Dive into deep,

in-depth research

We dive deep into the SaaS business.

Using publicly available data and proven analytical frameworks,

we deliver an in-depth analysis of the service structure and business model.

What is SaaS Deep Dive Research?

Deep Dive Research is a business analysis service that systematically examines the service structure, market environment, revenue model, and product strategy of a specific SaaS business.

It provides essential insights for aspiring founders and startup teams preparing to enter the SaaS market.

Why Do You Need Deep Dive Research?

The structure and market positioning of a SaaS business are not easily understood through surface-level information alone.

For aspiring founders, early-stage startup teams, and solo entrepreneurs, it is often difficult to conduct structured market research and competitor analysis due to limited time and resources.

Deep Dive Research solves this challenge by providing:

📌 A structured analysis based on publicly available information and proven business frameworks

📌 Optimization for early-stage SaaS analysis where quantitative data is limited

📌 Actionable insights to support business decisions, model planning, and competitor strategy analysis

Who Will Benefit from This Research?

This research is specifically designed for:

Aspiring SaaS founders looking for business ideas or validation.

Early-stage entrepreneurs preparing pitch decks or market entry strategies.

Small startup teams seeking actionable competitor analysis.

Solo founders building SaaS products without market research capacity.

Investors & advisors needing a structured SaaS business evaluation.

Please Note :

This research is not intended for investment solicitation.

It is provided as an informational report and a market study document to help you systematically understand the SaaS market and business structure.

Please Note :

This research is based on publicly available data.

If the target company or product has recently launched and lacks sufficient data for analysis, your request may be declined to ensure the quality of the report.

(Paid but no research? You get a refund)

Deep Dive Research Structure

Service Definition: Clearly describe the core features and value proposition of the service.

Value Proposition Analysis: Map customer needs and service value using the Value Proposition Canvas framework.

Customer Segments: Identify key target customer groups and their characteristics.

Revenue Model: Analyze the revenue structure, such as subscription, freemium, or licensing models.

Customer Acquisition Strategy: Evaluate customer acquisition channels and sales model.

SaaS Business Model Canvas: Analyze the key components of the B.M. using the SaaS Business Model Canvas framework.

Market Positioning: Identify the service’s position within the market and the overall competitive landscape.

Competitive Environment: Analyze key competitors and potential substitutes.

