

- Months 7-9: $60,000-70,000 monthly (Customer success hire, increased infrastructure costs, expanded marketing)

- Months 10-12: $75,000-85,000 monthly (Additional engineering and marketing hires, scaling infrastructure)

- Projected Monthly Expenses at Year 1 End: $85,000 (Team of 8-10, scaled infrastructure, ongoing marketing)

Monthly Cash Flow:

- Months 1-3: $25,000-35,000 monthly deficit

- Months 4-6: $20,000-30,000 monthly deficit

- Months 7-9: $0-20,000 monthly deficit (approaching break-even)

- Months 10-12: $0-40,000 monthly surplus (achieving profitability)

- Maximum Cumulative Deficit (Worst Case): Approximately $250,000

These projections represent our moderate scenario based on a 5% conversion rate from free to paid tiers and an average customer acquisition cost of $50. The best-case scenario assumes 8% conversion and $35 CAC, while the worst-case scenario assumes 3% conversion and $70 CAC. Key growth drivers will be word-of-mouth referrals and strategic partnerships with freelance platforms.

9.3 Break-Even Analysis

PortfolioSync’s break-even analysis provides insight into when the business will become self-sustaining:

Break-Even Point Parameters:

- Expected Timeframe: Month 9 after launch

- Required Paying Customers: Approximately 1,500 users

- Monthly Fixed Costs Base: $65,000

- Average Revenue Per User (ARPU): $14.50

- Variable Cost Per User: $1.20 (server costs, support, payment processing)

- Break-Even Monthly Revenue: $70,000

Post-Break-Even Projections:

- Months 10-12: Monthly net profit $5,000-35,000

- Months 13-18: Monthly net profit $40,000-80,000

- Months 19-24: Monthly net profit $85,000-150,000

- Expected Monthly Growth Rate Post-Break-Even: 15-20%

Profitability Enhancement Plans:

- Months 12-18: Introduce annual billing with 20% discount to improve cash flow and reduce churn, expected to improve lifetime value by 30%

- Months 18-24: Implement higher-tier enterprise plans for agencies ($49.99/month), targeting 5% of user base with potential 3x ARPU impact

- Months 24-36: Launch portfolio services marketplace with 15% commission model, potentially adding $20-30 to ARPU for active sellers

This break-even analysis is most sensitive to our user acquisition rate and conversion percentage from free to premium tiers. A 1% increase in conversion rate accelerates break-even by approximately one month, while a 20% increase in acquisition costs delays it by a similar period. Our CAC payback period is targeted at 6 months, requiring efficient customer acquisition channels and strong product retention.

9.4 Funding Strategy

PortfolioSync’s stage-by-stage funding strategy is designed to support growth while maximizing founder equity:

Initial Stage (Pre-seed):

- Target Funding Amount: $250,000

- Sources: Founder contributions ($50,000), angel investors ($150,000), startup accelerator ($50,000)

- Use of Funds: MVP development, initial marketing, and 6 months of runway

- Timing: Immediate (pre-launch)

Seed Round:

- Target Funding Amount: $750,000-1,000,000

- Target Investors: Angel syndicates, early-stage SaaS VCs, vertical-specific investors in creator economy

- Valuation Target: $4-5 million (pre-money)

- Timing: 6-9 months post-launch

- Use of Funds: Team expansion, product enhancement, marketing scale-up

- Key Milestones for Raise: 1,000 paying users, 15% month-over-month growth, <5% churn rate

Series A:

- Target Funding Amount: $3-5 million

- Target Investors: Established SaaS VCs, strategic corporate investors

- Valuation Target: $15-20 million (pre-money)

- Timing: 18-24 months post-launch

- Use of Funds: International expansion, AI feature development, enterprise offering

- Key Milestones for Raise: $1.5M ARR, positive unit economics, successful expansion to 2+ international markets

Alternative Funding Strategies:

- Revenue-Based Financing: Consider after reaching $50K MRR for marketing expansion without dilution

- Strategic Partnerships: Explore co-development opportunities with major portfolio platforms or creative tool providers

- Crowdfunding Campaign: Potential for community engagement and product validation if seeking $300K-500K

- Bootstrapping Extension: Slow growth option with focus on profitability if conversion metrics exceed 12% and CAC stays below $30

Our funding strategy will adjust based on key growth metrics, particularly user acquisition cost and lifetime value ratio. In a high-growth scenario (>25% monthly growth with stable CAC), we’ll accelerate our Series A timeline. In a capital-efficient scenario (early profitability with 15-20% growth), we’ll consider extending our runway between rounds to maximize valuation. We maintain a 12-month alternative funding plan in case market conditions become unfavorable for equity raises.

10. Implementation Roadmap

10.1 Key Milestones

PortfolioGen’s development and growth will follow these key milestones:

Pre-Launch (Months 1-6):

- Months 1-2: Complete market research, finalize core features, and develop technical architecture

- Months 2-3: Build MVP with basic portfolio generation capabilities and integration with primary platforms

- Months 3-4: Internal testing, bug fixes, and UX refinements based on initial user feedback

- Months 4-6: Beta testing with selected freelancers and creators, feature improvements

Post-Launch 3 Months (Months 7-9):

- User Acquisition: Reach 5,000 registered users through targeted digital marketing and community engagement

- Platform Integration: Complete integrations with major social media platforms and creative marketplaces

- Premium Conversion: Achieve 5% conversion rate from free to premium plans

- Content Library: Develop 20+ portfolio templates across different creative disciplines

- User Feedback Loop: Implement systematic feedback collection and prioritization process

