- Company : OpenPhone

- Brand : OpenPhone

- Homepage : https://www.openphone.com/

1. Service Overview

1.1 Service Definition

OpenPhone is a modern cloud-based business phone system designed to help professionals and teams maintain a professional business presence through dedicated business phone numbers and collaborative communication tools.

- Service Classification: Cloud-Based Business Phone System / VoIP (Voice over Internet Protocol) / Telecommunications SaaS

- Core Features: OpenPhone provides business phone numbers with calling, texting, and team collaboration features accessible across multiple devices, integrated with popular business tools.

- Founding Year: 2018

- Service Description: OpenPhone transforms how businesses handle phone communications by providing dedicated business phone numbers that work on any device through a simple app. It enables users to separate personal and business communications while maintaining a professional presence. The platform supports team collaboration with shared phone numbers, conversation history, and integrations with CRM and productivity tools. OpenPhone also offers automations, analytics, and international calling capabilities designed specifically for business needs.

[swpm_protected for=”4″ custom_msg=’This report is available to Executive members. Log in to read.‘]

1.2 Value Proposition Analysis

OpenPhone delivers significant value by solving common communication challenges faced by modern businesses while offering a compelling alternative to traditional business phone solutions.

- Core Value Proposition: Providing a professional, flexible business phone system that eliminates the need for separate physical phones, complex infrastructure, or mixing personal and business communications.

- Primary Target Customers: Small to medium-sized businesses, startups, entrepreneurs, freelancers, remote teams, and customer-facing professionals who need reliable business phone capabilities without traditional hardware.

- Differentiation Points: Simplicity of deployment with no hardware requirements, collaborative features like shared numbers and comments, seamless CRM integrations, and a pricing model that delivers enterprise-level features at a much lower price point than traditional business phone systems.

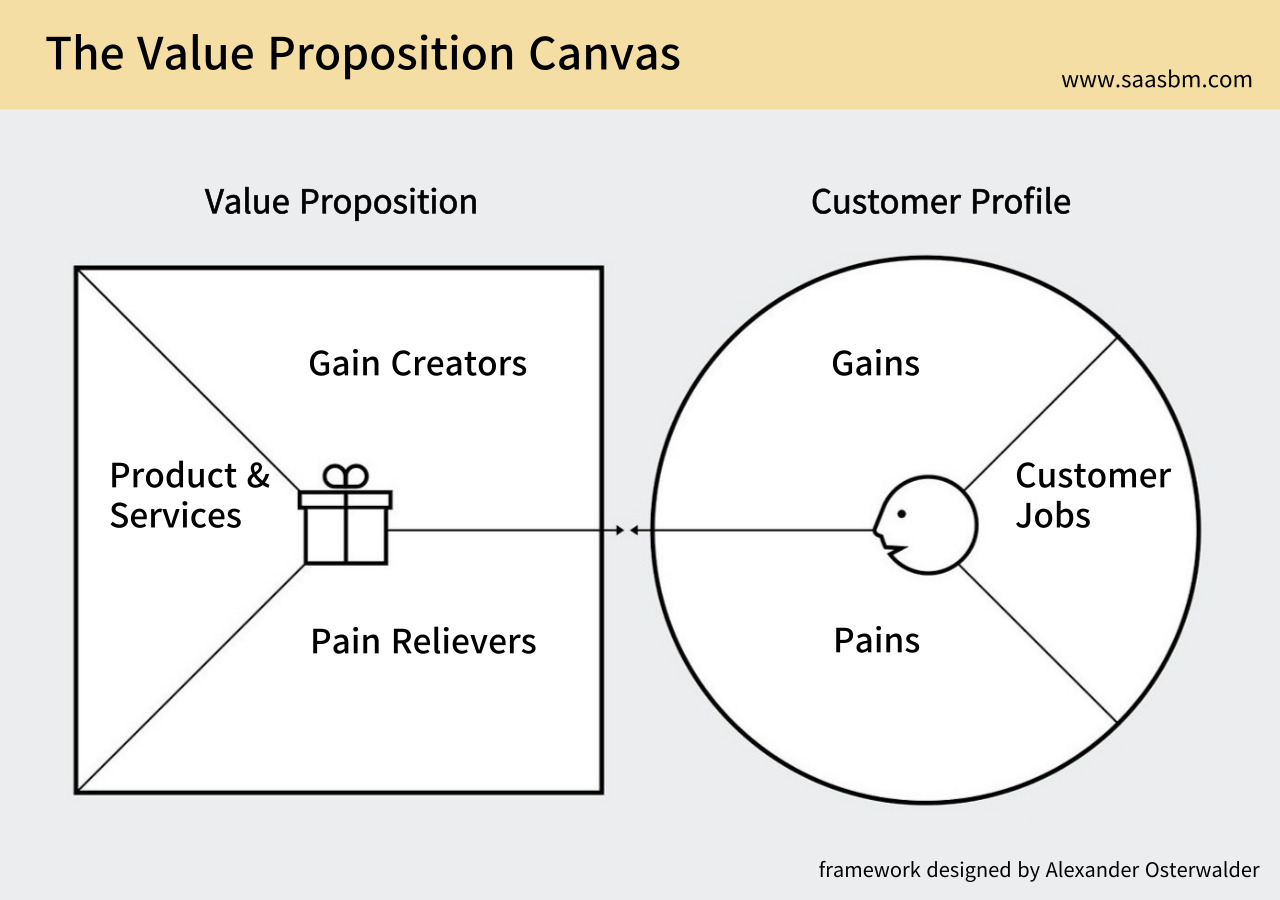

1.3 Value Proposition Canvas Analysis

The Value Proposition Canvas systematically analyzes customer needs, pain points, and expected gains, mapping how OpenPhone’s features address these elements.

Customer Jobs

- Maintaining professional communication with clients and partners

- Managing business calls separate from personal calls

- Collaborating with team members on customer communications

- Tracking and documenting important conversations

- Accessing business communications across multiple devices

Customer Pain Points

- Mixing personal and business calls on a single number

- High costs of traditional business phone systems

- Complexity of setting up and maintaining traditional PBX systems

- Difficulty in tracking team communications with customers

- Limited mobility and accessibility of office-based phone systems

Customer Gains

- Professional business presence without additional hardware

- Cost savings compared to traditional phone systems

- Improved team collaboration and visibility

- Better work-life balance with separate business identity

- Enhanced customer relationships through consistent communication

Service Value Mapping

OpenPhone directly addresses key pain points by providing dedicated business phone numbers that work on existing devices, eliminating the need to carry multiple phones or mix personal and business communications. The affordable subscription model (starting at $15/month) removes the cost barriers of traditional systems while offering enterprise features. Team collaboration tools solve coordination challenges by enabling shared access to numbers, conversation histories, and internal comments. The mobile-first approach with desktop availability ensures accessibility from anywhere, while integrations with tools like HubSpot, Slack, and Zapier enhance productivity by connecting phone communications with existing workflows. OpenPhone also offers auto-attendants, scheduled business hours, and analytics to help small businesses maintain a professional image regardless of their size.

1.4 Jobs-to-be-Done Analysis

The Jobs-to-be-Done framework identifies the fundamental reasons and situations that drive customers to “hire” OpenPhone, along with their success criteria.

Core Job

The primary job customers hire OpenPhone to do is to establish and maintain a professional business phone presence without the complications and costs of traditional phone systems. This includes functional aspects (making/receiving calls, texting, tracking conversations) and emotional aspects (projecting professionalism, maintaining work-life boundaries, and feeling confident in their business communications).