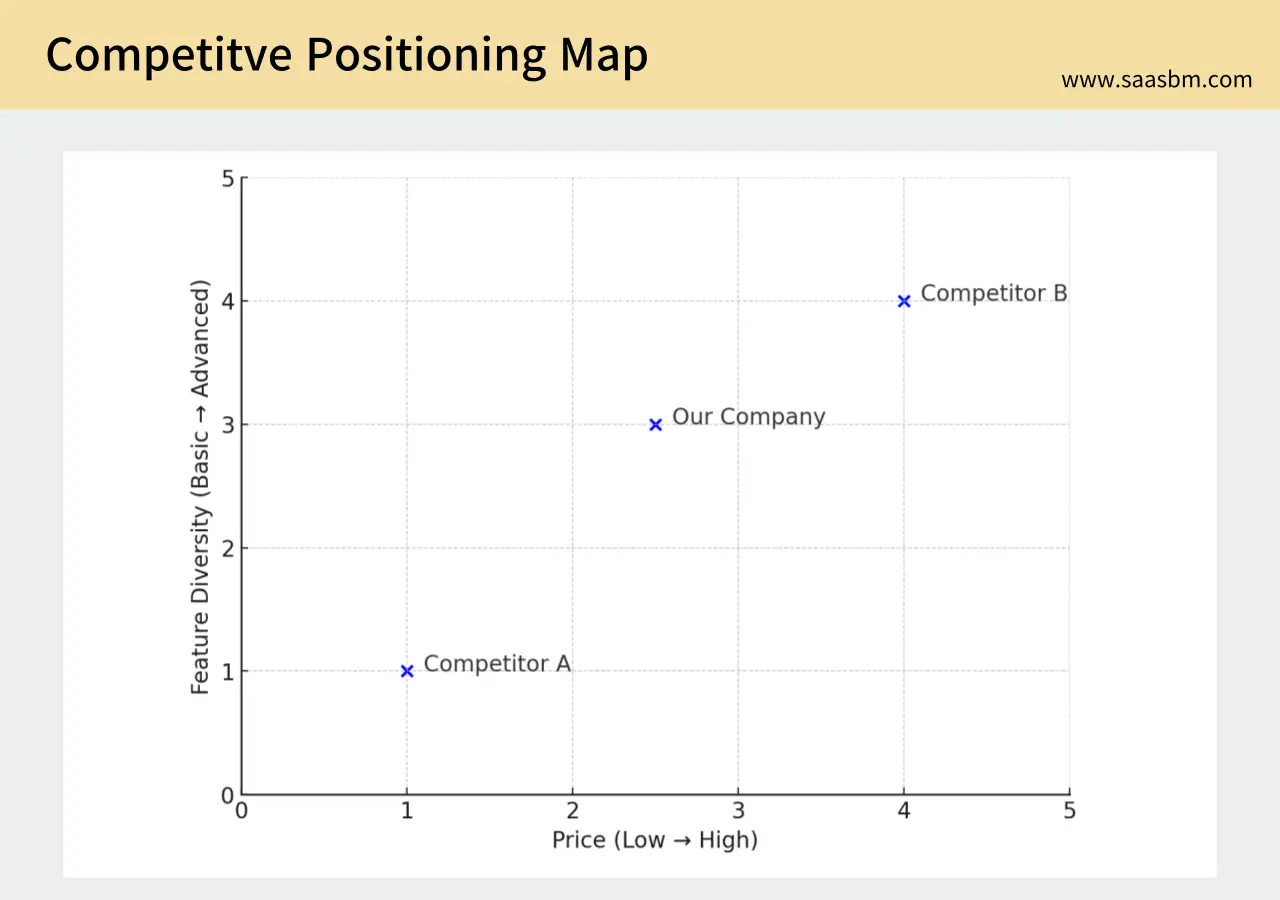

Competitive Positioning Map: Conduct a comparative analysis based on core differentiation factors.

Core Feature Analysis: Evaluate key features and differentiation factors of the producr or service.

User Experience: Analyze UI/UX characteristics and the user journey.

Feature-Value Mapping Matrix: Assess the connection between core features and customer value.

Current Growth Status: Identify the product’s position in its lifecycle and key growth drivers.

Expansion Opportunities: Evaluate the potential for product and market expansion.

SaaS Expansion Matrix: Analyze vertical, horizontal, and new market expansion strategies.

Product-Market Fit: Assess the alignment between customer problems and the service’s solution and market timing.

Key SaaS Metrics Analysis: Evaluate core metrics such as CAC, LTV, Churn Rate, and others.

SaaS Metrics Evaluation: Analyze business sustainability and performance based on key economic indicators.

Overall Evaluation: Assess the soundness of the business model and its competitiveness in the market.

Key Insights: Identify major strengths, challenges, and differentiation factors.

SaaS Scorecard: Provide a quantitative evaluation across key areas of the business.

Key Risks: Identify potential risks related to market conditions, competition, and the business model.

Growth Opportunities: Extract short-term and long-term opportunity factors.

SWOT Analysis: Conduct a structured analysis of strengths, weaknesses, opportunities, and threats.

- Target & Competitor References: Provide reference links for the analyzed service and its competitors or similar services.

- Additional Resources: Include a comprehensive list of related tools and services for further learning and market research.

- Innovative SaaS Business Ideas: Propose 3 actionable SaaS ideas based on the analysis.

- Detailed Proposal: Each idea outlines target customers, value proposition, business model, differentiation factors, and implementation plan.

- You can also discover niche market opportunities or unique offerings compared to competitors.

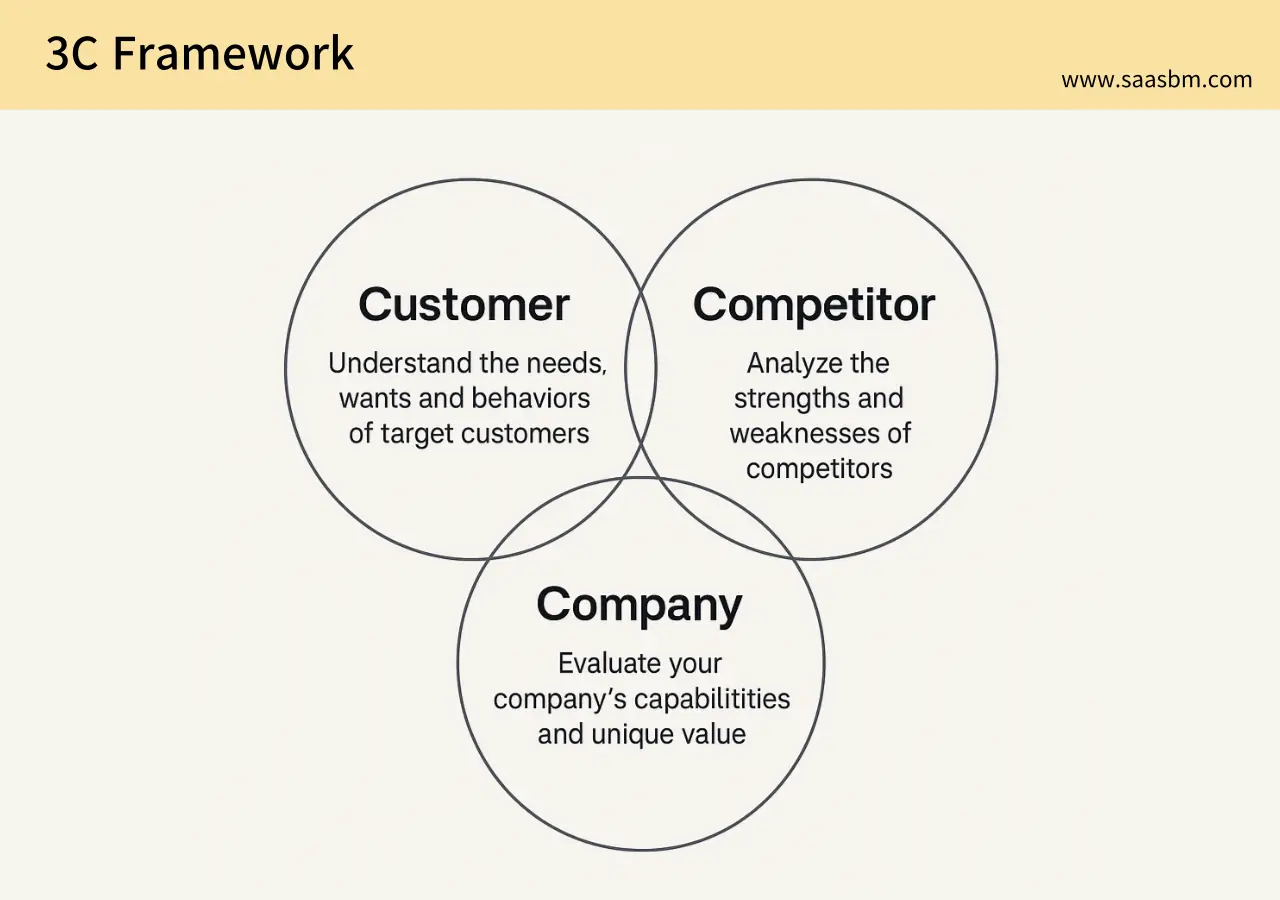

Analysis Frameworks

The Deep Dive Research is built upon industry-proven SaaS analysis frameworks.

These frameworks are widely used across the SaaS and startup industry for business planning, market analysis, and investor communication.

The structured insights provided in this research can be continuously utilized to refine your business strategy, marketing plan, and future decision-making.

Deep Dive Research Examples

Explore actual research to understand the structure, depth, and practical value of our Deep Dive Research.

Lawrina: Comprehensive Legal Resources Platform for Professionals

Lawrina is a comprehensive legal resources platform offering templates, documents, and professional guidance for both legal practitioners and individuals navigating legal matters.

OpenPhone: Professional Business Phone System for Teams

Trial and error means failure.

Time is money. Save both.

Understand the market. Decode your competitors.

Success starts with deep-dive research.

Ready to get fresh SaaS ideas and strategies in your inbox?

Start your work with real SaaS stories,

clear strategies, and proven growth models—no fluff, just facts.