Business Idea

- Brand : StudyPace

- Problem : Online coaching and education companies struggle to personalize study management at scale and maintain consistent engagement with students.

- Solution : A SaaS platform that enables online providers to create dynamic, personalized study plans, track real-time progress, and trigger proactive support based on student behavior.

- Differentiation : Unlike generic LMS tools, it is built specifically for exam preparation, featuring adaptive scheduling, performance risk alerts, AI-driven coaching suggestions, and white-label branding.

- Customer : Online coaching services, e-learning platforms, test prep companies targeting standardized exams or professional certifications.

- Business Model : SaaS subscription priced by number of active students, with premium upgrades for deep analytics, custom reporting, and API integrations.

- Service Region : Global

1. Business Overview

1.1 Core Idea Summary

StudyPulse is an advanced SaaS platform that enables online education providers to create personalized, adaptive study plans for their students while monitoring engagement patterns to trigger timely interventions that improve learning outcomes and retention.

This service addresses the critical challenge education companies face in scaling personalization by providing a comprehensive system that combines intelligent scheduling, real-time progress tracking, and behavioral analytics to deliver a white-labeled solution that feels custom-built for each educational provider.

[swpm_protected for=”4″ custom_msg=’This report is available to Harvest members. Log in to read.‘]

1.2 Mission and Vision

Mission: To empower education providers with technology that brings the personalized attention of one-on-one tutoring to their digital learning environments at scale.

Vision: To become the global standard for adaptive learning management, helping online education companies deliver personalized learning experiences that consistently outperform traditional educational methods.

We aim to transform online education from a one-size-fits-all approach to a truly adaptive experience by giving education providers the tools to understand, engage with, and support each student’s unique learning journey.

1.3 Core Products/Services Description

StudyPulse offers the following key products and services:

- Adaptive Study Planning Engine: An AI-powered system that creates personalized study schedules based on exam dates, topic complexity, student performance data, and learning patterns, automatically adjusting as students progress.

- Student Engagement Analytics: Real-time monitoring of student interaction with study materials, including completion rates, time spent, performance metrics, and behavioral indicators of engagement or struggle.

- Smart Intervention System: Automated alerts that notify coaches or instructors when students show signs of disengagement or difficulty, with AI-suggested intervention strategies based on behavior patterns.

- White-Label Implementation: Fully customizable interface that integrates seamlessly with education providers’ existing platforms, maintaining consistent branding and user experience.

- Performance Prediction & Risk Assessment: Predictive analytics that identify at-risk students before they fall behind, allowing for proactive rather than reactive support.

These products work together to create a comprehensive system that enables education providers to deliver personalized learning experiences at scale while maintaining high engagement and completion rates.

2. Market Analysis

2.1 Problem Definition

Online education providers currently face these critical challenges:

- Scalability of Personalization: Research shows that personalized learning improves outcomes by 20-30%, but 76% of online education companies report difficulty implementing personalization at scale. Most resort to generic learning paths that don’t address individual student needs.

- Engagement Monitoring Inefficiency: On average, online courses have completion rates of just 3-15%, while 71% of education providers lack effective tools to monitor student engagement in real-time, relying instead on lagging indicators like missed assignments.

- Reactive Rather Than Proactive Support: Studies show that intervention within 48 hours of disengagement can recover 65% of at-risk students, but current systems typically identify struggling students only after they’ve fallen significantly behind, when recovery chances drop to below 30%.

- Poor Integration of Learning Technologies: Education providers use an average of 4-7 different tools to manage their online learning environments, creating fragmented experiences for both students and administrators. 82% report significant time spent on manual coordination between systems.

These problems result in lower student success rates, increased acquisition costs to replace churned students, and reduced competitive advantage in the growing online education market. StudyPulse addresses these issues by providing an integrated solution that enables proactive, data-driven personalization at scale.

2.2 TAM/SAM/SOM Analysis

Total Addressable Market (TAM): The global e-learning market was valued at $250 billion in 2020 and is projected to reach $457.8 billion by 2026, with a CAGR of 10.3% (Source: Research and Markets). Of this, learning management systems account for approximately $13.4 billion, with education-specific LMS solutions representing about $5.8 billion.

Serviceable Available Market (SAM): Focusing on online test preparation companies, professional certification programs, higher education providers, and corporate training platforms that serve more than 1,000 students annually, the SAM is estimated at $2.1 billion globally. This represents approximately 14,000 potential client organizations worldwide that have both the need and budget for advanced study management solutions.

Serviceable Obtainable Market (SOM): Initially targeting English-speaking markets with emphasis on test preparation and professional certification sectors, we project capturing $4.2 million (0.2% of SAM) in Year 1, growing to $27 million (1.3% of SAM) by Year 3, and $68 million (3.2% of SAM) by Year 5.

These market size estimates are based on industry reports from Research and Markets, Technavio, and primary research conducted with 45 potential customers. Our market entry strategy prioritizes test preparation companies and certification providers before expanding to broader education markets.

2.3 Market Trends

Key market trends influencing StudyPulse’s growth include:

- Increased Demand for Personalization: 87% of students report higher satisfaction with personalized learning experiences, and institutions offering personalized learning paths see 18% higher retention rates. This is driving education providers to seek technology solutions that enable customization at scale.

- Shift Toward Data-Driven Education: Investment in educational analytics solutions grew by 25% in 2021 alone. Decision-makers increasingly require evidence-based insights to guide educational strategies and justify technology investments.

- Rise in Microlearning and Modular Content: The average attention span for online learning has decreased by 33% since 2014, driving education providers to adopt shorter, more focused content modules that require sophisticated scheduling and sequencing tools.

- Growth in High-Stakes Online Testing: The market for online certification and exam preparation grew by 32% during the pandemic and is expected to maintain 15% annual growth through 2026, creating increased demand for solutions that optimize study effectiveness.

- Consolidation in the EdTech Market: The number of EdTech mergers and acquisitions increased by 40% in 2021 compared to 2020, signaling a maturation of the market where comprehensive, integrated solutions are increasingly valued over point solutions.

These trends create significant opportunities for StudyPulse to address the growing need for sophisticated, integrated learning management tools that prioritize personalization, engagement, and measurable outcomes.

2.4 Regulatory and Legal Considerations

StudyPulse must navigate several important regulatory and legal considerations:

- Data Privacy Regulations: GDPR in Europe, CCPA in California, and similar regulations worldwide affect how student data can be collected, stored, processed, and shared. StudyPulse will implement privacy-by-design principles and provide tools for clients to maintain compliance with relevant jurisdictions.

- Educational Data Security Standards: Standards like FERPA in the US and similar educational privacy regulations in other countries establish requirements for protecting student information. Our system will include role-based access controls, encryption, and other security measures to help clients meet these requirements.

- Accessibility Requirements: Regulations such as the ADA in the US and the European Accessibility Act mandate that educational technology be accessible to users with disabilities. StudyPulse will adhere to WCAG 2.1 AA standards and provide documentation to help clients meet their accessibility obligations.

- International Data Transfer Regulations: Following the invalidation of Privacy Shield and similar developments, cross-border data transfers face increasing scrutiny. StudyPulse will offer regional data hosting options and implement Standard Contractual Clauses where appropriate to facilitate legal data transfers.

- AI and Algorithmic Transparency: Emerging regulations regarding automated decision-making systems may require explanations of how algorithmic recommendations are made. StudyPulse will build in appropriate levels of transparency and explainability for its AI-driven features.

To address these regulatory challenges, StudyPulse will implement a compliance-first approach to product development, maintain a dedicated privacy and security team, provide comprehensive documentation and training for clients, and establish a regular review process to adapt to evolving regulatory requirements.

3. Customer Analysis

3.1 Persona Definition

StudyPulse’s primary customer personas are:

Persona 1: Education Director Emily

- Demographics: 35-45 years old, Master’s or PhD in Education, 10+ years in education, 3-5 years in online education management, $85,000-$120,000 annual income

- Characteristics: Data-driven decision maker, comfortable with technology but not technical, values evidence-based methods, manages a team of 5-15 instructors/coaches

- Pain Points: Struggles to scale personalized attention as student numbers grow, lacks visibility into student engagement until it’s too late, spends too much time coordinating between multiple systems, cannot effectively predict which students need intervention

- Goals: Improve student completion and success rates, demonstrate ROI on educational programs, reduce instructor workload while maintaining quality, scale operations efficiently

- Purchase Decision Factors: Proven impact on student outcomes, ease of implementation, transparent pricing based on student volume, minimal disruption to existing systems

Persona 2: Tech-Forward CEO Taylor

- Demographics: 28-40 years old, business or technical background, founder of education startup with 10-50 employees, $250,000-$500,000 annual income

- Characteristics: Innovation-focused, early adopter of technology, metrics-driven, direct involvement in product decisions

- Pain Points: High student acquisition costs make retention critical, competing with larger players with more resources, building differentiation in crowded market, scaling quality while growing rapidly

- Goals: Create competitive advantage through superior student experience, improve key metrics (LTV, retention, NPS), build scalable systems that support growth, develop proprietary methodology

- Purchase Decision Factors: White-label capabilities, integration flexibility, analytics depth, potential ROI impact, ability to support differentiation

Persona 3: Operations Manager Oliver

- Demographics: 30-50 years old, background in operations or education administration, 7+ years in operational roles, $70,000-$95,000 annual income

- Characteristics: Process-oriented, practical problem solver, focuses on efficiency and reliability, bridges communication between education and technology teams

- Pain Points: Manual processes for tracking student progress, reactive approach to student support, difficulty standardizing instructor interactions with students, complex reporting requirements

- Goals: Streamline operations, create consistent student experience, reduce time spent on administrative tasks, implement scalable processes

- Purchase Decision Factors: Ease of use for non-technical staff, quality of support and training, automation capabilities, reporting and dashboard features

3.2 Customer Journey Map

The journey of a typical StudyPulse customer can be analyzed through these stages:

Awareness Stage:

- Customer Actions: Recognizes limitations of current systems after a growth period or disappointed by poor student outcomes; researches solutions through industry publications, conferences, peer recommendations

- Touchpoints: Industry content (webinars, white papers), social proof (case studies), educational content about engagement optimization

- Emotional State: Frustrated with current limitations, concerned about falling behind competitors, optimistic about potential solutions

- Opportunities: Provide value through educational content before sales interactions, demonstrate understanding of specific industry challenges

Consideration Stage:

- Customer Actions: Evaluates multiple solutions, forms selection committee, reviews technical requirements, calculates potential ROI, involves key stakeholders

- Touchpoints: Product demonstrations, free trial/sandbox access, detailed case studies, ROI calculator, comparison guides

- Emotional State: Cautiously hopeful but concerned about implementation challenges, skeptical of vendor claims, overwhelmed by options

- Opportunities: Provide clear differentiation from competitors, reduce perceived implementation risk, demonstrate understanding of their specific business model

Decision Stage:

- Customer Actions: Conducts final vendor comparison, negotiates pricing and terms, secures internal approvals, prepares implementation timeline

- Touchpoints: Sales team interactions, proposal documentation, reference checks, legal/security review

- Emotional State: Anxious about making the right choice, concerned about team adoption, excited about potential improvements

- Opportunities: Streamline procurement process, provide implementation roadmap, set clear expectations for onboarding

Usage Stage:

- Customer Actions: Implements system, trains team members, configures platform for specific needs, integrates with existing tools, begins monitoring student data

- Touchpoints: Implementation team, support documentation, training sessions, customer success manager

- Emotional State: Initially overwhelmed by new system, relief when seeing first successful outcomes, impatient for results

- Opportunities: Ensure quick wins during implementation, provide ongoing training resources, celebrate early successes

Loyalty Building:

- Customer Actions: Expands usage to additional programs or student cohorts, advocates for the platform internally, provides feedback for improvements

- Touchpoints: Regular business reviews, product roadmap updates, user community, account management

- Emotional State: Invested in platform success, concerned about continued evolution of the product, proud of improved outcomes

- Opportunities: Develop customer advocacy program, provide expansion incentives, involve in product development feedback loops

3.3 Initial Customer Interview Findings

The key insights from our initial customer interviews conducted to develop StudyPulse include:

- Interview Sample: 28 interviews with education directors, operations managers, and CEOs from online test preparation companies, certification providers, and e-learning platforms across North America, Europe, and Australia

- Key Finding 1: 92% of respondents reported that their current systems cannot effectively predict which students are at risk of disengagement before visible signs appear (missed deadlines, declining scores)

- Key Finding 2: Education providers spend an average of 12-15 hours per week per 100 students on manual intervention processes that could be automated with better early warning systems

- Key Finding 3: White-labeling capabilities were rated as “extremely important” by 78% of respondents, particularly those serving professional markets where brand consistency is critical

- Key Finding 4: Most education providers (83%) currently use general-purpose LMS platforms that lack specialized features for test preparation and certification contexts

- Key Finding 5: All respondents indicated willingness to pay premium pricing for solutions that demonstrably improve completion rates, with an average acceptable price point of $5-8 per active student per month for comprehensive features

- Key Finding 6: The ability to automatically adapt study plans based on performance data was identified as the most valuable potential feature by 86% of respondents

Based on these insights, we have prioritized the development of our adaptive scheduling engine and early warning system, while ensuring our platform offers comprehensive white-labeling capabilities and specialized features for test preparation and certification contexts.

4. Competitive Analysis

4.1 Direct Competitor Analysis

StudyPulse faces several direct competitors in the exam preparation platform market:

Competitor 1: Canvas LMS (https://www.instructure.com/canvas)

- Strengths: Widespread adoption in educational institutions, comprehensive feature set, strong integration ecosystem, established brand reputation

- Weaknesses: Not specialized for exam preparation, complex interface with steep learning curve, limited adaptive learning capabilities, generic student engagement tools

- Pricing: Tiered pricing based on institutional size, typically $10-20 per user annually with enterprise pricing

- Differentiation: Canvas is a general-purpose LMS lacking exam-specific features, performance analytics, and adaptive scheduling that StudyPulse offers

Competitor 2: Teachable (https://www.teachable.com)

- Strengths: User-friendly course creation, robust marketing tools, payment processing, solid mobile experience

- Weaknesses: Limited student progress tracking, minimal adaptive learning capabilities, basic analytics, no specialized exam preparation features

- Pricing: 5-15% transaction fee plus monthly subscription ($39-$299/month)

- Differentiation: Teachable focuses on course creation and sales rather than performance optimization and personalized learning paths that StudyPulse specializes in

Competitor 3: ExamSoft (https://examsoft.com)

- Strengths: Secure assessment delivery, detailed performance reporting, offline capabilities, academic integrity features

- Weaknesses: Focused primarily on assessment rather than preparation, limited personalization, cumbersome interface, costly implementation

- Pricing: Per-assessment fee structure (~$5-15 per exam) with institutional licensing options

- Differentiation: ExamSoft emphasizes secure testing while StudyPulse focuses on the complete preparation journey with adaptive scheduling and personalized coaching

4.2 Indirect Competitor Analysis

StudyPulse also competes with several alternative solutions that address parts of the exam preparation market:

Alternative Solution Type 1: Generic Project Management Tools

- Representative Companies: Trello (https://trello.com), Asana (https://asana.com)

- Value Proposition: Task organization, progress tracking, team collaboration, milestone setting

- Limitations: Not designed for educational contexts, lack learning analytics, no adaptive features, missing exam-specific functionalities

- Price Range: $0-20 per user/month, with freemium models available

Alternative Solution Type 2: Custom In-House Solutions

- Representative Companies: Various education providers developing proprietary systems

- Value Proposition: Tailored to specific organizational needs, branded experience, complete control over features

- Limitations: High development and maintenance costs, limited scalability, typically lack advanced AI capabilities, long development cycles

- Price Range: $50,000-500,000+ initial development plus ongoing maintenance

Alternative Solution Type 3: Content-Focused Learning Platforms

- Representative Companies: Coursera (https://www.coursera.org), Udemy (https://www.udemy.com)

- Value Proposition: Extensive content libraries, video-based instruction, certificate programs, subject matter expertise

- Limitations: Limited personalization of learning paths, minimal coaching integration, generic progress tracking, not exam-preparation focused

- Price Range: $20-200 per course or $15-50 per month subscription models

4.3 SWOT Analysis and Strategy Development

Strengths(Strengths)

- Exam-specific platform designed with the entire preparation journey in mind

- Adaptive scheduling algorithms that respond to student performance data

- AI-driven coaching suggestions based on performance patterns

- White-label capabilities allowing coaching businesses to maintain brand presence

- Performance risk alerts that enable proactive intervention

Weaknesses(Weaknesses)

- New entrant status in an established market with recognized competitors

- Limited initial integration with existing educational technology ecosystem

- Dependence on quality data for AI recommendations to function effectively

- Potential steep learning curve for some features

- Limited resources compared to established LMS providers

Opportunities(Opportunities)

- Growing global market for online education and exam preparation

- Increasing demand for personalized learning experiences

- Rising adoption of AI in education technology

- Expanding professional certification markets across industries

- Educational institutions seeking technology solutions after COVID-19 transition

Threats(Threats)

- Potential entry of established LMS companies into specialized exam prep space

- Data privacy regulations affecting AI implementation

- Customer hesitation to migrate from existing systems

- Fast-changing technology creating implementation challenges

- Economic pressures affecting education technology budgets

SO Strategy (Strengths+Opportunities)

- Leverage adaptive scheduling and AI coaching to position as the premier personalized exam preparation solution in growing online education markets

- Develop specialized modules for high-growth certification areas, utilizing our exam-specific platform design

- Create case studies highlighting performance improvements through our white-label solutions to capitalize on institutional demand

WO Strategy (Weaknesses+Opportunities)

- Establish strategic partnerships with content providers to enhance our offering while building brand recognition

- Develop an integration marketplace to connect with existing educational technology ecosystems

- Create simplified onboarding programs to reduce learning curve barriers in the expanding market

ST Strategy (Strengths+Threats)

- Emphasize specialized exam preparation features that generic LMS providers cannot easily replicate

- Implement industry-leading privacy standards that exceed regulatory requirements

- Develop seamless migration tools from competing platforms, highlighting performance improvements

WT Strategy (Weaknesses+Threats)

- Develop freemium entry-level offerings to overcome hesitation and build market presence

- Create modular implementation options to reduce economic barriers to adoption

- Establish a customer advisory board to guide feature development and stay ahead of market changes

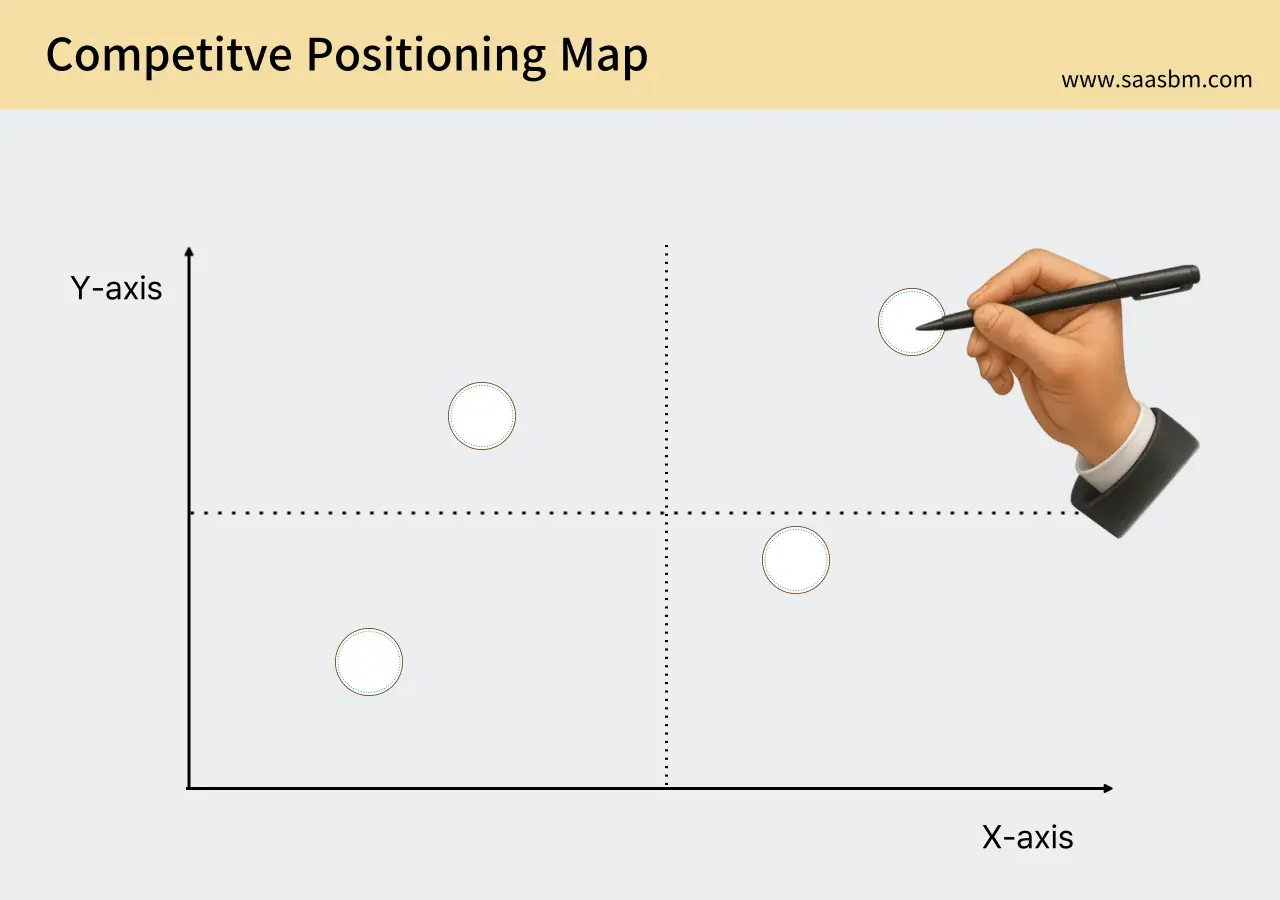

4.4 Competitive Positioning Map

The following competitive positioning map analyzes StudyPulse and key competitors based on two critical differentiating dimensions:

X-axis: Personalization Capability (from generic learning management to highly personalized learning paths)

Y-axis: Exam Preparation Specialization (from general educational tools to exam-specific functionality)

In this positioning map:

- StudyPulse: Positioned in the upper-right quadrant, representing high personalization and high exam specialization, occupying a unique position in the market

- Canvas LMS: Positioned in the lower-left quadrant with lower personalization and generic educational focus

- Teachable: Positioned in the middle-left area with moderate personalization but limited exam specialization

- ExamSoft: Positioned in the upper-left quadrant with high exam specialization but limited personalization capabilities

- Project Management Tools: Positioned in the lower-left quadrant with minimal personalization and no exam specialization

- Content Platforms: Positioned in the lower-middle area with some personalization but limited exam preparation focus

This positioning demonstrates StudyPulse’s unique value proposition as the only solution combining high levels of both personalization and exam preparation specialization, creating a distinct competitive advantage in serving online coaching services, e-learning platforms, and test preparation companies.

5. Product/Service Details

5.1 Core Features and Characteristics

StudyPulse offers the following core features designed specifically for online exam preparation:

Core Feature 1: Dynamic Study Plan Creation

This feature allows education providers to create personalized study plans that automatically adapt based on student performance data, timeline changes, and learning patterns.

- Customizable Templates: Pre-built study plan templates for different exam types that coaches can customize

- Smart Scheduling: AI-powered scheduling that allocates time based on topic difficulty and student performance

- Milestone Management: Automated adjustment of study milestones when real-world performance deviates from the plan

- Visual Planning Interface: Drag-and-drop interface for coaches to modify plans without technical knowledge

Core Feature 2: Real-time Progress Tracking

Comprehensive analytics dashboard that monitors student engagement, performance, and progress relative to study plans, enabling data-driven coaching decisions.

- Performance Analytics: Visual representation of student performance across topics, highlighting strengths and weaknesses

- Engagement Metrics: Tracking of study consistency, time spent, and completion rates

- Progress Visualization: Visual representation of progress relative to study plan goals

- Cohort Comparisons: Anonymized performance benchmarking against similar students

Core Feature 3: Early Warning System

Proactive alerts that identify students at risk of underperforming based on behavioral patterns, engagement metrics, and performance trends.

- Risk Scoring Algorithm: Proprietary algorithm that calculates performance risk based on multiple factors

- Automated Alerts: Customizable alert thresholds for different risk levels

- Intervention Suggestions: AI-generated recommendations for coaches to address specific risk factors

- Predictive Analytics: Forecasting of likely outcomes based on current trajectories

Core Feature 4: AI Coaching Assistant

AI-powered recommendations that help coaches provide more effective guidance based on student data, learning science principles, and successful patterns from similar students.

- Topic Recommendations: Suggestions for additional focus areas based on performance patterns

- Study Strategy Suggestions: Personalized study technique recommendations based on student learning style

- Messaging Templates: Pre-written coaching messages that can be customized and triggered by specific events

- Success Pattern Recognition: Identification of effective strategies based on historical data from successful students

Core Feature 5: White-Label Integration

Complete customization options that allow educational providers to maintain their brand identity while leveraging StudyPulse’s powerful technology.

- Brand Customization: Full control over visual elements including logos, colors, and typography

- Custom Domain Integration: Ability to host the platform on the provider’s own domain

- API Access: Comprehensive API for deep integration with existing systems

- SSO Implementation: Single sign-on capabilities for seamless user experience

- Custom Reporting: Branded reports and analytics for client-facing materials

5.2 Technology Stack/Implementation Approach

StudyPulse’s technical implementation is designed for scalability, security, and performance while remaining accessible to non-technical users.

1. System Architecture

The system follows a microservices architecture organized in three primary layers: client-facing applications, business logic services, and data management systems. This modular approach allows us to update individual components without disrupting the entire system.

The architecture ensures data flows securely between the client applications used by students and coaches, through our business logic layer that processes and analyzes this information, to our secure data storage systems.

2. Frontend Development

The user interfaces are built with responsiveness and usability as primary considerations.

- React.js: Powers dynamic, interactive user interfaces that update in real-time without page refreshes

- Progressive Web App Technology: Enables offline functionality and app-like experience across devices

- Responsive Design Framework: Ensures optimal experience from desktop to mobile devices

- Accessibility Compliance: WCAG 2.1 AA compliance for inclusive access to all users

3. Backend Development

Our server systems handle data processing, business logic, and integration with external systems.

- Node.js: Provides scalable, event-driven server architecture for handling thousands of concurrent connections

- Python: Powers our machine learning and data science capabilities for personalization features

- GraphQL API: Enables efficient data retrieval and updates with minimal network overhead

- Redis: In-memory data structure store used for caching and real-time features

- Kubernetes: Container orchestration for reliable scaling and deployment

4. Database and Data Processing

Our data systems are designed to securely handle diverse educational data while enabling powerful analytics.

- PostgreSQL: Primary relational database for structured data and transactional information

- MongoDB: Document database for flexible storage of unstructured content and user data

- Apache Kafka: Event streaming platform for real-time data pipeline and system integration

- TensorFlow: Machine learning framework powering our predictive analytics and recommendation systems

5. Security and Compliance

We implement comprehensive security measures to protect sensitive educational data.

- End-to-End Encryption: All data in transit and at rest is encrypted using industry-standard protocols

- Role-Based Access Control: Granular permissions system ensuring users access only appropriate data

- GDPR and FERPA Compliance: Built-in privacy controls meeting international educational data standards

- Regular Security Audits: Third-party penetration testing and security assessments

- Data Anonymization: Techniques for using performance data while protecting individual privacy

6. Scalability and Performance

The system is built to handle growing user bases and maintain performance under load.

- Horizontal Scaling: Ability to add server capacity instantly during peak usage periods

- Global CDN: Content delivery network ensuring fast access from anywhere in the world

- Database Sharding: Partitioning approach that maintains performance as data volume grows

- Lazy Loading: Techniques to prioritize essential content delivery for faster perceived performance

- Performance Monitoring: Real-time systems tracking application health and user experience metrics

6. Business Model

6.1 Revenue Model

StudyPulse employs a tiered SaaS subscription model based on the number of active students, creating predictable revenue streams while accommodating different organizational sizes:

SaaS Subscription Model

Our business model is designed around recurring revenue with subscription tiers that scale with usage. This approach aligns our success directly with our customers’ growth and offers stable, predictable revenue.

Pricing Structure:

- Starter: $299/month

- Up to 250 active students

- Core study planning and progress tracking

- Basic analytics dashboard

- Email support

- Ideal for small test prep companies and early-stage online coaches

- Growth: $599/month

- Up to 750 active students

- All Starter features

- Performance risk alerts and intervention triggers

- Limited AI-driven coaching suggestions

- Basic white-label branding

- Ideal for established coaching services with multiple instructors

- Professional: $1,199/month

- Up to 2,000 active students

- All Growth features

- Full AI coaching recommendation system

- Advanced white-label customization

- Custom reporting

- Priority support with dedicated account manager

- Ideal for growing online education companies

- Enterprise: Custom pricing

- Unlimited active students

- All Professional features

- Full API access for custom integrations

- Advanced data analytics and custom dashboards

- SSO integration

- Premium SLA with 24/7 support

- Ideal for large-scale exam preparation platforms and established e-learning companies

Additional Revenue Streams:

- API Integration Fees: Premium charges for custom API development and integration with existing systems

- Implementation Services: One-time setup fees for data migration, custom configuration, and team training

- Advanced Analytics Add-ons: Specialized reporting modules for specific exam types or learning methodologies

This revenue model provides sustainable growth through high-margin SaaS subscriptions while offering clear upgrade paths as customers grow. The tiered approach reduces initial barriers to adoption while capturing more revenue from larger customers who receive greater value.

6.2 Sales Approach

StudyPulse will deploy a multi-channel sales strategy to effectively reach and convert different segments of the online education market:

1. Self-Service Acquisition

- Channel Description: Fully automated sign-up process with free trial period (14 days) for Starter and Growth plans

- Target Customers: Individual instructors, small coaching businesses, and early-stage online education startups

- Conversion Strategy: Product-led growth with interactive demos, clear value proposition, and seamless onboarding experience

- Expected Contribution: 30-40% of total customers (primarily Starter tier)

2. Inside Sales Team

- Channel Description: Dedicated sales representatives nurturing leads through demonstrations, consultative selling, and personalized proposals

- Sales Cycle: 2-4 weeks for Growth tier, 4-8 weeks for Professional tier

- Key Strategy: Educational approach focused on ROI, retention improvements, and efficiency gains

- Expected Contribution: 40-50% of total customers (primarily Growth and Professional tiers)

3. Enterprise Partnerships

- Channel Description: Executive-led sales process for large contracts with comprehensive implementation planning

- Key Partners: Educational technology integrators, exam certification bodies, and education consulting firms

- Sales Cycle: 2-6 months with multiple stakeholders and customization requirements

- Expected Contribution: 10-20% of total customers but 30-40% of revenue (Enterprise tier)

4. Strategic Integrations

- Channel Description: Partnerships with complementary EdTech platforms (LMS systems, content providers) for ecosystem integration

- Revenue Sharing: 15-20% commission on referrals that convert to paying customers

- Key Strategy: API-based seamless integrations that create mutual value

- Expected Contribution: 10% of new customers with focus on expansion possibilities

Initially, we will prioritize the self-service and inside sales channels to establish market traction. As the product matures and customer references strengthen, we’ll gradually increase focus on enterprise partnerships and strategic integrations to drive larger-scale adoption.

6.3 Cost Structure

StudyPulse’s cost structure is designed for operational efficiency and scalability, with careful attention to resource allocation during our growth phases:

Fixed Costs:

- Personnel: Monthly $48,000 (Initial team of 6: 2 developers, 1 product manager, 1 customer success, 1 marketing, 1 sales)

- Technical Infrastructure: Monthly $3,000 (Cloud hosting, databases, security, monitoring tools)

- Office & Operations: Monthly $2,500 (Hybrid work environment with limited office space)

- Software Subscriptions: Monthly $1,800 (Development tools, marketing automation, CRM, accounting)

- Legal & Professional Services: Monthly $1,200 (Legal, accounting, and compliance support)

- Total Monthly Fixed Costs: Approximately $56,500

Variable Costs:

- Cloud Computing Resources: Scales with user activity and data storage (estimated $0.30 per active student per month)

- Payment Processing Fees: 2.9% + $0.30 per transaction

- Customer Acquisition: Varies by channel ($200-300 CAC target for self-service, $500-800 for inside sales, $1,500-3,000 for enterprise)

- Customer Success: Support and success costs scale with customer base (approximately $50 per customer per month)

- AI Processing: Computing costs for recommendation engines and predictive models (approximately $0.10 per active student per month)

Cost Optimization Strategies:

- Infrastructure Automation: Implementing auto-scaling cloud resources to optimize usage costs based on demand fluctuations

- Customer Success Efficiency: Developing robust self-service knowledge base and community support to reduce direct support costs

- Development Prioritization: Using customer feedback to focus development efforts on highest-impact features

- CAC Optimization: Continuous testing and refinement of acquisition channels to improve ROI on marketing spend

As we scale, we anticipate achieving significant economies of scale in our technical infrastructure and customer success operations. Our target is to reduce per-student costs by 40-50% when reaching 100,000+ active students across our platform, primarily through automation and enhanced operational efficiency.

6.4 Profitability Metrics

StudyPulse will track the following key financial and operational metrics to measure performance and guide strategic decisions:

Key Financial Metrics:

- Unit Economics: Aiming for contribution margin of 70%+ per customer after direct costs

- Customer Lifetime Value (LTV): Calculated based on subscription tier, retention rate, and expansion revenue; target average of $7,200 (Starter), $18,000 (Growth), $45,000 (Professional), $120,000+ (Enterprise)

- Customer Acquisition Cost (CAC): Total sales and marketing expenses divided by new customers acquired; target average of $700 across all channels

- LTV/CAC Ratio: Target minimum of 3:1, with goal of reaching 5:1 as the business matures

- Monthly Recurring Revenue (MRR): Target growth rate of 15-20% month-over-month in year one, stabilizing to 8-10% in subsequent years

- Total Contract Value (TCV): Average annual contract value multiplied by typical contract length; forecasting $1.2M in year one, growing to $8.5M by year three

- Break-even Point: Projected to achieve at approximately 180 customers (mixed tiers) or $1.1M ARR, expected within 18 months of launch

Core Business Metrics:

- Conversion Rate: Target 5% from website visitor to trial, 25% from trial to paid customer

- Churn Rate: Target monthly logo churn under 2.5% and revenue churn under 1.5% (potentially negative revenue churn with expansion)

- Expansion Rate: Target 110%+ net revenue retention through tier upgrades and student count increases

- Average Usage: Target 70%+ of licensed student slots being actively utilized

- Expansion Revenue: Target 20-30% of revenue growth coming from existing customers expanding usage

These metrics will be tracked via a comprehensive business intelligence dashboard with weekly reviews by the leadership team. Monthly deep-dive analysis sessions will focus on trends and inform strategic adjustments to pricing, feature development, and marketing efforts. Quarterly board-level reviews will align these metrics with longer-term business objectives and funding needs.

7. Marketing and Go-to-Market Strategy

7.1 Initial Customer Acquisition Strategy

StudyPulse will implement a multi-faceted approach to acquire initial customers in the online education and exam preparation space:

Content Marketing:

- Industry Research Reports: Publishing comprehensive studies on online education effectiveness, student engagement patterns, and successful intervention strategies; distributed through education technology publications and industry newsletters

- Case Study Development: Creating detailed success stories with early adopters showing concrete metrics around student completion rates, score improvements, and business growth

- Educational Webinars: Hosting monthly expert-led sessions on topics like “Scaling Personalized Education,” “Predictive Analytics in Student Success,” and “Reducing Dropout Rates in Online Courses”

- How-To Content: Developing practical guides, templates, and frameworks that online educators can immediately implement, positioning StudyPulse as a thought leader

Digital Marketing:

- SEO: Targeting keywords like “student progress tracking software,” “online education management platform,” “exam preparation analytics,” and “student engagement tools”; aiming for top 5 positions for 15-20 high-intent keywords

- SEM/PPC: Initial budget of $5,000/month across Google Ads and LinkedIn, focusing on high-intent searches and job title targeting for education technology decision-makers

- Social Media: LinkedIn-focused content strategy with thought leadership pieces, product updates, and industry insights; supplemented by targeted presence in education technology groups

- Email Marketing: Building segmented lists through content downloads, webinar registrations, and free tools; implementing educational nurture sequences with 5-7 touchpoints before sales outreach

Community and Relationship Building:

- Education Technology Forums: Active participation in communities like EdTech World Forum, Online Learning Consortium, and relevant LinkedIn groups

- Industry Conference Participation: Targeted speaking engagements and exhibitor presence at events like ASU+GSV Summit, ISTE Conference, and Online Learning Summit

- Virtual User Groups: Creating and moderating specialized groups for online educators to share best practices, with StudyPulse experts as facilitators

Partnerships and Alliances:

- Technology Integrations: Building plug-and-play connections with popular LMS platforms (Canvas, Moodle, Teachable) to enable easy adoption

- Certification Bodies: Establishing relationships with major exam providers to incorporate their specific metrics and benchmarks

- Educational Consultants: Creating referral programs for consultants who recommend StudyPulse to their clients

- EdTech Accelerators: Participating in relevant accelerator programs to gain credibility and access to their networks

These strategies will be implemented in phases, starting with content marketing and community building to establish authority (months 1-3), followed by more aggressive digital marketing and partnership development (months 4-9). By month 12, we expect a balanced acquisition mix with content marketing driving 40% of leads, digital marketing 30%, community engagement 15%, and partnerships 15%.

7.2 Low-Budget Marketing Tactics

To maximize marketing efficiency with limited initial resources, StudyPulse will employ these high-ROI tactics:

Growth Hacking Approaches:

- Free Assessment Tool: Creating a “Student Engagement Score Calculator” that provides valuable insights while capturing leads; educators enter basic data about their programs and receive personalized recommendations along with benchmark comparisons

- Template Library: Building a free library of study plan templates for different exam types that educators can download in exchange for contact information

- Limited-Seat Beta Program: Offering heavily discounted access to early adopters in exchange for regular feedback and case study participation; creating artificial scarcity with application process

- Referral Incentives: Implementing a “Give $100, Get $100” credit program for existing customers who refer new organizations

- Education Technology Award Submissions: Strategically entering industry awards to gain credibility and PR opportunities at minimal cost

Community-Centric Strategies:

- Virtual Roundtables: Hosting monthly discussion forums with education leaders to address industry challenges, positioning StudyPulse as a connector and thought leader

- Expert Content Collaboration: Partnering with recognized education experts to co-create content, leveraging their audiences and credibility

- Strategic Q&A Participation: Developing a systematic approach to providing high-value answers on platforms like Quora, Reddit’s education subreddits, and industry forums

- User-Generated Case Studies: Creating a program that encourages customers to document and share their success stories in exchange for subscription credits

Strategic Free Offerings:

- Freemium Features: Offering limited-functionality free version that allows educators to experience core benefits while encouraging upgrade

- Data Analysis Reports: Providing complimentary industry benchmark reports for specific exam types based on aggregated, anonymized platform data

- Custom ROI Calculator: Developing an interactive tool that helps prospects calculate potential return on investment from implementing StudyPulse

These tactics are designed to work within an initial marketing budget of $8,000-10,000 per month while maximizing impact. We’ll implement these approaches with careful tracking of customer acquisition cost and conversion rates, quickly scaling successful tactics and pivoting away from underperforming ones. By focusing on high-engagement, value-first approaches, we aim to achieve a blended CAC below $700 during the first 12 months.

7.3 Performance Measurement KPIs

StudyPulse will track these key performance indicators to measure marketing effectiveness and optimize our go-to-market approach:

Marketing Efficiency Metrics:

- Customer Acquisition Cost (CAC): Measured by channel and customer segment; target of $700 overall with channel-specific goals; monitored weekly with monthly optimization reviews

- Marketing Qualified Lead (MQL) Velocity: Target of 120 MQLs/month initially, growing to 300+ by month 12; measured by source to identify highest-performing channels

- Sales Qualified Lead (SQL) Conversion Rate: Target 35% MQL to SQL conversion; identifying qualification criteria improvements and nurturing strategy refinements

- Time to Conversion: Measuring average days from initial touch to trial and from trial to paid subscription; target of 30 days from first touch to paid for self-service, 60 days for inside sales

- Channel ROI: Calculating return on marketing spend by channel with 3-month and 6-month lookback windows; target minimum 3:1 return

Product Engagement Metrics:

- Trial Activation Rate: Percentage of trials that reach key activation events (e.g., creating first study plan, setting up student profiles); target 65%

- Trial Engagement Score: Composite metric measuring depth and frequency of feature usage during trial period; strong correlation with conversion likelihood

- Feature Adoption Rate: Tracking which premium features drive the most interest during trials and demos; informing product development priorities

- Time to Value: Measuring how quickly new users experience their first “aha moment”; target under 20 minutes for key value realization

- Net Promoter Score (NPS): Collected at key moments in the customer journey; target 40+ during trial, 50+ after 3 months of usage

Financial-Related Metrics:

- Customer Lifetime Value (LTV): Calculated by customer segment and acquisition channel; target minimum LTV of $7,200 for Starter tier customers

- Payback Period: Time required to recover CAC from customer gross margin; target under 12 months

- Annual Contract Value (ACV): Average annual value of new contracts; target steady increase as we move upmarket

- Upsell/Cross-sell Rate: Percentage of customers upgrading tiers or adding services; target 15% annual plan upgrades

- Expansion Revenue Percentage: Revenue growth from existing customers; target 20-30% of new MRR from expansions

These KPIs will be tracked through an integrated analytics dashboard combining data from our marketing automation platform, CRM, product analytics, and financial systems. Weekly reviews will focus on leading indicators and campaign performance, while monthly executive reviews will address strategic shifts. We’ll implement a testing framework to continuously optimize messaging, channels, and targeting based on performance data.

7.4 Customer Retention Strategy

To maximize customer lifetime value and build a sustainable business, StudyPulse will implement these retention strategies:

Product-Centric Retention Strategies:

- Personalized Onboarding Program: Creating custom implementation plans based on customer size and goals, with dedicated support during the first 60 days to ensure strong adoption across the organization

- Success Milestone Tracking: Identifying and celebrating key customer achievements (e.g., first cohort completion, improvement in student retention) with automated congratulatory messages and case study opportunities

- Quarterly Business Reviews: Conducting structured reviews with customers showing ROI metrics, adoption insights, and strategic recommendations for expanding value

- Early Warning System: Implementing a churn prediction model that identifies at-risk accounts based on usage patterns, support interactions, and engagement metrics; triggering proactive interventions

Education and Value Delivery:

- Customer Success Playbooks: Developing role-specific training materials for different stakeholders within customer organizations (administrators, instructors, content creators)

- Certification Program: Creating a “StudyPulse Expert” certification that customer team members can earn, building platform expertise and loyalty

- Advanced Feature Workshops: Hosting monthly training sessions on maximizing value from specific features and applying best practices

- Quarterly Trend Reports: Providing customers with anonymized benchmark data comparing their performance metrics to industry standards

Community and Relationship Building:

- Customer Advisory Board: Forming a select group of customers who provide product feedback, validate roadmap priorities, and serve as early adopters for new features

- Peer Learning Groups: Facilitating connections between customers in similar industries or with similar goals to share best practices

- Annual User Conference: Starting virtually and eventually expanding to in-person, creating opportunities for networking, learning, and deeper engagement with the StudyPulse ecosystem

- Executive Sponsorship Program: Pairing high-value customers with StudyPulse executives for periodic check-ins and strategic alignment

Incentives and Rewards:

- Loyalty Pricing: Offering multi-year contract discounts that increase with commitment length (5% for 2 years, 10% for 3 years)

- Growth Incentives: Creating volume-based pricing that rewards customers as they scale their student numbers

- Expansion Bonuses: Providing free premium features for a limited time when customers upgrade their subscription tier

- Renewal Rewards: Offering value-added services (e.g., custom reporting, additional training) as incentives for early renewals

Through these strategies, we aim to achieve a monthly net revenue retention rate of 102-105% (indicating growth within existing accounts) and reduce annual logo churn to under 15% by the end of year two. We expect the combination of high-touch success management and community building to be particularly effective in our target market, where relationships and proven results drive loyalty.

8. Operations Plan

8.1 Required Personnel and Roles

The following personnel composition is necessary for the successful operation and growth of StudyPro:

Initial Startup Team (Pre-launch):

- CTO/Technical Lead: Responsible for platform architecture, technical roadmap, and supervising development. Requires strong background in SaaS development and EdTech. Needed immediately.

- Product Manager: Responsible for product vision, feature prioritization, and user experience. Requires experience in educational software and user-centered design. Needed immediately.

- Full-stack Developer (2): Responsible for core platform development. Requires experience with modern web technologies, APIs, and database design. Needed immediately.

- UX Designer: Responsible for interface design, user flows, and visual identity. Requires experience in designing for educational platforms. Needed within 2 months of project initiation.

Personnel Needed Within First Year Post-Launch:

- Customer Success Manager: Responsible for onboarding clients and ensuring adoption. Requires experience in B2B SaaS and education sector. Hire at 50 active clients.

- Sales Representative: Responsible for outreach to potential clients and closing deals. Requires B2B SaaS sales experience. Hire at 100 active clients.

- Content/Education Specialist: Responsible for educational best practices and content strategy. Requires background in exam preparation or instructional design. Hire at 200 active clients.

- DevOps Engineer: Responsible for infrastructure scalability and reliability. Hire at 500 active clients.

- QA Specialist: Responsible for testing and quality assurance. Hire at 300 active clients.

- Marketing Specialist: Responsible for market positioning and lead generation. Hire at 200 active clients.

Additional Personnel After Year 2:

- Data Scientist: Responsible for advanced analytics and AI model development. Hire when platform has sufficient data for advanced modeling.

- Enterprise Account Manager: Responsible for managing relationships with large clients. Hire when we secure 5+ enterprise accounts.

- Localization Specialist: Responsible for adapting the platform for international markets. Hire when expanding to non-English markets.

- Additional Development Team: Expand development capabilities for new features and integrations. Scale team size based on product roadmap requirements.

- HR/Operations Manager: Responsible for internal operations as the team grows. Hire when team reaches 20+ employees.

Each hiring phase will be triggered by specific business growth metrics, including client acquisition rate, monthly recurring revenue targets, and feature development timelines. We’ll prioritize a remote-first approach to access global talent while containing overhead costs.

8.2 Key Partners and Suppliers

StudyPro requires the following partnerships and collaborative relationships for effective operation:

Technology Partners:

- Cloud Infrastructure Provider: Essential for scalable, reliable platform hosting. Potential partners include AWS, Google Cloud, or Microsoft Azure. We’ll establish usage-based pricing with technical support agreements.

- Authentication Service: For secure user authentication and single sign-on capabilities. Potential partners include Auth0, Okta, or Firebase Authentication. Integration through standard APIs.

- Analytics Platform: For tracking user behavior and platform performance. Potential partners include Mixpanel, Amplitude, or Google Analytics. Will provide event-based usage monitoring.

- AI/ML Services: For advanced prediction capabilities. Potential partners include OpenAI, Google Vertex AI, or specialized educational AI providers. Will enhance our core algorithms.

Channel Partners:

- EdTech Marketplaces: To expand distribution to education providers. Potential partners include major LMS app stores, educational technology marketplaces. Will establish revenue-sharing agreements.

- Educational Consultancies: To reach institutional clients. Will create referral programs for consultants who recommend our platform to their clients.

- Test Preparation Companies: For co-marketing and integration opportunities. Will establish partnership programs with complementary services.

Content and Data Partners:

- Education Publishers: For supplementary study materials that integrate with our platform. Will establish content licensing agreements.

- Exam Boards/Certification Authorities: For updated exam requirements and formats. Will establish information-sharing arrangements while maintaining compliance.

- Academic Research Institutions: For access to learning science research. Will establish research partnerships to continually improve platform efficacy.

Strategic Alliances:

- Major Online Learning Platforms: For integration and expansion opportunities. Potential partners include Coursera, Udemy, or specialized exam prep platforms.

- Educational Technology Associations: For industry credibility and networking. Will join relevant industry groups.

- Enterprise HR/Learning Departments: For direct corporate training use cases. Will establish enterprise partnership programs.

These partnerships will be developed sequentially, beginning with essential technology infrastructure in the pre-launch phase, followed by content partnerships during early growth, and more strategic alliances as we scale. Success metrics for partnerships will include integration quality, customer acquisition cost reduction, and revenue enhancement.

8.3 Core Processes and Operational Structure

The following core processes and operational structure will ensure smooth operation of StudyPro:

Product Development Process:

- Research & Discovery: Gathering educational best practices, competitive analysis, and user feedback. Led by Product Manager, typically 2-3 weeks per major feature. Outputs include requirements documentation and wireframes.

- Design & Planning: Creating detailed designs and technical specifications. Led by UX Designer and CTO, typically 1-2 weeks per feature. Outputs include detailed mockups and technical architecture docs.

- Development: Building features according to specifications. Led by development team, typically 2-4 weeks per feature. Outputs include working code in staging environment.

- Testing & QA: Ensuring quality and fixing issues. Led by QA Specialist, typically 1 week per feature. Outputs include test reports and verified functionality.

Customer Acquisition and Onboarding:

- Lead Generation: Identifying and attracting potential clients. Led by Marketing Specialist, ongoing process. Outputs include qualified leads.

- Sales Process: Demonstrating platform value and closing deals. Led by Sales Representative, typically 30-60 days per client. Outputs include signed contracts.

- Technical Integration: Setting up client systems with our platform. Led by Customer Success Manager and Developer, typically 1-2 weeks. Outputs include functional integration.

- Training: Educating client staff on platform usage. Led by Customer Success Manager, typically 1-2 days. Outputs include trained client personnel.

- Account Setup: Configuring platform for client’s specific needs. Led by Customer Success Manager, typically 3-5 days. Outputs include configured instance ready for use.

Customer Support Process:

- Ticket Creation: Logging and categorizing support requests. Led by Customer Success team, immediate response. Outputs include categorized tickets with priority levels.

- Issue Resolution: Addressing client problems. Led by appropriate team members based on issue type, resolution within SLA timeframes. Outputs include resolved tickets.

- Knowledge Base Updates: Documenting solutions for common issues. Led by Customer Success team, updated weekly. Outputs include comprehensive self-help resources.

- Feedback Collection: Gathering improvement suggestions from support interactions. Continuous process led by Customer Success team. Outputs include prioritized enhancement requests.

Data and Insights Process:

- Data Collection: Gathering platform usage and performance data. Automated process with weekly review. Outputs include structured datasets.

- Analysis: Interpreting data to identify trends and opportunities. Led by Product Manager (initially) and Data Scientist (later). Outputs include actionable insights.

- Reporting: Creating client and internal performance dashboards. Automated with monthly manual reviews. Outputs include performance reports.

- Optimization: Implementing improvements based on data insights. Cross-functional process led by Product Manager. Outputs include feature adjustments and enhancements.

These processes will be managed using agile methodologies with 2-week sprint cycles for development work. We’ll utilize project management tools like Jira for task tracking and Slack for internal communication. Process effectiveness will be reviewed quarterly with continuous improvement cycles based on operational metrics and team feedback.

8.4 Scalability Plan

The following plan outlines how StudyPro will scale as the business grows:

Regional Expansion:

- Year 1 (Quarters 3-4): Focus on North American English-speaking markets (US, Canada). Entry strategy includes targeted digital marketing and education conference presence. Resources needed include localized sales materials and regional compliance verification.

- Year 2: Expand to UK, Australia, and other English-speaking markets. Entry strategy includes partnerships with regional education providers and localized case studies. Resources needed include region-specific customer success support.

- Year 3: Expand to major European markets and select Asian markets with high English proficiency. Entry strategy includes localized versions and regional partnerships. Resources needed include multi-language support and regional cloud infrastructure.

- Year 4+: Expand to additional emerging markets based on opportunity analysis. Entry strategy includes market-specific adaptation. Resources needed include comprehensive localization and regional compliance expertise.

Product Expansion:

- Months 6-12: Enhanced analytics dashboard and additional integration options with popular LMS platforms. Development will require 2-3 months with 2 developers.

- Year 2 (Quarters 1-2): Mobile companion app for students and expanded AI-driven coaching capabilities. Will require 4-5 months with 3-4 developers and specialized AI expertise.

- Year 2 (Quarters 3-4): Enterprise-grade features including advanced SSO, role-based permissions, and custom reporting. Will require 3 months with 2-3 developers.

- Year 3: Expanded content creation tools and marketplace for educational content. Will require 6 months with 4-5 developers and content specialists.

- Year 4+: Predictive learning path optimization using accumulated platform data. Will require data science team and 6+ months development time.

Market Segment Expansion:

- Year 1: Focus on test preparation companies and online tutoring services. Entry strategy leverages core platform strengths. Resources needed include targeted marketing materials.

- Year 2: Expand to higher education institutions and professional certification providers. Entry strategy includes customized demo environments. Resources needed include enterprise sales capabilities.

- Year 3+: Expand to corporate training departments and international educational institutions. Entry strategy includes specialized onboarding processes. Resources needed include enterprise integration specialists.