Job Context

The need for OpenPhone typically arises when businesses are forming, scaling, or transitioning to remote work. Key contexts include: starting a new business and needing a professional number immediately; growing a team and needing shared access to communications; struggling with the limitations of personal phones for business use; wanting to improve customer service through better call management; and transitioning to remote or hybrid work environments where traditional office phones are impractical. The job is frequent (daily communication) and critical (directly impacts customer relationships).

Success Criteria

Customers measure success through several outcomes: reliability (calls never missed, clear quality), professional appearance (business hours, voicemail, auto-attendant features), team efficiency (reduced miscommunication, faster response times), cost-effectiveness (lower TCO than alternatives), simplicity (easy setup, minimal training), and integration with existing workflows (data syncing with CRM, reduced manual work).

2. Market Analysis

2.1 Market Positioning

OpenPhone operates in a specific segment of the business telecommunications market, with a strong connection to current industry trends.

- Service Category: Cloud-Based Business Phone Systems / VoIP Services for SMBs / Collaborative Communication Tools

- Market Maturity: Growth phase – The cloud-based business phone market has moved beyond early adoption but hasn’t yet reached maturity. There is significant ongoing growth as businesses increasingly migrate from legacy systems to cloud-based solutions, accelerated by remote work trends.

- Market Trend Alignment: OpenPhone strongly aligns with several key market trends: the shift to remote and hybrid work models requiring flexible communication tools; increasing demand for integrated business tools rather than standalone solutions; growing preference for subscription-based services over capital expenditures; and rising expectations for mobile-first business applications with seamless cross-device experiences.

OpenPhone has strategically positioned itself at the intersection of business telephony and team collaboration, targeting the underserved segment of small to medium businesses that need professional communication capabilities without enterprise complexity or costs. This positioning allows OpenPhone to differentiate from both traditional telecom providers and general communication tools by offering business-specific features with modern usability.

2.2 Competitive Environment

The business phone system market features several established players and newer entrants with varying approaches to solving similar communication challenges.

- Key Competitors: Google Voice for Business, Grasshopper, Line2, Dialpad, and RingCentral

- Competitive Landscape: The market contains a mix of legacy telecom providers transitioning to cloud offerings (like RingCentral), established VoIP players with broad feature sets (Dialpad), and newer entrants focusing on specific segments (Grasshopper for small businesses, Google Voice leveraging its ecosystem). Competition is intensifying as remote work drives increased demand, but there remains significant differentiation in pricing models, target segments, and feature emphasis.

- Substitutes: Traditional approaches include physical PBX systems, using personal mobile numbers for business, carrier-provided second line services, and general-purpose communication tools like WhatsApp Business or free VoIP services.

The competitive environment features both horizontal competition from similar cloud phone systems and vertical pressure from comprehensive unified communications platforms targeting larger enterprises. While larger players like RingCentral and Dialpad offer more extensive feature sets, they typically come with greater complexity and higher costs. Google Voice benefits from ecosystem integration but lacks some business-specific features. OpenPhone has carved out a position by focusing specifically on modern, small business needs with a balance of professional features and usability, competing primarily on simplicity, team collaboration capabilities, and value.

2.3 Competitive Positioning Analysis

Mapping OpenPhone and its competitors along key differentiating dimensions reveals its strategic positioning in the market.

Competitive Positioning Map

Analyzing the business phone system market along two critical axes reveals distinct positioning strategies among competitors:

- X-axis: Feature Complexity (Simple to Complex) – Reflecting the range from basic calling/texting functionality to advanced enterprise communications capabilities

- Y-axis: Target Customer Size (Solo/Small to Enterprise) – Representing the primary customer focus from individual entrepreneurs to large corporate deployments

Positioning Analysis

Within this competitive landscape, each provider occupies a distinct position:

- Google Voice: Positioned in the simple-to-medium feature complexity range, primarily targeting individuals and small teams. Benefits from Google Workspace integration but offers limited business-specific features.

- Grasshopper: Focuses on solo entrepreneurs and very small businesses with relatively simple feature needs, emphasizing ease of setup and management without technical expertise.

- RingCentral: Occupies the high-complexity, mid-to-enterprise customer segment with extensive unified communications capabilities, extensive integrations, and advanced call center functionalities.

- Dialpad: Positions in the medium-to-high complexity range targeting mid-sized businesses to enterprises, with AI-enhanced communications and significant emphasis on analytics.

- OpenPhone: Strategically positioned in the medium feature complexity range for small to mid-sized businesses, balancing professional capabilities with collaborative features and usability. This position represents an underserved “sweet spot” between overly simplified personal solutions and complex enterprise systems.

3. Business Model Analysis

3.1 Revenue Model

OpenPhone employs a straightforward subscription-based revenue model with tiered pricing to address different customer segments and needs.

- Revenue Structure: Pure subscription model with monthly or annual billing options (with discount for annual commitment)

- Pricing Strategy: Tiered pricing based on feature needs and team size. The Standard plan ($15/user/month) provides core functionality, while the Premium plan ($20/user/month) adds advanced features like call analytics, CRM integrations, and enhanced collaboration tools. An Enterprise plan offers custom solutions for larger organizations.

- Free Offerings: OpenPhone does not offer a permanent free tier but provides a 7-day free trial to allow potential customers to experience the platform before committing.

OpenPhone’s pricing strategy is transparent and value-based, positioning between basic consumer-grade services and expensive enterprise solutions. The per-user pricing model ensures revenue scales with customer growth while maintaining a low entry barrier for small businesses. The tiered approach creates natural upsell opportunities as businesses grow or require more advanced features. Additional phone numbers can be added at $5/month each, creating another avenue for revenue expansion beyond user count. OpenPhone also generates revenue through international calling fees, though this represents a smaller portion of overall revenue compared to subscription fees.

By avoiding complex pricing variables or hidden costs common in traditional telecom services, OpenPhone simplifies budgeting for small businesses while maintaining healthy margins typical of SaaS businesses. The annual billing option improves cash flow predictability and customer retention while providing customers with savings.

3.2 Customer Acquisition Strategy

OpenPhone employs a multi-channel customer acquisition approach focused on digital channels and product-led growth mechanisms.

- Key Acquisition Channels: Content marketing (blog, resources), search engine optimization, digital advertising (primarily Google, Facebook), referral program, product review platforms, and partnerships with complementary business tools and services.

- Sales Model: Primarily self-service for small businesses and individuals, with inside sales support for larger teams or organizations with more complex needs. The model emphasizes product-led growth where the product experience itself drives expansion.

- User Onboarding: Streamlined, quick-start onboarding prioritizing fast time-to-value. New users can set up their business phone number and make their first call within minutes. Guided in-app tutorials, contextual help, and knowledge base resources support self-service adoption.

OpenPhone’s acquisition strategy leverages content addressing common business communication challenges to attract organic traffic from search engines. The company maintains an active blog focused on topics relevant to their target audience, such as remote work best practices, business communication tips, and small business growth strategies. This content positions OpenPhone as a thought leader while capturing search traffic from potential customers actively seeking solutions.

The company has designed its trial and onboarding experience to demonstrate value quickly, focusing on the core “aha moments” of receiving a business number, making/receiving calls, and experiencing the cross-device functionality. This rapid value demonstration increases trial conversion rates. OpenPhone also leverages social proof heavily, featuring customer testimonials, case studies, and reviews prominently throughout their marketing materials and website.

For team expansion, OpenPhone employs a land-and-expand strategy, where individual users or small teams can start using the product and then easily invite colleagues, driving organic growth within organizations. The collaborative features naturally encourage this expansion by demonstrating increased value as more team members join the platform.

3.3 SaaS Business Model Canvas

The Business Model Canvas framework provides a systematic analysis of OpenPhone’s overall business structure and value creation mechanism.

Value Proposition

Professional business phone system that works on existing devices, enables team collaboration, integrates with business tools, and costs significantly less than traditional solutions while maintaining enterprise-grade reliability and features.

Customer Segments

Primary: Small to medium-sized businesses (2-50 employees), startups, and entrepreneurs. Secondary: Remote teams, professional service providers, and customer-facing teams within larger organizations.

Channels

Digital marketing (content, SEO, paid), product review platforms, partner referrals, app stores (iOS/Android), and word-of-mouth. Direct website as primary conversion channel with in-app expansion for existing users.

Customer Relationships

Primarily self-service with automated onboarding, in-app support, knowledge base, and community resources. Dedicated account management for larger teams and enterprise customers.

Revenue Streams

Subscription fees (tiered based on features and user count), additional phone number fees, international calling charges, and potential API usage fees for custom integrations.

Key Resources

Cloud infrastructure, telecommunications partnerships for number provisioning and routing, software development team, customer support operations, and intellectual property (software platform).

Key Activities

Platform development and innovation, telecommunications network management, customer support, content creation, digital marketing, and business development (partnerships).

Key Partnerships

Telecommunications carriers for phone number provisioning, cloud infrastructure providers, payment processors, integration partners (CRM systems, productivity tools), and potentially channel partners for reaching specific industries.

Cost Structure

Software development and engineering (fixed), cloud infrastructure and scaling (variable), telecommunications costs (variable based on usage), marketing and customer acquisition, customer support operations, and general administration.

Business Model Analysis

OpenPhone’s business model demonstrates several strengths typical of successful SaaS companies: predictable recurring revenue, relatively low marginal costs for serving additional customers, natural expansion opportunities within existing accounts, and strong alignment between value creation and monetization. The model benefits from network effects within teams, as the value increases when more colleagues use the platform for collaboration. The primary challenge is managing telecommunications costs that scale with usage while maintaining competitive pricing.

The model is particularly effective because it transforms what was traditionally a capital expense (phone systems) into an operational expense, removing barriers to adoption for small businesses. It also creates strong switching costs once customers have established their business identity with an OpenPhone number and integrated it with their workflows. The direct-to-customer approach minimizes distribution costs compared to traditional telecom solutions that rely on reseller networks, though this may limit enterprise penetration where relationships and complex sales cycles dominate.

4. Product Analysis

4.1 Core Feature Analysis

OpenPhone’s feature set focuses on delivering professional business phone capabilities with modern collaboration elements and workflow integration.

- Main Feature Categories: Business Phone Numbers & Communication (voice, SMS, MMS), Team Collaboration, Contact Management & CRM Integration, Call Management & Routing, Analytics & Reporting, and Mobile & Cross-Platform Access

- Key Differentiating Features: Shared phone numbers with team inbox approach, threaded conversations with internal comments that clients can’t see, contextual contact information display during calls, and seamless CRM bi-directional sync

- Feature Completeness: Comprehensive for small to medium business needs, covering essential business phone functionality with strong team collaboration features. Less extensive than enterprise-focused competitors in areas like call center functionality, advanced IVR systems, or compliance features.

OpenPhone has strategically built its feature set around the core needs of modern small businesses, emphasizing team collaboration and workflow integration over the comprehensive PBX features of legacy systems. The shared phone number functionality allows entire teams to access conversation history and respond to customer communications, eliminating information silos common with traditional phone systems. The platform’s threading of all communications (calls, texts, and voicemails) with a contact creates a unified conversation view that provides context for ongoing customer relationships.

The platform offers standard business phone features like auto-attendants, business hours, and custom voicemail, but implements them with significantly improved usability compared to traditional systems. For call handling, OpenPhone provides flexible routing options, call recording, and snippets (saved responses) to streamline common interactions. The mobile apps (iOS and Android) offer full functionality rather than the limited capabilities typical of mobile extensions for traditional phone systems.

OpenPhone has prioritized integration depth over breadth, focusing on deep two-way synchronization with key business tools rather than surface-level connections with numerous platforms. The HubSpot integration, for example, automatically logs calls and messages while displaying relevant contact information during interactions. Zapier integration extends connectivity to hundreds of other tools through custom workflow automation.

While OpenPhone lacks some advanced features found in enterprise UCaaS platforms (like video conferencing, extensive compliance certifications, or complex call center functionality), this focused approach contributes to its simplicity and usability for its target market.

4.2 User Experience

OpenPhone delivers a modern, consumer-grade user experience that stands in stark contrast to the typically complex interfaces of traditional business phone systems.

- UI/UX Characteristics: Clean, minimal interface with intuitive navigation, consistent design across platforms (web, iOS, Android), and modern visual elements focused on readability and efficient information hierarchy.

- User Journey: Key scenarios include setting up a new business number, transitioning between personal and business calls, managing team communication with customers, tracking conversation history, and integrating phone communications with business workflows.

- Accessibility and Ease of Use: High accessibility with minimal technical knowledge required for setup and daily use. Learning curve is substantially lower than traditional PBX systems, with most users becoming proficient within hours rather than days or weeks.

OpenPhone’s user experience is built around conversation-centric design rather than the device-centric approach of traditional phone systems. The inbox-style interface organizes communications by contact rather than by call logs and voicemail boxes, making it intuitive for users already familiar with email or messaging apps. This approach also helps maintain conversation context over time, improving customer service consistency.

The cross-device experience is seamless, allowing users to start a conversation on their mobile device and continue it on desktop without disruption. Notifications are intelligently managed to alert users without overwhelming them, with customizable settings for different types of communications. The mobile apps maintain full functionality rather than offering a limited subset of features, ensuring users can perform any task regardless of their device.

Team collaboration features are thoughtfully integrated into the conversational interface, with internal comments appearing directly within customer conversation threads but clearly differentiated and invisible to external contacts. This contextual collaboration eliminates the need to switch between communication tools when discussing customer interactions.

The onboarding experience focuses on immediate value delivery, guiding new users through selecting a phone number and making their first call within minutes. Contextual help and tooltips explain more advanced features as users encounter them, rather than requiring extensive up-front training.

One notable UX innovation is the presentation of relevant contact and company information during incoming calls, providing immediate context for the interaction without requiring the user to search for records in separate systems. This small but impactful feature demonstrates OpenPhone’s understanding of real-world usage scenarios and attention to workflow optimization.

4.3 Feature-Value Mapping Analysis

This analysis maps OpenPhone’s key features to specific customer value delivery and assesses their differentiation level compared to competitors.

| Core Feature | Customer Value | Differentiation Level |

|---|---|---|

| Dedicated Business Phone Numbers | Enables separation of personal and business communications while maintaining professional identity; eliminates need for second physical device | Medium |

| Shared Phone Numbers & Team Inbox | Ensures no customer calls/messages are missed; eliminates communication silos; facilitates team collaboration; preserves conversation history during employee transitions | High |

| Cross-Device Availability | Provides business call access from anywhere; ensures consistent customer experience regardless of employee location; supports remote/hybrid work models | Medium |

| CRM Integration & Contact Management | Reduces manual data entry; provides context during customer interactions; ensures conversation history is preserved with customer records; improves relationship management | High |

| Internal Commenting & Collaboration | Enables team discussion within customer conversations without creating separate channels; improves response quality through internal knowledge sharing; reduces miscommunication | High |

| Auto-attendant & Business Hours | Creates professional appearance regardless of business size; ensures appropriate call handling during non-business hours; improves work-life balance | Low |

| Analytics & Call Insights | Provides visibility into communication patterns; helps optimize response times; identifies potential training needs; supports data-driven decision making | Medium |

Mapping Analysis

The feature-value mapping reveals that OpenPhone’s highest differentiation and value delivery comes from its collaborative features and workflow integration capabilities rather than from basic telephony functions. While competitors offer similar basic business phone capabilities (explaining the “Low” to “Medium” differentiation for features like auto-attendant and dedicated numbers), OpenPhone’s implementation of team collaboration within the phone system creates unique value that addresses specific pain points for small and growing businesses.

The shared phone numbers and team inbox approach represents OpenPhone’s most distinctive innovation, transforming what is traditionally an individual communication tool into a collaborative platform. This feature directly addresses the challenge of maintaining consistent customer communications across a team – particularly valuable for businesses without dedicated receptionist resources. Similarly, the internal commenting functionality creates significant value by keeping related discussions within the context of the customer conversation rather than fragmenting them across email, messaging platforms, and phone systems.

CRM integration represents another high-value, highly differentiated area, particularly in the depth of integration rather than just the presence of it. While many systems offer basic CRM connectivity, OpenPhone’s bidirectional sync and contextual information display create workflow efficiencies that competitors often lack.

Areas of competitive strength but lower differentiation include cross-device availability and analytics, which deliver significant value but in ways that other advanced competitors also provide. This suggests that while these features are essential to include, they are not primary differentiators for customer decision-making.

OpenPhone has an opportunity to further differentiate through enhanced automation capabilities, more advanced routing options, and expanded API capabilities to support custom integrations and workflows – areas where enterprise competitors currently have advantages but that would deliver high value to OpenPhone’s target market segment.

5. Growth Strategy Analysis

5.1 Current Growth State

OpenPhone is currently positioned in a strong growth phase with multiple avenues for continued expansion in both product capabilities and market penetration.

- Growth Stage: Early growth phase in the product lifecycle, having moved beyond initial product-market fit validation but not yet reaching market saturation or maturity. The company has established a solid core offering and is now focused on expanding both features and market reach.

- Expansion Direction: Dual focus on product expansion (adding more team collaboration and workflow integration features) and market expansion (moving upmarket to serve larger teams while maintaining the core SMB focus).

- Growth Drivers: Primary growth drivers include the accelerating shift to remote and hybrid work, increasing adoption of cloud communication tools by SMBs, growing expectation for integrated business software rather than siloed tools, and the ongoing replacement of legacy PBX systems with cloud alternatives.

OpenPhone’s current growth is characterized by strong product-led momentum, where the user experience and collaborative features drive word-of-mouth expansion and team adoption. The company has successfully established product-market fit within the small business segment, evidenced by high engagement metrics and team expansion within existing accounts.

The remote work acceleration triggered by global events has served as a significant catalyst for OpenPhone’s growth, as businesses seek flexible communication solutions that support distributed teams. This trend shows every indication of continuing as hybrid work models become the norm rather than an exception, creating a sustained tailwind for cloud-based business communication tools.

OpenPhone’s strategic focus on integration with other business tools positions it favorably within the broader trend of workflow consolidation, where businesses seek to reduce the number of disconnected tools in favor of integrated platforms. As the company continues to deepen its integrations with CRM, help desk, and team collaboration tools, this becomes an increasingly powerful differentiation and growth driver.

Current expansion patterns suggest OpenPhone is experiencing both horizontal growth (acquiring more customers in their core small business segment) and vertical growth (existing customers adding more users and upgrading to higher-tier plans). This balanced growth approach provides revenue stability while the company continues to refine its product-market fit for larger team deployments.

The company appears to be navigating the typical SaaS growth challenge of maintaining product simplicity while adding features to serve larger or more sophisticated customers. Their approach of offering tiered pricing with clear feature differentiation helps manage this complexity while creating natural upgrade paths as customer needs evolve.

5.2 Expansion Opportunities

OpenPhone has multiple promising avenues for expansion across product capabilities, market segments, and revenue streams.

- Product Expansion Opportunities: Enhanced workflow automation capabilities, deeper integration with vertically-specific tools, advanced analytics and reporting, expanded compliance and security features for regulated industries, and potential unified communications features like video conferencing.

- Market Expansion Opportunities: Upmarket movement to mid-sized businesses, international expansion beyond North America, vertical specialization for high-value industries with specific communication needs (legal, healthcare, real estate, etc.), and departmental penetration within larger enterprises.

- Revenue Expansion Opportunities: API and developer platform offering, premium support and managed services for larger teams, specialized compliance packages, advanced call center functionality as add-ons, and potential white-label solutions for partners serving specific industries.

OpenPhone’s product expansion opportunities center around increasing the platform’s value through deeper workflow integration and automation. By enhancing capabilities that connect phone communications with other business processes, OpenPhone can increase its stickiness and expand its footprint within customer organizations. Specific opportunities include developing more sophisticated routing rules, enhanced IVR capabilities, expanded automation options through integrations, and potentially adding complementary communication channels like video.

Market expansion offers several promising directions. An upmarket strategy to serve larger teams (50-250 employees) would leverage the platform’s existing collaborative strengths while requiring enhancements to management, security, and analytics features. This would unlock higher contract values while still remaining within the company’s core competency of user-friendly business communications.

Vertical specialization represents another compelling market expansion path. By developing industry-specific templates, workflows, and integrations, OpenPhone could better serve high-value sectors with specialized communication needs such as professional services firms, healthcare providers, or real estate teams. This approach would differentiate the platform from generalist competitors while potentially commanding premium pricing.

International expansion would open significant new markets, though this would require addressing country-specific telecommunications regulations, local number availability, and potentially localization of the platform. The most promising initial international targets would be English-speaking markets with similar SMB characteristics to the current customer base.

Revenue expansion through add-on services and capabilities represents a third growth dimension. Developing a robust API and developer platform would enable custom integrations and potentially create an ecosystem of third-party extensions, increasing the platform’s value and addressable use cases. Premium support packages and professional services for larger implementations could provide additional revenue streams while improving customer success metrics.

5.3 SaaS Expansion Matrix

The SaaS Expansion Matrix systematically analyzes OpenPhone’s growth paths and prioritizes the most promising directions.

Vertical Expansion (Vertical Expansion)

Definition: Delivering deeper value to existing customer segments

Potential: High

Strategy: OpenPhone can expand vertically by developing more advanced collaboration features, deeper CRM and workflow integrations, enhanced analytics and reporting, and potentially adding complementary communication channels like scheduled callbacks or limited video capabilities. This approach leverages the existing product foundation while increasing value for current customer segments, potentially enabling price increases or upselling to higher tiers.

Horizontal Expansion (Horizontal Expansion)

Definition: Expanding to adjacent customer segments

Potential: Medium

Strategy: Horizontal expansion involves developing specialized offerings for related but distinct customer segments. For OpenPhone, this could mean creating tailored solutions for specific professional service verticals (legal, accounting, consulting), developing packages for field service businesses, or creating specialized offerings for customer service teams within larger organizations. This approach leverages the core platform while adapting messaging, features, and potentially pricing to address segment-specific needs.

New Market Expansion (New Market Expansion)

Definition: Entering entirely new customer segments

Potential: Medium-Low

Strategy: New market expansion for OpenPhone would involve targeting significantly different customer types, such as moving upmarket to serve enterprise organizations, expanding internationally to non-English speaking markets, or developing simplified offerings for very small businesses/solopreneurs with minimal communication needs. This approach typically requires more substantial product adaptations, new go-to-market strategies, and potentially different pricing models, making it higher risk but potentially opening larger revenue opportunities.

Expansion Priorities

Based on potential return, execution complexity, market opportunity, and alignment with core strengths, OpenPhone’s expansion priorities should be:

- Vertical Expansion (Enhance collaboration and workflow integration) – This represents the highest near-term opportunity with the lowest execution risk. By deepening the value delivered to existing customer segments, OpenPhone can increase retention, enable price increases, and drive organic growth through enhanced customer satisfaction and word-of-mouth. Key initiatives should include expanded automation capabilities, deeper CRM integrations, and enhanced team collaboration features.

- Upmarket Horizontal Expansion (Mid-sized businesses) – Moving slightly upmarket to serve teams of 50-250 employees represents a natural evolution that leverages existing strengths while opening larger contract values. This would require enhancing administrative controls, security features, and scalability, but would build on the existing product foundation rather than requiring a complete reimagining.

- Vertical-specific Horizontal Expansion – Developing specialized offerings for high-value verticals like professional services, real estate, or healthcare would allow OpenPhone to differentiate from generalist competitors while commanding premium pricing. This approach should follow the upmarket expansion to leverage the enhanced capabilities developed for larger teams.

6. SaaS Success Factor Analysis

6.1 Product-Market Fit

OpenPhone demonstrates strong product-market fit with its target segments, addressing significant business communication challenges with an appropriately designed solution.

- Problem-Solution Fit: OpenPhone directly addresses high-priority pain points for small businesses, including the complexity and cost of traditional phone systems, the unprofessionalism of using personal phones for business, and the communication silos that occur when phone conversations aren’t shared across teams. The solution effectively solves these problems with minimal compromise.

- Target Market Fit: The focus on small to medium-sized businesses and teams represents an ideal target segment – large enough to support significant growth but underserved by both enterprise-focused competitors (too complex and expensive) and consumer solutions (lacking necessary business features).

- Market Timing: OpenPhone’s market entry and growth phase align perfectly with several significant trends: the acceleration of remote and hybrid work, increasing cloud adoption by SMBs, and the expectation for mobile-first business tools that work across devices. The platform addresses needs that have become significantly more pressing in recent years.

OpenPhone’s product-market fit is evidenced by several indicators beyond just feature alignment. User engagement metrics likely show consistent usage patterns that reflect real business communication needs rather than exploratory or sporadic use. The collaborative nature of the product creates natural network effects within organizations, as the value increases when more team members use the platform for coordination.

The company has carved out a distinct position between overly simplified consumer-grade solutions and complex enterprise systems, recognizing that small businesses have unique needs that aren’t well-served by either extreme. By building specifically for this segment rather than attempting to serve everyone, OpenPhone has achieved stronger product-market fit than competitors with broader but less focused approaches.

OpenPhone has also aligned well with evolving customer expectations around business software. Modern users expect consumer-grade usability and mobile experiences combined with business-grade functionality and reliability – something OpenPhone delivers while many legacy competitors struggle with interfaces and experiences designed for IT administrators rather than everyday users.

The strongest evidence of product-market fit comes from expansion patterns within customer accounts. When businesses adopt OpenPhone for one team or use case and then expand to others, it demonstrates that the product is delivering real value that users want to extend throughout their organization. This organic growth within accounts is typically a reliable indicator of strong product-market fit for SaaS businesses.

6.2 SaaS Key Metrics Analysis

Analysis of OpenPhone’s key operational metrics reveals important insights about its business efficiency and potential for sustainable growth.

- Customer Acquisition Efficiency: OpenPhone likely maintains efficient customer acquisition through a combination of content marketing, product-led growth tactics, and targeted digital advertising. The relatively straightforward value proposition enables effective messaging that resonates with the target audience’s explicit needs, reducing education costs compared to more novel or complex solutions.

- Customer Retention Factors: The platform demonstrates several strong stickiness factors: the business identity becomes tied to the phone number (creating switching costs), accumulated conversation history provides ongoing value, team collaboration features increase with usage over time, and integrations with other business tools create workflow dependencies that discourage switching.

- Revenue Expansion Potential: OpenPhone has multiple avenues for expanding revenue within existing accounts: adding more users as teams grow, upgrading to higher-tier plans as needs evolve, adding additional phone numbers for different departments or functions, and potentially adopting advanced features or add-ons as they’re introduced.

OpenPhone’s metrics likely show healthy fundamentals for a SaaS business in the growth phase. The combination of strong product-market fit and a transparent, value-based pricing model typically leads to favorable retention metrics, with churn primarily driven by business circumstances (closures, major strategic shifts) rather than product dissatisfaction.

The net revenue retention (NRR) – which measures how revenue from existing customers changes over time – is likely positive (over 100%), indicating that expansion revenue from growing accounts outpaces losses from churn or downgrades. This is especially true for businesses that use OpenPhone as their primary phone system and grow their team over time, naturally expanding their user count and potentially moving to higher-tier plans.

Customer expansion patterns likely show a “land and expand” dynamic, where initial adoption by a small team or even an individual creates a foothold that grows as value is demonstrated. This is particularly effective when collaboration features show increasing returns as more users join the platform, creating internal advocacy for wider adoption.

The predictable nature of business phone needs creates stable usage patterns that support reliable forecasting. Unlike some SaaS tools that might see sporadic or project-based usage, communication tools typically become daily necessities, creating consistent engagement metrics that correlate with retention.

Given the essential nature of business communications, OpenPhone likely experiences less seasonality or cyclicality than many SaaS businesses, though it may see growth spikes aligned with business formation trends or fiscal year budget cycles when businesses evaluate communications technologies.

6.3 SaaS Metrics Evaluation

Estimating and evaluating key SaaS business metrics provides insights into OpenPhone’s economic fundamentals and long-term sustainability.

Customer Acquisition Cost (CAC)

Estimate: Medium

Rationale: OpenPhone likely experiences moderate customer acquisition costs relative to customer lifetime value. The combination of product-led growth, content marketing, and targeted digital advertising creates multiple acquisition channels with varying efficiency. Self-service acquisition for smaller customers keeps costs lower, while larger teams may require more sales touch and thus higher acquisition costs.

Industry Comparison: Likely lower than enterprise-focused UCaaS providers that require extensive sales cycles and higher than consumer-grade communication tools with viral adoption patterns. OpenPhone’s focus on small business market allows more efficient targeting than broad-market competitors.

Customer Lifetime Value (LTV)

Estimate: Medium-High

Rationale: Several factors contribute to healthy customer lifetime value: strong retention due to business identity being tied to phone numbers, natural expansion as businesses grow their teams, potential for upselling to higher tiers as needs evolve, and the essential nature of communication tools that results in longer customer relationships.

Industry Comparison: Likely higher than consumer communication tools but lower than enterprise UCaaS platforms with large contract values. The combination of reasonable pricing and strong retention creates healthy lifetime value despite lower initial contract sizes compared to enterprise players.

Churn Rate

Estimate: Low-Medium

Rationale: OpenPhone likely experiences relatively low churn for several reasons: the high switching costs once a business establishes its phone identity, the accumulated value of conversation history and contacts, the essential nature of communication tools for ongoing operations, and the increasing value as team members collaborate through the platform.

Industry Comparison: Probably lower than generic communication tools but slightly higher than enterprise UCaaS providers with longer contracts and more complex implementations. Small business natural churn (from business closures) likely represents a significant portion of overall churn rather than competitive losses.

LTV:CAC Ratio

Estimate: 3:1 to 4:1

Economic Analysis: This estimated ratio suggests a healthy economic model with good return on customer acquisition investment. A ratio in this range indicates OpenPhone can profitably acquire customers while maintaining efficient marketing spend. The combination of reasonable acquisition costs and strong retention creates sustainable unit economics that support continued growth investment.

Improvement Opportunities: The ratio could be further improved by: enhancing self-service onboarding to reduce initial support costs, creating more effective upsell paths to higher tiers, developing additional revenue opportunities within existing accounts, improving retention through deeper integrations with critical business systems, and optimizing marketing channel mix to reduce acquisition costs.

7. Risk and Opportunity Analysis

7.1 Key Risks

OpenPhone faces several significant risks that could impact its continued growth and market position in the business phone system space.

- Market Risks: The business phone system market is experiencing rapid digital transformation with increasing adoption of unified communication platforms that combine voice, video, and messaging. OpenPhone may face challenges as larger players offer more comprehensive solutions. Additionally, global economic uncertainty could impact small business spending on communication tools, which represents a core customer segment for OpenPhone.

- Competitive Risks: The unified communications market is becoming increasingly crowded with major players like Microsoft Teams, Zoom Phone, and RingCentral expanding their offerings. These companies have significantly larger resources for development and marketing. Traditional telecom providers are also modernizing their offerings to compete in the cloud-based business phone space, creating downward pricing pressure.

- Business Model Risks: OpenPhone’s subscription-based revenue model, while providing recurring revenue, is vulnerable to churn, especially among small businesses that may be price-sensitive. The company must continuously demonstrate value to maintain customer retention. Additionally, as OpenPhone expands its feature set to compete with larger UCaaS (Unified Communications as a Service) providers, development and infrastructure costs may increase, potentially impacting profitability margins.

A particularly concerning risk is the increasing trend of all-in-one workplace communication platforms that bundle phone services with other tools. Companies like Microsoft and Zoom can leverage their existing market position to offer phone systems as an add-on to their primary products, potentially at more competitive prices. OpenPhone’s focus on being phone-first rather than part of a broader unified communications suite could become a liability if market preferences continue to shift toward integrated solutions.

7.2 Growth Opportunities

Despite the risks, OpenPhone has several promising opportunities for growth across different time horizons.

- Short-term Opportunities: OpenPhone can immediately expand its CRM and business tool integrations beyond current partnerships, making it more valuable to business users. Developing more advanced analytics and call intelligence features would appeal to sales-focused organizations looking to optimize communication. The company could also introduce team collaboration features specifically designed for remote and hybrid teams, capitalizing on the continued shift to flexible work arrangements.

- Medium-term Opportunities: Over the next 1-3 years, OpenPhone could expand internationally by adding local numbers and compliance features for key markets in Europe, Asia, and Latin America. Developing industry-specific versions of their platform with tailored features for sectors like healthcare, real estate, and professional services would create new vertical markets. There’s also potential to move upmarket by creating enterprise-grade offerings with advanced security, compliance, and administrative features.

- Differentiation Opportunities: OpenPhone can carve a unique position by focusing on being the most user-friendly business phone system with consumer-grade design paired with business capabilities. Emphasizing privacy and data ownership as competitive advantages against larger tech platforms could appeal to privacy-conscious businesses. Additionally, building the most comprehensive API and developer platform for business communications would enable customers to build custom workflows and integrations.

A particularly promising opportunity lies in creating an ecosystem of communication-focused micro-apps and extensions that solve specific business problems. By opening a platform for developers to build specialized tools on top of OpenPhone’s communication infrastructure, the company could create network effects that increase switching costs and provide additional revenue streams through a marketplace model. This would differentiate OpenPhone from competitors while increasing the range of problems the platform can solve without building everything in-house.

7.3 SWOT Analysis

A comprehensive SWOT analysis provides a structured framework for understanding OpenPhone’s strategic position and potential directions.

Strengths

- User-friendly interface with modern mobile-first design that appeals to small businesses and startups

- Strong collaboration features like shared phone numbers and conversation threads

- Seamless integration with popular CRM and productivity tools

- Transparent pricing model that’s accessible to small businesses

Weaknesses

- Limited video conferencing capabilities compared to unified communications competitors

- Less established brand recognition compared to legacy telecom providers

- Smaller feature set compared to enterprise-focused competitors

- Limited international coverage compared to global telecom providers

Opportunities

- Growing demand for cloud-based business phone solutions as companies abandon legacy systems

- Increasing adoption of remote and hybrid work models requiring flexible communication tools

- Integration potential with emerging AI technologies for call analytics and automation

- Expansion into international markets as businesses increasingly operate globally

Threats

- Consolidation in the communications industry leading to increased competition

- Larger tech companies bundling phone capabilities into workplace suites

- Potential regulatory changes affecting VoIP and digital communication services

- Commoditization of basic business phone features putting pressure on pricing

SWOT-Based Strategic Directions

- SO Strategy: Leverage the user-friendly design and collaboration features to capitalize on the shift to remote work by developing specific packages and marketing campaigns targeting distributed teams.

- WO Strategy: Address the limited video capabilities by developing strategic partnerships with complementary video conferencing tools while focusing marketing efforts on building brand recognition among growing businesses.

- ST Strategy: Combat the threat of bundled offerings from larger players by doubling down on deep integrations with popular business tools and emphasizing OpenPhone’s specialized focus on optimizing business communications.

- WT Strategy: Mitigate the weaknesses in feature depth and the threat of commoditization by creating unique AI-powered capabilities that larger, less agile competitors cannot quickly replicate.

8. Conclusions and Insights

8.1 Overall Assessment

OpenPhone presents a compelling modern alternative to traditional business phone systems with particularly strong positioning for small to mid-sized businesses seeking simplicity and collaboration features.

- Business Model Soundness: OpenPhone’s subscription-based revenue model provides stable, recurring revenue with clear monetization. Their tiered pricing structure offers natural upgrade paths as customers grow, allowing the company to increase revenue per customer over time. The model is sustainable as cloud communication costs continue to decrease while the value of their software layer increases. Their focus on self-service acquisition keeps customer acquisition costs reasonable compared to enterprise-focused competitors.

- Market Competitiveness: Within the business phone system market, OpenPhone occupies a favorable position in the small to mid-sized business segment with its balance of affordability and functionality. While facing intense competition from both specialized VoIP providers and broader unified communications platforms, OpenPhone’s product design quality and focus on collaboration features provide meaningful differentiation. The company has wisely positioned itself between overly simplified consumer solutions and complex enterprise systems.

- Growth Potential: OpenPhone has substantial room for expansion through multiple avenues: moving upmarket with more robust enterprise features, expanding internationally, deepening vertical specialization, and broadening their platform through integrations and API capabilities. Their product architecture appears scalable, allowing them to add features and capacity without rebuilding their core technology.

OpenPhone exemplifies the modern SaaS approach to disrupting established industries – starting with a narrower but superior solution for an underserved segment, then methodically expanding capabilities and market reach. Their focus on product design and user experience creates word-of-mouth growth potential that can reduce acquisition costs over time. The main challenge will be balancing feature expansion to compete with larger platforms while maintaining the simplicity that distinguishes them. If OpenPhone can continue executing on their product roadmap while keeping acquisition costs in check, they have the potential to build a substantial business in the business communications market, potentially becoming an acquisition target for larger platforms seeking to improve their communications offerings.

8.2 Key Insights

Our analysis of OpenPhone reveals several critical insights that define the company’s position and prospects.

Major Strengths

- Product design excellence that brings consumer-grade user experience to business communications, significantly lowering the learning curve compared to traditional business phone systems

- Team collaboration features like shared phone numbers, commenting, and internal discussions that specifically address the needs of modern distributed teams

- Strategic integrations with critical business tools (CRM, helpdesk, etc.) that embed OpenPhone into customer workflows, increasing stickiness and value

Major Challenges

- Competing against deep-pocketed unified communications providers who can bundle phone features with video conferencing and team collaboration tools

- Maintaining product simplicity and ease of use while adding enterprise-grade features necessary to move upmarket and reduce churn

- Scaling customer acquisition efficiently as the company targets larger organizations with longer sales cycles and more complex requirements

Key Differentiating Factor

OpenPhone’s most significant differentiation is its seamless blend of personal mobile phone usability with professional business capabilities. By creating a business phone system that feels as intuitive as consumer messaging apps while incorporating powerful collaboration features, OpenPhone has found a unique position between overly simplified consumer apps and complex enterprise communications systems. This approach particularly resonates with modern small businesses and startups that prioritize user experience and team collaboration over complex feature sets.

8.3 SaaS Scorecard

Using a quantitative evaluation on a 1-5 scale for key success factors, we assess OpenPhone’s overall competitiveness in the business phone system market.

| Evaluation Criteria | Score (1-5) | Assessment |

|---|---|---|

| Product Capability | 4 | Strong core phone system features with excellent mobile experience and collaboration tools, though lacking some advanced enterprise features and comprehensive video conferencing capabilities |

| Market Fit | 5 | Excellent alignment with the needs of small to mid-sized businesses, particularly those with distributed teams or mobile workforces that value simplicity and collaboration |

| Competitive Positioning | 4 | Well-differentiated through design excellence and collaboration features, though facing substantial competition from both specialized providers and larger unified communications platforms |

| Business Model | 4 | Strong subscription-based model with clear upgrade paths, though facing some pricing pressure from larger platforms that can bundle phone capabilities |

| Growth Potential | 4 | Multiple viable growth avenues available through upmarket expansion, international growth, and platform extension, though requiring careful prioritization and execution |

| Total Score | 21/25 | Excellent – OpenPhone demonstrates strong capabilities across all major evaluation criteria |

With a total score of 21/25, OpenPhone demonstrates exceptional potential as a SaaS business in the business communications market. The company has achieved an excellent product-market fit for small to mid-sized businesses while building a sustainable business model with multiple paths for future growth. While facing intense competition, OpenPhone’s focus on design excellence and team collaboration features provides meaningful differentiation. The main areas for improvement are in expanding enterprise capabilities without compromising on simplicity, and potentially developing stronger video capabilities to compete more effectively with unified communications platforms. Overall, OpenPhone represents a strong example of how focused product design and understanding of specific customer segments can create a compelling SaaS business even in a competitive market.

9. Reference Sites

9.1 Analyzed Service

OpenPhone’s official website and key related pages.

- Official Website: https://www.openphone.com/ – OpenPhone’s cloud-based business phone system that allows teams to call, text, and collaborate using dedicated business phone numbers through mobile and desktop applications

9.2 Competing/Similar Services

Major services that compete with or are similar to OpenPhone in the business phone system market.

- Dialpad: https://www.dialpad.com/ – AI-powered cloud communications platform offering voice, video, messaging, and contact center capabilities with more enterprise features than OpenPhone

- Google Voice: https://voice.google.com/ – Google’s telephony service that integrates with Google Workspace, offering a simpler solution with fewer business-specific features than OpenPhone

- RingCentral: https://www.ringcentral.com/ – Comprehensive unified communications platform with more extensive enterprise capabilities and broader international coverage than OpenPhone

- Grasshopper: https://grasshopper.com/ – Virtual phone system specifically designed for small businesses and entrepreneurs, with less emphasis on team collaboration than OpenPhone

9.3 Reference Resources

Resources that help in building or understanding a similar SaaS business in the communications space.

- Twilio: https://www.twilio.com/ – Communication APIs that provide the underlying infrastructure for building voice and messaging capabilities into applications

- GetApp VoIP Software Category: https://www.getapp.com/it-communications-software/voip/ – Comprehensive directory and reviews of business phone software to understand market positioning and feature comparisons

- Y Combinator Startup School: https://www.startupschool.org/ – Free resource for founders building startups, relevant as OpenPhone is a Y Combinator-backed company

- SaaS Metrics 2.0: https://www.forentrepreneurs.com/saas-metrics-2/ – David Skok’s guide to the key metrics for running and evaluating a SaaS business

10. New Service Ideas

Idea 1: ConvoAI

Overview

ConvoAI is a conversation intelligence platform that automatically records, transcribes, analyzes, and extracts insights from business calls and meetings. The system uses advanced AI to identify customer sentiment, key topics, action items, and sales opportunities, providing teams with actionable insights to improve performance and customer relationships. Unlike generic recording tools, ConvoAI is specifically designed for sales and customer service workflows with pre-built templates, integrations, and industry-specific analysis models.

Who is the target customer?

▶ Sales teams in B2B companies looking to improve conversion rates and coaching

▶ Customer service departments seeking to improve quality assurance and training

▶ Account management teams managing ongoing client relationships

▶ Small to mid-sized businesses without resources for dedicated call monitoring teams

What is the core value proposition?

Business conversations contain valuable information about customer needs, objections, and satisfaction, but this data is typically lost or requires manual effort to document. Sales managers can’t review every call, leading to missed coaching opportunities. Customer service quality is inconsistent without proper monitoring. ConvoAI solves these problems by automatically capturing call data and transforming it into actionable insights. This helps businesses close more deals, improve customer satisfaction, reduce churn, and onboard new team members faster. The system effectively turns every conversation into structured data that can be analyzed, searched, and used to drive business decisions.

How does the business model work?

• Basic Tier ($25/user/month): Call recording, transcription, basic sentiment analysis, searchable library

• Professional Tier ($49/user/month): Advanced analytics, coaching highlights, integration with CRM systems, custom topic detection

• Enterprise Tier ($79/user/month): Team performance analytics, custom AI models for industry-specific terminology, compliance features, API access

What makes this idea different?

Unlike general transcription services, ConvoAI is purpose-built for sales and customer service workflows with pre-built templates and analysis models specific to these functions. Compared to enterprise call center solutions, ConvoAI is accessible to smaller teams with self-service onboarding and transparent pricing. The platform’s focus on extracting actionable insights rather than just providing raw data distinguishes it from recording tools. ConvoAI also empowers individual contributors with personal improvement suggestions, not just managers, creating bottom-up adoption potential.

How can the business be implemented?

- Build initial MVP using existing speech-to-text APIs and basic sentiment analysis to validate core functionality

- Create integrations with popular CRM systems and business phone providers (including OpenPhone)

- Develop industry-specific AI models for sales, customer service, and account management

- Implement feedback loops where user corrections improve transcription and analysis accuracy

- Expand to video meeting analysis and additional communication channels for comprehensive coverage

What are the potential challenges?

• Privacy and compliance concerns with recording conversations – address with robust security, consent management, and compliance features

• Accuracy of AI transcription and analysis – mitigate by allowing human corrections and continuously improving models

• Integration complexity with various phone systems – solve through partnerships and a dedicated integration team

• Potential resistance from employees who feel monitored – position as a personal improvement tool, not just management oversight

Idea 2: TeamReach

Overview

TeamReach is a unified customer interaction platform that brings together web chat, social media messages, SMS, WhatsApp, and other communication channels into a single collaborative workspace for distributed teams. The platform allows organizations to provide consistent customer support across all channels, with smart routing, shared conversation history, and team collaboration features. TeamReach is designed specifically for modern companies with remote or hybrid teams that need to maintain cohesive customer communication without a physical contact center.

Who is the target customer?

▶ E-commerce businesses managing customer inquiries across multiple platforms

▶ SaaS companies providing customer and technical support through various channels

▶ Marketing agencies managing client social media interactions

▶ Small to mid-sized businesses without dedicated contact center infrastructure

What is the core value proposition?

Modern businesses interact with customers across an ever-expanding number of channels, but these conversations often happen in silos. This fragmentation leads to slow response times, inconsistent messaging, and frustrated customers who receive different answers depending on the channel they use. For companies with distributed teams, this problem is amplified by the lack of physical proximity for coordination. TeamReach solves this by unifying all customer interactions in one collaborative workspace, ensuring consistent messaging, reducing response times, and enabling seamless handoffs between team members regardless of location. The system provides customers with a cohesive experience while giving businesses complete visibility into their communication history across all channels.

How does the business model work?

• Starter Plan ($29/agent/month): Up to 3 channels, basic routing, shared inbox, chat history

• Business Plan ($59/agent/month): Unlimited channels, automated routing rules, SLA management, basic analytics

• Professional Plan ($99/agent/month): Advanced analytics, customer journey mapping, custom integrations, priority support

What makes this idea different?

Unlike traditional help desk software that focuses primarily on email tickets, TeamReach is built from the ground up for real-time messaging across multiple channels. The platform emphasizes team collaboration with features specifically designed for distributed teams, such as virtual “shoulder taps” for quick consultations and synchronized viewing of customer context. While existing solutions often treat newer channels as add-ons, TeamReach gives equal priority to all communication methods, recognizing that customers expect consistent service regardless of how they reach out.

How can the business be implemented?

- Develop core platform with integrations for the most popular communication channels (web chat, SMS, social messaging)

- Create collaborative features specifically designed for distributed teams (presence indicators, knowledge sharing)

- Build smart routing engine that directs conversations based on agent expertise, availability, and context

- Implement analytics that provide insights across channels and team performance

- Develop self-service onboarding and marketplace for additional channel integrations

What are the potential challenges?

• Technical complexity of maintaining reliable connections to multiple platforms – address with robust API management and fallback mechanisms

• Changes to third-party APIs that could disrupt integrations – mitigate with a dedicated integration maintenance team

• Educating users accustomed to single-channel workflows – provide comprehensive onboarding and training resources

• Competition from existing help desk solutions expanding to messaging – differentiate through superior team collaboration features and multi-channel parity

Idea 3: LoopLink

Overview

LoopLink is a no-code platform that allows businesses to create interactive voice and messaging workflows without programming knowledge. The system enables companies to automate routine customer interactions through phone calls, SMS, WhatsApp, and other channels using a visual workflow builder. Users can create complex interaction flows with conditional logic, integrate with their existing systems, and seamlessly transition between automated and human interactions when needed. LoopLink focuses on making communication automation accessible to non-technical business users while providing the sophistication needed for effective customer engagement.

Who is the target customer?

▶ Small and medium businesses looking to automate appointment scheduling and reminders

▶ Service businesses needing to manage customer follow-ups and satisfaction checks

▶ Sales teams implementing lead qualification and nurturing sequences

▶ Customer support teams automating common requests and information gathering

What is the core value proposition?

Many businesses waste valuable employee time on repetitive communication tasks like appointment reminders, status updates, and basic information gathering. Traditional IVR (Interactive Voice Response) and automation systems require technical expertise to implement and modify, making them inaccessible to most small businesses. When companies do implement automation, it often creates frustrating customer experiences with no easy way to reach a human. LoopLink solves these problems by providing an intuitive visual builder that non-technical staff can use to create natural-sounding automation workflows, with seamless human handoffs when needed. This reduces labor costs, ensures consistent communication, improves response times, and frees staff to focus on interactions that truly require a human touch.

How does the business model work?

• Starter Plan ($49/month): Up to 500 interactions, basic workflows, standard templates

• Growth Plan ($149/month): Up to 2,500 interactions, advanced conditional logic, CRM integrations

• Business Plan ($349/month): Up to 10,000 interactions, custom integrations, advanced analytics, priority support

• Usage-based pricing for additional interactions beyond plan limits

What makes this idea different?

Unlike enterprise automation platforms that require technical implementation, LoopLink is designed for business users with a visual, no-code approach. The platform emphasizes maintaining the human touch in automated communications with natural language processing and easy human handoffs. LoopLink also uniquely supports both voice and messaging channels in the same workflow builder, allowing businesses to meet customers in their preferred communication medium while maintaining a consistent experience across channels.

How can the business be implemented?

- Develop the visual workflow builder with drag-and-drop interface and pre-built templates

- Integrate with telephony and messaging APIs to enable multi-channel communication

- Create connectors for popular business tools (CRM, scheduling, payment systems)

- Implement analytics to help users optimize their automation workflows

- Build a template marketplace where users can share and sell successful workflows

What are the potential challenges?

• Balancing simplicity for non-technical users with power for complex scenarios – address with progressive disclosure of advanced features

• Maintaining natural-sounding voice and text interactions – invest in conversation design guidelines and templates

• Integration complexity with diverse business systems – develop a partner program for custom integrations

• Overcoming negative perceptions of automated systems – emphasize human-centered design and seamless human handoffs

Disclaimer & Notice

- Information Validity: This report is based on publicly available information at the time of analysis. Please note that some information may become outdated or inaccurate over time due to changes in the service, market conditions, or business model.

- Data Sources & Analysis Scope: The content of this report is prepared solely from publicly accessible sources, including official websites, press releases, blogs, user reviews, and industry reports. No confidential or internal data from the company has been used. In some cases, general characteristics of the SaaS industry may have been applied to supplement missing information.

- No Investment or Business Solicitation: This report is not intended to solicit investment, business participation, or any commercial transaction. It is prepared exclusively for informational and educational purposes to help prospective entrepreneurs, early-stage founders, and startup practitioners understand the SaaS industry and business models.

- Accuracy & Completeness: While every effort has been made to ensure the accuracy and reliability of the information, there is no guarantee that all information is complete, correct, or up to date. The authors disclaim any liability for any direct or indirect loss arising from the use of this report.

- Third-Party Rights: All trademarks, service marks, logos, and brand names mentioned in this report belong to their respective owners. This report is intended solely for informational purposes and does not infringe upon any third-party rights.

- Restrictions on Redistribution: Unauthorized commercial use, reproduction, or redistribution of this report without prior written consent is prohibited. This report is intended for personal reference and educational purposes only.

- Subjectivity of Analysis: The analysis and evaluations presented in this report may include subjective interpretations based on the available information and commonly used SaaS business analysis frameworks. Readers should treat this report as a reference only and conduct their own additional research and professional consultation when making business or investment decisions.

No comment yet, add your voice below!