Post-Launch 6 Months (Months 10-12):

- User Growth: Scale to 15,000 registered users with strategic partnerships

- Feature Expansion: Launch analytics dashboard and SEO optimization tools

- Revenue Target: Achieve $10,000 in monthly recurring revenue

- Mobile Optimization: Release responsive mobile version with core functionality

Year 2 Key Goals:

- Q1: Launch native mobile app for iOS and Android, implement AI-driven portfolio recommendations

- Q2: Introduce enterprise plans for agencies and educational institutions

- Q3: Expand to international markets with localization in 5 major languages

- Q4: Add advanced customization tools and direct client communication features

These milestones will be tracked using agile project management methodologies with bi-weekly sprints and monthly reviews. We’ve built in buffer periods between major releases to accommodate unexpected challenges and incorporate user feedback effectively.

10.2 Launch Strategy

PortfolioGen’s market entry strategy is designed to validate core assumptions quickly while building a solid foundation for growth:

MVP (Minimum Viable Product) Stage:

- Core Features: Automated portfolio generation from social media accounts, basic customization options, and 5 starter templates – focusing on solving the immediate pain point of portfolio creation

- Development Timeline: 3 months from initial design to internal testing

- Testing Method: Internal dogfooding by team members, followed by controlled testing with 20 freelancers from different creative disciplines

- Success Criteria: 80% of test users successfully generate portfolios within 30 minutes with minimal assistance

Beta Test Plan:

- Target Users: 200-300 freelancers and creators recruited from relevant online communities and professional networks

- Duration: 6 weeks with structured feedback collection points

- Incentives: Free lifetime access to premium features and priority feature request implementation

- Test Objectives: Validate user experience, identify integration challenges with different platforms, test premium feature value perception

- Feedback Collection: In-app surveys, user interviews, usage analytics, and community discussion forum

Official Launch Strategy:

- Initial Markets: North America, UK, and Australia as primary English-speaking markets with high freelancer populations

- Primary Target: Digital designers, content creators, and web developers seeking portfolio modernization

- Launch Events: Virtual launch party with demos from beta users, webinar series on portfolio best practices

- Promotional Offers: 30-day free premium trial, 40% discount on annual subscriptions for first 1,000 users

- PR Strategy: Guest posts on freelancer blogs, partnerships with creator communities, and targeted outreach to freelance industry influencers

Post-Launch Stabilization:

- Monitoring Plan: 24/7 performance monitoring, daily user analytics review, and real-time error tracking

- Response Protocol: Tiered support system with guaranteed response times based on issue severity

- Improvement Cycle: Bi-weekly feature updates based on user feedback prioritization during first three months

This launch strategy is based on lean startup principles, emphasizing rapid iteration and close customer feedback loops. We’ve studied successful SaaS platform launches in the creative space, particularly Behance and Dribbble, to incorporate best practices while avoiding common pitfalls.

10.3 Growth Metrics and Targets

PortfolioGen will track the following key performance indicators to measure growth and success:

User Growth:

- Year 1, Q1: 5,000 registered users with 30% monthly growth rate

- Year 1, Q2: 15,000 registered users with 25% monthly growth rate

- Year 1, Q3: 30,000 registered users with 20% monthly growth rate

- Year 1, Q4: 50,000 registered users with 15% monthly growth rate

Product Usage:

- Portfolio Creation Rate: Target 80% of new users creating and publishing portfolios within 7 days

- Monthly Active Users: Maintain 60% of registered users actively updating portfolios monthly

- Platform Integrations: Average 3+ connected platforms per user (social media, project repositories)

- Content Updates: 40% of active users adding new work weekly

Financial Targets:

- Month 6: $5,000 MRR with 70% from premium subscriptions, 30% from custom domain fees

- Month 9: $15,000 MRR with 65% from premium subscriptions, 25% from custom domains, 10% from analytics

- Month 12: $30,000 MRR with premium tier distribution shifting toward annual plans

- Month 18: $75,000 MRR with introduction of enterprise plans for agencies and educational institutions

User Satisfaction:

- Net Promoter Score: Achieve and maintain NPS of 40+ through quarterly surveys

- Churn Rate: Keep monthly churn below 5% for free users, below 3% for premium users

- Feature Adoption: 70% of premium users utilizing at least 3 premium-only features monthly

Performance Tracking:

- Weekly Metrics: User acquisition cost, activation rate, feature usage patterns

- Monthly Review: Revenue growth, churn analysis, customer satisfaction, feature requests

- Quarterly Assessment: Unit economics, market penetration by segment, competitive positioning

These metrics will be tracked through an integrated dashboard combining data from our analytics platform, CRM system, and financial tools. We’ll conduct monthly all-hands meetings to review performance against targets, with a rapid response plan for any metrics that fall below 80% of goals for two consecutive measurement periods.

10.4 Risk Analysis and Mitigation Strategies

PortfolioGen faces several potential risks that must be addressed proactively:

Technical Risks:

- API Dependency Vulnerabilities:

- Impact: Changes to third-party platform APIs could disrupt our ability to import user content

- Probability: High

- Mitigation Strategy: Implement abstraction layers between our system and external APIs, maintain relationships with platform developer relations teams, and develop backup content import methods

- Scalability Challenges:

- Impact: Performance degradation during periods of rapid user growth

- Probability: Medium

- Mitigation Strategy: Design for horizontal scaling from day one, implement comprehensive load testing, and establish cloud infrastructure auto-scaling protocols

Market Risks:

- Competitive Response: