Unlock the power of press release distribution to boost your SaaS launch. Learn how to craft stories that build trust, drive traffic, and attract real attention.

Continue readingSaaS Launching #2 – Product Demo That Converts Powerfully

Learn why a high-converting SaaS launch page is your first step to success. Capture leads, validate demand, and build visibility before you even launch.

Continue readingSaaS Launching #1 – Build Your SaaS Launch Page Right Now

Learn why a high-converting SaaS launch page is your first step to success. Capture leads, validate demand, and build visibility before you even launch.

Continue reading3C Framework: Customer, Competitor, Company in SaaS

Introduction

Launching a SaaS startup isn’t just about writing great code or releasing cool features.

It’s about building something that your customers truly need—something that stands out in a crowded market and plays to your unique strengths.

To do that, you need a clear strategic lens.

That’s where the 3C Analysis Framework comes in.

Used by top strategists and product teams, 3C helps you answer three crucial questions:

- Who are your real customers, and what do they want?

- What are your competitors doing, and how can you differentiate?

- What strengths does your company have to win in this market?

Let’s break it down.

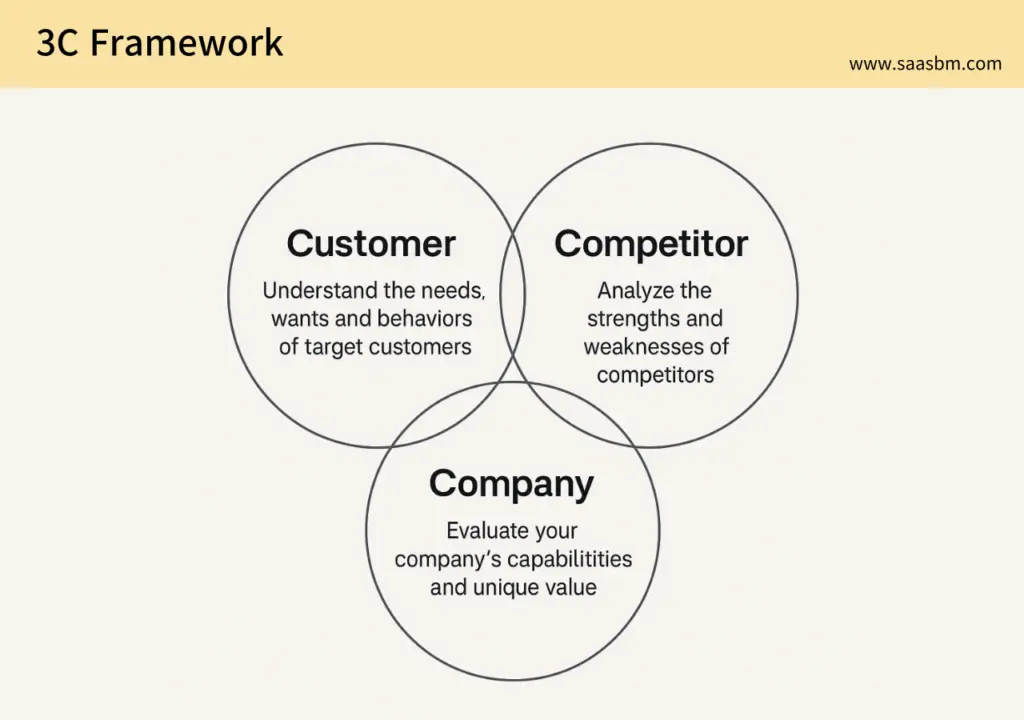

What is the 3C Framework?

The 3C Framework was originally introduced by Kenichi Ohmae and has been widely adopted across industries.

For SaaS businesses, it means analyzing the market from three angles:

- Customer – Understand who you’re serving and what they’re trying to accomplish.

- Competitor – Identify your competitors and what makes them successful or vulnerable.

- Company – Pinpoint your strengths, capabilities, and limitations as a team and a business.

Where these three align is where your opportunity lies.

1. Customer: Who Are You Really Serving?

In SaaS, your customer is not just a “user” but someone with a job to be done.

That job might be:

- Functional: Manage tasks, streamline processes, automate workflows

- Emotional: Feel less overwhelmed, be seen as efficient

- Organizational: Improve reporting, meet compliance, reduce team friction

Ask yourself:

- Who is the buyer? Who is the user?

- What pain are they solving today—often with spreadsheets or manual work?

- How urgent is their need? Are they willing to pay?

The better you understand your customer’s world, the better your product-market fit will be.

2. Competitor: Who Else Is Solving the Same Problem?

Competition in SaaS is fierce—and not always obvious.

It includes:

- Direct competitors – Companies offering similar SaaS tools

- Indirect competitors – General-purpose tools (Excel, Notion) or manual solutions

What to evaluate:

- Their product features and strengths

- Their pricing model

- Their brand messaging and customer perception

- What users love or hate based on reviews

Understanding your competitors helps you define your differentiator.

3. Company: What Are You Uniquely Good At?

Not all SaaS teams are the same.

You need to play to your strengths, whether that’s:

- Technical expertise (e.g., NLP, AI, infrastructure)

- Domain knowledge (e.g., legaltech, edtech)

- Access to an initial user base or network

- Speed, agility, or design excellence

Ask:

- What unique insight do we have about the market?

- What can we build faster or better than others?

- Where are we weak—and how do we mitigate that?

SaaS Example: “Docly” – An AI-Powered Contract Generator

| Component | Analysis |

|---|---|

| Customer | Freelancers, small startups, legal teams who want fast and simple contract creation |

| Competitor | PandaDoc, DocuSign, Notion templates |

| Company | Strong NLP capabilities, clean UX, affordable pricing, tailored for small teams |

Insight:

Rather than chasing complex enterprise features, focus on speed, ease-of-use, and affordability. Win early adopters in the freelance and SMB space before expanding vertically.

Summary: A Simple Framework with Strategic Power

| C | Strategic Focus |

|---|---|

| Customer | Who is your ideal user and what problem do they face? |

| Competitor | What alternatives exist and how are you different? |

| Company | What strengths can you uniquely leverage? |

3C isn’t just about research—it’s about building clarity and confidence into your decisions.

Final Thoughts

Startups often rush into building and shipping.

But building without strategic alignment leads to burnout and missed opportunities.

The 3C Framework brings structure to your intuition.

It guides your thinking across market, user, and team.

Before you build your MVP, pitch investors, or launch your next campaign—step back and ask:

- Do we really understand our Customer?

- Do we know how we differ from our Competitors?

- Do we know what we’re uniquely capable of as a Company?

3C is where strategy starts.

A Strategic Guide to the SaaS Expansion Matrix

Introduction

“Should we add new features or target a new market?”

“Do we go deeper with our current users, or reach new ones?”

These are common — and critical — questions SaaS startups face once early traction is achieved.

Growth isn’t just about moving fast — it’s about moving in the right direction.

That’s why the SaaS Expansion Matrix exists.

It’s a simple but powerful strategic framework that helps SaaS founders choose how to expand — with clarity and intention.

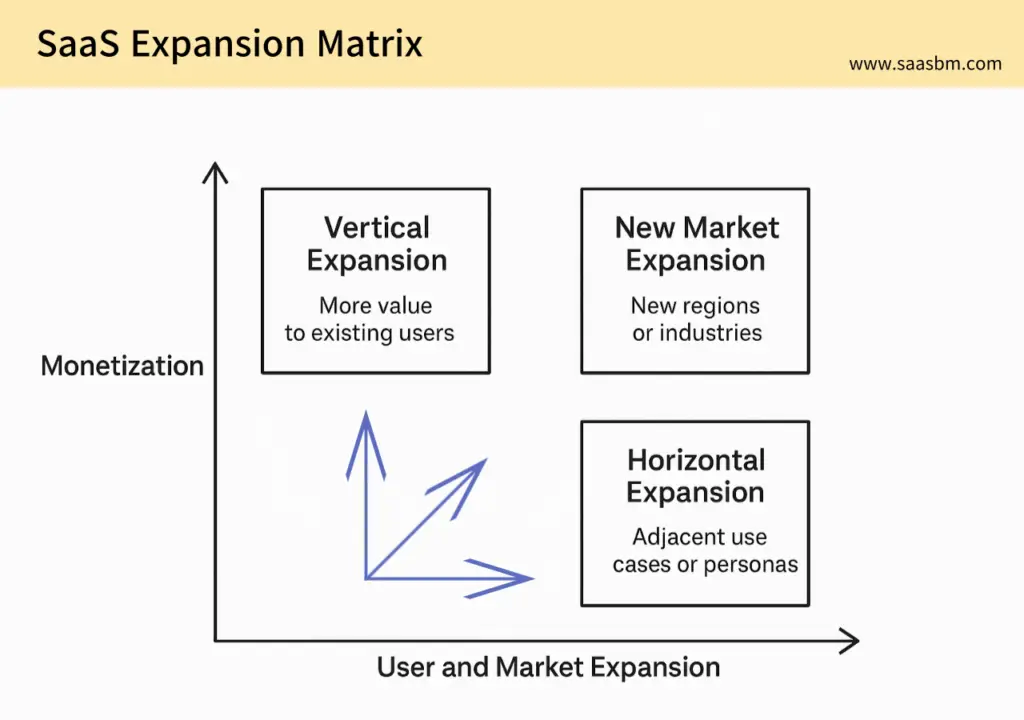

What Is the SaaS Expansion Matrix?

The SaaS Expansion Matrix outlines three core directions of strategic growth:

- Vertical Expansion

- Horizontal Expansion

- New Market Expansion

Each direction focuses on a different dimension of scale — whether it’s deeper monetization, broader user reach, or tapping into untapped territories.

The matrix gives you a structured way to prioritize and allocate resources for maximum impact.

The Three Types of SaaS Expansion

✅ Vertical Expansion

- Definition: Offer more value to your existing customers

- Examples:

- Upselling premium features to current users

- Offering admin controls, analytics, or security add-ons

- When to Use:

- High user retention, but flat revenue growth

- Strong product-market fit within a single persona

- Goal: Boost ARPU (Average Revenue Per User)

✅ Horizontal Expansion

- Definition: Expand into adjacent use cases or personas

- Examples:

- A design tool adding use cases for developers

- A CRM offering HR or finance team templates

- When to Use:

- Core product solves universal problems

- Early signs of use by multiple roles or industries

- Goal: Grow total active user base

✅ New Market Expansion

- Definition: Enter a new region, industry, or business size

- Examples:

- Launching in APAC after gaining traction in North America

- Targeting enterprise after starting with SMBs

- When to Use:

- Saturation in current market

- Competitive advantage in underserved geographies or verticals

- Goal: Diversify revenue, reduce dependence on a single market

Real-World Example: “Schedly” – A SaaS Calendar for Creative Teams

Let’s say you run Schedly, a smart calendar tool built for creative teams.

Here’s how the Expansion Matrix might apply:

| Expansion Type | Strategy Example |

|---|---|

| Vertical | Add project analytics, client dashboards for existing users |

| Horizontal | Launch features for marketing, sales, and support teams |

| New Market | Localize for Japan and Korea, integrate with local tools |

Schedly doesn’t just grow by “adding features.” It grows by aligning each expansion strategy with user behavior and market opportunity.

Summary: Choose Your Growth Direction

| Expansion Type | Core Question | Strategic Purpose |

|---|---|---|

| Vertical Expansion | “Can we offer more to existing users?” | Increase ARPU, deepen value |

| Horizontal Expansion | “Can we serve adjacent use cases?” | Expand user base |

| New Market Expansion | “Can we win in new territories?” | Diversify and de-risk |

Final Thoughts

SaaS growth isn’t just about adding — it’s about aligning.

If you don’t know where you’re going, you’ll waste time, money, and morale.

The SaaS Expansion Matrix keeps you grounded and focused.

It forces your team to ask: “Which move makes the most sense, right now?”

So before launching a new feature or investing in international ads, gather your team and ask:

“Are we growing vertically, horizontally, or into a new market?”

The answer will help you scale faster — and smarter.

A Practical Guide to SWOT Analysis for SaaS Startups

Introduction

“Why aren’t users sticking around?”

“Are we ready to pitch to investors?”

“What’s our real edge over the competition?”

If you’ve ever asked yourself these questions, you’re not alone. Every early-stage SaaS founder faces them.

Before you scale, pivot, or raise funds, you need a clear understanding of where you stand — both inside and out.

That’s where SWOT Analysis comes in.

In this post, you’ll learn:

- What SWOT really means

- How to apply it to your SaaS business

- Key questions to ask

- A real SaaS example in action

- How to turn insights into strategy

Let’s dive in.

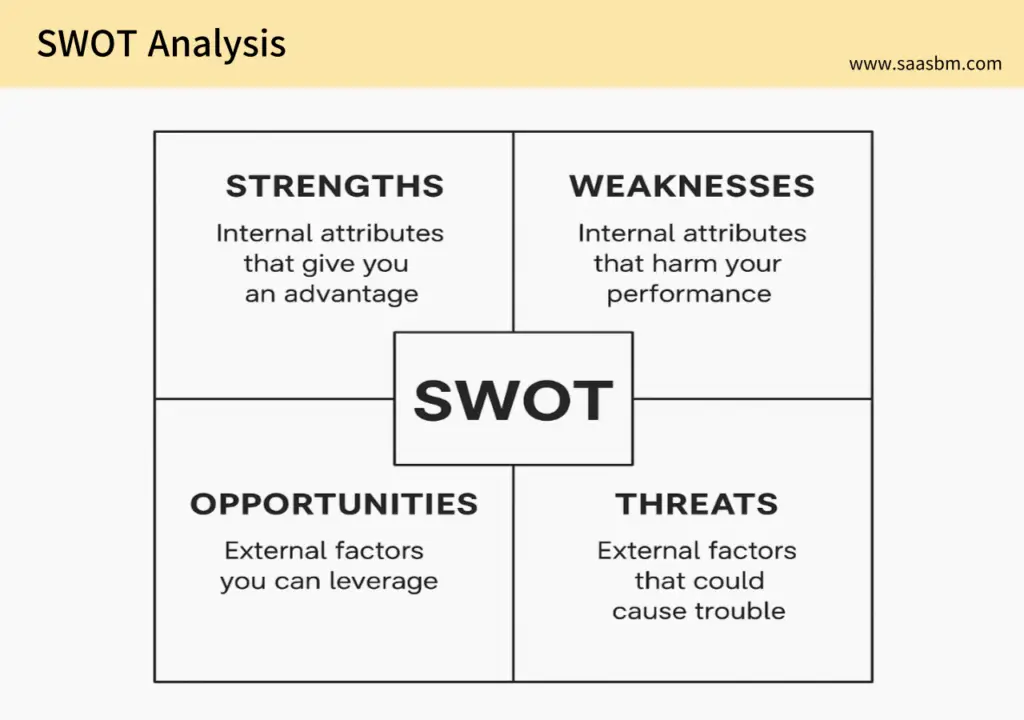

What Is SWOT Analysis?

SWOT stands for:

- Strengths – What you’re great at

- Weaknesses – Where you need improvement

- Opportunities – External trends or gaps you can leverage

- Threats – External risks that could harm your business

It’s a strategic tool to help you see your business from every angle.

And in SaaS — where recurring revenue and product-market fit are everything — a SWOT analysis is one of the fastest ways to map your path forward.

SaaS-Focused SWOT Breakdown

✅ Strengths

- Solving a specific pain point well

- Fast product development and agile team

- Recurring revenue through subscriptions

- Loyal early users giving rich feedback

Key Questions:

- What’s our core feature that competitors lack?

- Why do users choose us over others?

- Where can we execute faster than the competition?

⚠️ Weaknesses

- Low brand awareness

- Bugs, technical debt, or limited scalability

- Weak marketing funnel or sales process

- No strong analytics or data for decision-making

Key Questions:

- Why are users churning?

- Where is our UX failing?

- Are we ready for scale?

📈 Opportunities

- Accelerated digital transformation

- Growth in remote teams or niche verticals

- Integration/API partnerships

- Frustrated users of legacy tools

Key Questions:

- What trends are reshaping our space?

- What are our users unhappy about in other tools?

- Where are the market gaps?

🔥 Threats

- Enterprise players moving fast into our niche

- New SaaS tools launching daily

- Price-sensitive customers

- Funding winter or economic downturn

Key Questions:

- Are barriers to entry low in our market?

- Can we survive without raising capital soon?

- What external forces could pull users away?

Real-World Example: TimeHatch – A Scheduling SaaS for Creative Teams

Let’s say your startup, TimeHatch, offers a simple scheduling platform for design and video teams.

Here’s how SWOT might look:

| SWOT | TimeHatch Summary |

|---|---|

| Strengths | Clean UX, fast integrations, freemium model driving signups |

| Weaknesses | Limited analytics, weak CRM features, no enterprise play |

| Opportunities | Remote work trends, demand for Notion-like integration, untapped Asia market |

| Threats | Google Calendar bundling more features, churn at 7% monthly |

From this, you can derive actionable strategies:

- SO Strategy: Use strengths to seize opportunities → Deepen Notion integration to boost UX

- WO Strategy: Fix weaknesses to pursue opportunities → Improve CRM for Asian expansion

- ST Strategy: Use strengths to neutralize threats → Emphasize integrations to compete with bundled tools

- WT Strategy: Reduce weaknesses and threats → Trim features, focus on core experience

Summary: Why SWOT Matters for SaaS Startups

| Element | Strategic Purpose |

|---|---|

| Strengths | What gives you a competitive edge |

| Weaknesses | What limits your growth or scale |

| Opportunities | Where the market is moving |

| Threats | What could block or destroy progress |

Final Thoughts

SaaS isn’t just about building software — it’s about building value.

To deliver that value sustainably, you need to know your position in the market.

SWOT is simple, but it forces clarity.

It aligns your product roadmap, marketing strategy, and even fundraising pitch.

So before your next sprint or campaign, ask yourself:

“What are we great at, and what could take us down?”

The answers might change the way you build.

SaaS Metrics Evaluation: A Practical Guide to Measuring What Really Matters

Introduction

You’ve launched your SaaS product.

Users are signing up. Revenue is trickling in.

But here’s the question:

Is your business actually healthy — or are you just growing blind?

Success in SaaS isn’t just about building cool features or acquiring users.

It’s about building a repeatable, profitable, and scalable business model.

And that means tracking the right metrics.

In this post, you’ll learn:

- What SaaS metrics really are

- Why they matter for every startup

- A breakdown of the most critical metrics

- A real-life SaaS example

- How to use these metrics to drive better decisions

Let’s break it down.

What Are SaaS Metrics?

SaaS metrics are key performance indicators (KPIs) that measure the health, profitability, and sustainability of your business.

They give you insight into whether your product, pricing, and customer experience are working — or failing.

These metrics include:

- CAC (Customer Acquisition Cost)

- LTV (Customer Lifetime Value)

- Churn Rate

- LTV:CAC Ratio

- MRR / ARR

- Expansion Revenue

SaaS is a recurring-revenue business. These metrics help you make sure that revenue actually recurs.

Why These Metrics Matter for SaaS Startups

Many startups fall into the “growth trap” — obsessing over vanity metrics like signups or downloads.

But without retention and monetization, growth becomes meaningless.

SaaS metrics help you:

- ✅ Identify weaknesses before it’s too late

- ✅ Allocate budget to what’s really working

- ✅ Set realistic growth and profitability goals

- ✅ Build trust with investors

In other words: They’re your SaaS dashboard for survival and scale.

The Core SaaS Metrics You Need to Know

1. CAC (Customer Acquisition Cost)

How much it costs to acquire a new customer.

Formula: Total sales & marketing spend ÷ Number of new customers

A low CAC means efficient acquisition.

A very low CAC? You might be underinvesting in growth.

2. LTV (Customer Lifetime Value)

How much revenue a customer brings over their entire lifecycle.

Basic formula: Average monthly revenue × Customer lifespan × Gross margin

Higher LTV = more value per customer.

Your goal? Make sure LTV is significantly greater than CAC.

3. Churn Rate

The percentage of customers who cancel their subscriptions in a given period.

Monthly churn = Lost customers ÷ Total customers at start of month

Lower is better.

<5% per month is ideal

<2% is excellent.

4. LTV:CAC Ratio

Your business’s unit economics. It tells you if your acquisition is paying off.

Benchmark: A healthy SaaS business should aim for 3:1 or higher.

- <1:1 = Losing money per customer

- 5:1 = Might be underinvesting in growth

5. MRR / ARR

- MRR: Monthly Recurring Revenue

- ARR: Annual Recurring Revenue (MRR × 12)

This is your predictable revenue engine.

It helps investors (and your team) forecast with confidence.

6. Expansion Revenue

Revenue from existing customers — via upsells, add-ons, or upgrades.

It’s a great sign of product-market fit and customer satisfaction.

SaaS companies with >20% expansion revenue grow faster and churn less.

Real-World Example: FocusBoard – A SaaS Collaboration Tool

Let’s imagine a fictional SaaS startup, FocusBoard, that offers minimalist collaboration tools for creative teams.

Here are their metrics:

- CAC: $120

- LTV: $540

- LTV:CAC Ratio: 4.5

- Monthly Churn Rate: 3.2%

- MRR: $38,000

- Expansion Revenue Share: 28%

- Net Revenue Retention (NRR): 111%

These numbers tell a strong story.

FocusBoard is efficiently acquiring users, keeping them happy, and growing revenue through upsells.

Investors love this kind of clarity.

Summary Table

| Metric | What It Measures | Healthy Benchmark |

|---|---|---|

| CAC | Cost to acquire a customer | As low as possible |

| LTV | Total value of a customer | 3–5× CAC |

| Churn Rate | How many customers leave | <5% monthly |

| LTV:CAC Ratio | Unit economics (value vs cost) | 3:1 or higher |

| MRR / ARR | Recurring revenue | Consistent growth |

| Expansion Rev | Additional revenue from current users | 20%+ share is excellent |

Final Thoughts

SaaS isn’t about the size of your signup list.

It’s about the quality of your revenue.

The best founders obsess over CAC, churn, and LTV because those numbers tell the truth.

So before launching your next campaign, stop and ask:

“Are we building a sustainable business — or just a leaky bucket?”

The answer lies in your metrics.

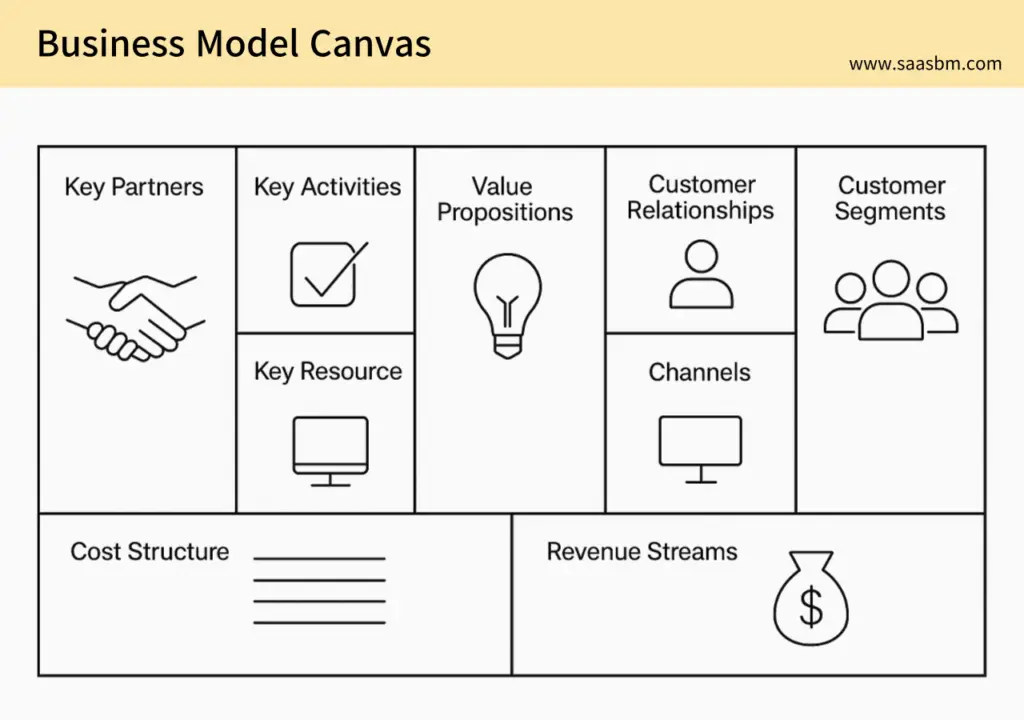

Business Model Canvas for SaaS Startups: A Practical Guide

Introduction

So you’ve got a great SaaS idea.

You’re planning to build something useful, maybe even revolutionary.

But here’s the catch:

Do you really understand how your business will work — from product to profit?

This is where the Business Model Canvas (BMC) becomes essential.

It helps SaaS founders and product teams visualize their entire business model on a single page. No 50-page business plans. No guesswork. Just clarity.

In this post, you’ll learn:

- What the Business Model Canvas is

- Why it’s a must-have for SaaS founders

- A breakdown of the 9 key elements

- A real-world SaaS example

- How to apply BMC to your own idea

Let’s dive in.

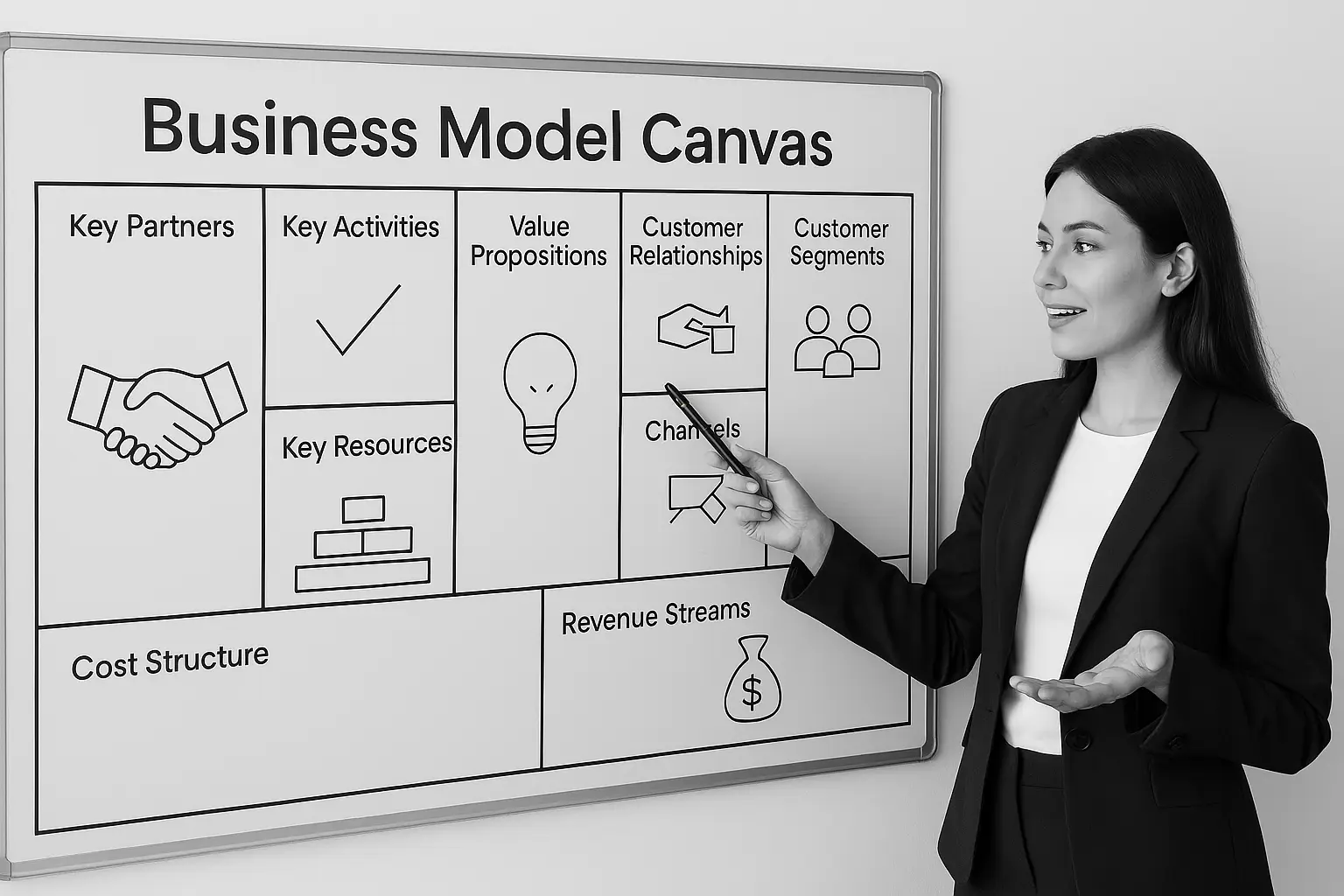

What Is the Business Model Canvas?

The Business Model Canvas (BMC) is a strategic framework created by Alexander Osterwalder.

It helps you describe how your product creates, delivers, and captures value — all in one visual map.

Rather than writing lengthy business plans, the BMC focuses on 9 building blocks that cover every core aspect of your business:

- Customer Segments

- Value Propositions

- Channels

- Customer Relationships

- Revenue Streams

- Key Resources

- Key Activities

- Key Partnerships

- Cost Structure

In short, the BMC answers this:

“Who are we building for, what are we offering them, and how will it all work operationally and financially?”

Why the BMC Matters for SaaS Startups

SaaS startups often move fast — launching features, acquiring users, iterating endlessly.

But without a structured model, speed can lead to chaos.

The BMC gives you clarity, alignment, and direction:

- ✅ Validate your business model early

- ✅ Map your product to real customer needs

- ✅ Communicate clearly with your team or investors

- ✅ Spot weak links before investing too much

For SaaS businesses where monthly recurring revenue, retention, and scalability are key, the BMC is not optional — it’s foundational.

The 9 Building Blocks of a SaaS Business Model

1. Customer Segments

Who are your ideal users?

Define your primary customers as clearly as possible.

Example: “Remote-first creative agencies with teams under 20 people”

2. Value Propositions

What problem are you solving?

What makes your solution valuable and different?

Example: “A distraction-free project management tool built for creative workflows”

3. Channels

How will customers find and use your product?

What are the key touchpoints?

Example: “Content marketing → free trial → in-app onboarding → paid plan”

4. Customer Relationships

What type of support or engagement will you offer?

Example: “Self-service for SMBs, account managers for enterprise customers”

5. Revenue Streams

How do you make money?

What pricing strategy are you using?

Example: “$12/month/user with optional paid integrations”

6. Key Resources

What are your essential assets — technical, human, or financial?

Example: “Full-stack dev team, cloud infrastructure, proprietary scheduling engine”

7. Key Activities

What are the most important things your business must do well?

Example: “Product development, onboarding optimization, content creation”

8. Key Partnerships

Who are your strategic collaborators or third-party providers?

Example: “Stripe for billing, Firebase for backend, Intercom for support”

9. Cost Structure

What are your biggest costs?

What does it take to run your SaaS?

Example: “Developer salaries, server costs, ad spend, customer support”

Real-World Example: FocusBoard – A Lightweight Team Collaboration SaaS

Let’s imagine a SaaS product called FocusBoard — a minimalist team collaboration tool for remote workers.

Here’s what its Business Model Canvas might look like:

- Customer Segments: Freelancers, remote creative teams, async-first startups

- Value Proposition: Simplified collaboration without distraction

- Channels: Blog, YouTube tutorials, LinkedIn ads

- Customer Relationships: In-app chat + help docs + Slack community

- Revenue Streams: Freemium model + $12/month/user

- Key Resources: Core development team, UI/UX designer, AWS

- Key Activities: Weekly product releases, bug fixes, user feedback loop

- Key Partnerships: Google SSO, Stripe, Notion API

- Cost Structure: Hosting fees, support, content marketing, dev salaries

Summary

| Traditional Approach | BMC Approach |

|---|---|

| Long business plans | Visual one-pager |

| Feature-first thinking | Customer and value-driven |

| Confused team communication | Aligned through shared canvas |

| Unclear monetization | Tested, structured revenue flows |

The BMC isn’t just a canvas — it’s a conversation starter, a clarity tool, and a strategy lens.

Final Thoughts

The Business Model Canvas isn’t about perfection — it’s about understanding.

For SaaS founders, it offers a fast, visual way to de-risk your idea and sharpen your value proposition.

It helps you answer questions like:

- Who are we really building this for?

- What pain are we solving?

- How will we acquire, retain, and monetize users?

Before writing your next line of code or pitching your next investor, ask yourself:

“Can I explain our entire business on one page?”

If not, start with the Business Model Canvas — because clarity is the foundation of traction.

How to Build a SaaS Competitive Positioning Map

Introduction

If you’re building a SaaS product, you might be wondering:

“How do I clearly show how we’re different from the competition?”

Most startups think it’s enough to list product features or pricing tiers.

But customers — and investors — need more than a bullet list.

They want to see:

👉 Where do you stand in the market?

👉 What makes you different?

👉 Why should they choose you over others?

This is where the Competitive Positioning Map comes in.

In this guide, you’ll learn:

- What the Competitive Positioning Map is

- Why it matters for SaaS businesses

- A real-world SaaS example

- How to apply it to your own startup

- Common mistakes to avoid

Let’s dive in.

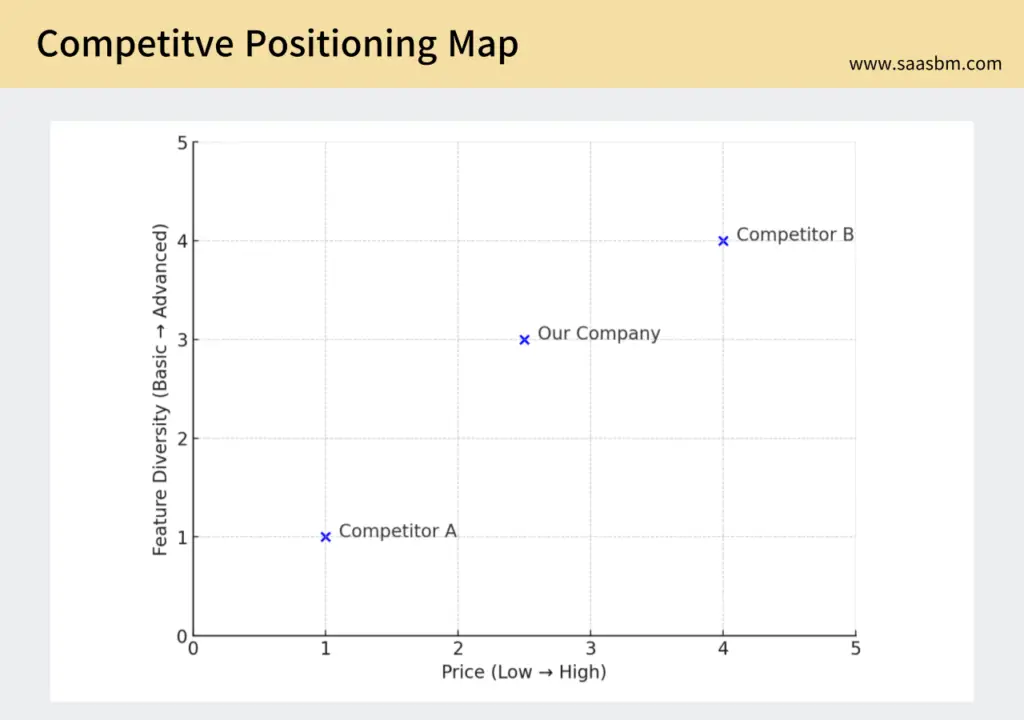

What is the Competitive Positioning Map?

The Competitive Positioning Map is a visual strategy tool that helps you define your product’s position relative to competitors.

It’s built on two axes — usually the most important factors in your market — and shows where each product falls.

Think of it as a 2D battlefield for your SaaS product.

For example:

- X-axis: Price (Low to High)

- Y-axis: Feature Complexity (Basic to Advanced)

By plotting products on this grid, you instantly reveal:

✅ Who’s dominating which area

✅ Where your product fits

✅ Which segments are under-served

This tool turns vague statements like “we’re simpler than others” into clear visual strategy.

Why It Matters for SaaS Startups

SaaS markets are often crowded. If you don’t stand out, you get lost.

Here’s why Competitive Positioning is mission-critical:

✅ Clarify Differentiation

Clearly show how your product compares on dimensions that matter to customers.

✅ Identify Opportunities

Find gaps in the market that your competitors have ignored.

✅ Shape Product Roadmaps

Guide your team on whether to improve pricing, features, UI, or integrations.

✅ Align Marketing & Sales

Craft messages that directly explain how you’re different — and why it matters.

✅ Communicate With Investors

Investors love maps. It shows you understand the market and your place in it.

Example: SaaS Collaboration Tool – TeamFlow

Let’s say you’re building TeamFlow, a new team collaboration SaaS.

You map the landscape:

- X-axis: Price (Low → High)

- Y-axis: Specialization (General-purpose → Role-specific)

Now you plot:

- Slack: Mid-price, general-purpose

- Microsoft Teams: High-price, enterprise-focused

- Discord: Free, general-purpose for informal use

- TeamFlow (Your SaaS): Affordable, designed for design teams

You realize no one is targeting affordable tools specifically designed for creative professionals.

That’s your sweet spot.

How to Build Your Own Competitive Map

- Choose the Right Axes

Don’t pick random traits. Ask:- What matters most to my target customer?What are the top decision-making factors?

- Price vs Feature Complexity

- Ease of Use vs Customization

- Enterprise Fit vs Startup Fit

- List Your Competitors

Include not only direct competitors, but substitutes (e.g., Excel, Notion, Trello). - Plot Each Product Honestly

Don’t exaggerate. This is for your team’s clarity, not just investor slides. - Analyze the Gaps

Where are the underserved zones?

Where is everyone clustering? - Craft a Positioning Statement

Example: “TeamFlow offers mid-priced, design-centric collaboration for creative teams — a segment underserved by Slack and Teams.”

Common Mistakes to Avoid

❌ Using vague axes like “innovation” or “coolness”

✅ Use measurable, customer-relevant dimensions

❌ Only plotting yourself and one competitor

✅ Include 4–6 players to see the full picture

❌ Making the map and never updating it

✅ Revisit every 6–12 months as the market evolves

Summary

| Common Approach | Positioning Map Approach |

|---|---|

| Focus on features | Focus on strategic differentiation |

| Talk about pricing tiers | Show where you stand in the market |

| Guess who your competitors are | Analyze actual alternatives and substitutes |

| Build roadmap blindly | Use map to guide product direction |

Final Thoughts

The Competitive Positioning Map is more than a slide — it’s a strategy tool.

It helps you visually define:

- What your product stands for

- What segment you serve best

- Where you have a chance to win

Before your next investor pitch, product meeting, or go-to-market plan, ask yourself:

👉 “Can I clearly show how we’re different?”

If the answer is “Not yet,”

build your Competitive Positioning Map — and find your space to win.