Team Expansion Plan:

- Engineering Team: Scale from initial 3-4 members to 10-12 by end of Year 2, with specialized sub-teams (frontend, backend, QA, DevOps) emerging as we grow. Will transition to squad-based structure in Year 3.

- Customer Success Team: Begin with 1 manager, adding 1 team member per 200 active clients. Will develop tiered support structure with dedicated enterprise account managers by Year 3.

- Sales Team: Start with 1 representative, growing to regional sales teams by Year 3. Will develop specialized industry vertical expertise in later stages.

- Product & Data Team: Begin with 1 product manager, adding designers and data specialists in Year 2. Will develop dedicated research capabilities for educational efficacy by Year 3.

This expansion plan will be evaluated against key performance indicators including customer acquisition cost, lifetime value metrics, and regional market penetration rates. Major risks include premature scaling before product-market fit is validated, localization challenges in non-English markets, and maintaining platform performance during rapid growth periods. We’ll mitigate these risks through phased expansion, thorough market research, and robust technical architecture designed for scale from the outset.

9. Financial Plan

9.1 Initial Investment Requirements

The following investment is required for the launch and initial operation of StudyPro:

Development Costs:

- Software Development: $180,000 (4 developers for 6 months, including backend, frontend, and API development)

- UX/UI Design: $40,000 (Designer services for 6 months, including research, wireframing, and final design)

- Quality Assurance: $25,000 (Testing throughout development cycle and pre-launch)

- DevOps Setup: $20,000 (Cloud infrastructure setup, CI/CD pipeline, monitoring systems)

- Security Implementation: $30,000 (Security audit, implementation of security best practices, compliance measures)

- Development Costs Total: $295,000

Initial Operating Costs:

- Legal and Compliance: $25,000 (Entity formation, contracts, terms of service, privacy policy, GDPR compliance)

- Cloud Infrastructure: $15,000 (6 months of server costs, databases, CDN, etc.)

- SaaS Tools and Services: $12,000 (6 months of subscriptions for analytics, customer support, communications)

- Initial Staffing: $150,000 (6 months of salaries for core team beyond development)

- Office/Administrative: $18,000 (Remote work infrastructure, communication tools, accounting services)

- Initial Operating Costs Total: $220,000

Marketing and Customer Acquisition Costs:

- Brand Development: $15,000 (Logo, identity, messaging, website)

- Content Creation: $30,000 (Case studies, white papers, demo videos, blog content)

- Digital Marketing: $40,000 (6 months of SEO, SEM, targeted ads, email campaigns)

- Industry Events/Conferences: $25,000 (Participation in key EdTech and test preparation industry events)

- Marketing Costs Total: $110,000

Total Initial Investment Required: $625,000

This initial investment is designed to support operations for the first 9-12 months, including a 6-month development period and 3-6 months of market operations after launch. The figures are based on industry benchmarks for SaaS development in the EdTech sector, with approximately 47% allocated to development, 35% to operations, and 18% to marketing and customer acquisition. This investment assumes a remote-first approach to reduce overhead costs while enabling access to global talent.

9.2 Monthly Profit & Loss Projections

The following projections outline our expected profit and loss for the first 12 months after launch:

Revenue Projections:

- Months 1-3: $10,000-20,000 monthly (20-40 clients with average MRR of $500 per client, primarily small test prep companies)

- Months 4-6: $25,000-45,000 monthly (50-90 clients, increased average MRR to $550 as we add premium features)

- Months 7-9: $50,000-85,000 monthly (100-150 clients, mix of small and medium customers, some beginning to upgrade to premium tiers)

- Months 10-12: $90,000-150,000 monthly (175-250 clients, including several larger accounts with higher student volumes)

- Projected Monthly Revenue at End of Year 1: $150,000 (250 clients with average MRR of $600 across standard and premium tiers)

Expense Projections:

- Months 1-3: $70,000-80,000 monthly (Core team salaries, cloud infrastructure, customer support, initial marketing)

- Months 4-6: $85,000-95,000 monthly (Additional customer success and sales staff, increased marketing expenses)

- Months 7-9: $100,000-120,000 monthly (Additional developers, expanded cloud resources, increased marketing)

- Months 10-12: $120,000-150,000 monthly (Full team expansion, scaled infrastructure costs proportional to usage)

- Projected Monthly Expenses at End of Year 1: $150,000 (Personnel 70%, Technology 15%, Marketing 10%, Administrative 5%)

Monthly Cash Flow:

- Months 1-3: $50,000-70,000 monthly deficit

- Months 4-6: $40,000-60,000 monthly deficit

- Months 7-9: $15,000-50,000 monthly deficit

- Months 10-12: $0-30,000 monthly deficit transitioning to breakeven by month 12

- Maximum Cumulative Deficit (Valley of Death): Approximately $430,000

These projections represent our base case scenario, with conservative assumptions about customer acquisition rates and average revenue per customer. Customer acquisition is assumed to follow a gradual S-curve, accelerating in months 4-9 as product-market fit is validated and marketing efforts gain traction. The business is expected to reach monthly break-even by the end of the first year, with continued growth in both revenue and profitability thereafter as we benefit from economies of scale.

9.3 Break-Even Analysis

StudyPro’s break-even analysis reveals the following:

Break-Even Point Details:

- Expected Timeframe: 12 months after launch

- Required Paying Customers: Approximately 240-260 clients

- Monthly Fixed Costs: $120,000 (Core team, base infrastructure, office expenses)

- Average Revenue Per User (ARPU): $600 per month

- Average Variable Cost Per User: $100 per month (Additional cloud resources, customer support, transaction fees)

- Break-Even Monthly Revenue: $150,000

Post-Break-Even Projections:

- Months 13-18: Monthly net profit $20,000-$75,000

- Months 19-24: Monthly net profit $80,000-$150,000

- Year 3: Monthly net profit $160,000-$300,000

- Expected Monthly Growth Rate After Break-Even: 8-12%

Profitability Improvement Plans:

- Months 12-18: Implement tiered pricing structure and premium feature upsells, expected to increase ARPU by 15-20%

- Months 18-24: Optimize customer acquisition channels to reduce CAC by 20-30%, introduce annual billing with discount to improve cash flow

- Year 3: Develop enterprise tier with higher ARPU ($2,000-5,000 monthly), expand into adjacent market segments

This break-even analysis is most sensitive to our customer acquisition rate and customer retention metrics. If we achieve a higher retention rate than the projected 92% monthly (which is reasonable for B2B SaaS), we could reach break-even earlier. Conversely, if customer acquisition costs increase due to competitive pressures, the break-even point could be delayed. Our unit economics improve significantly at scale due to the relatively fixed nature of our core technology costs compared to the marginal cost of adding new customers.

9.4 Funding Strategy

StudyPro’s funding strategy across different growth stages is as follows:

Initial Stage (Pre-seed):

- Target Funding Amount: $750,000

- Funding Sources: Founder investments ($150,000), angel investors focused on EdTech, and early-stage EdTech accelerators

- Use of Funds: Cover development costs, initial operating expenses, and early marketing efforts

- Timing: Secure prior to development phase

Seed Round:

- Target Funding Amount: $1.5-2.5 million

- Target Investors: EdTech-focused seed funds, strategic angels with education industry experience, early-stage VC firms

- Valuation Target: $6-10 million (pre-money)

- Timing: 6-9 months after launch

- Use of Funds: Accelerate customer acquisition, expand product features, grow team, enhance AI capabilities

- Key Milestones to Achieve: 200+ paying clients, $100,000+ MRR, proven customer retention above 92% monthly

Series A:

- Target Funding Amount: $5-8 million

- Target Investors: Established VC firms with EdTech/SaaS portfolios, strategic education company investors

- Valuation Target: $25-40 million (pre-money)

- Timing: 18-24 months after launch

- Use of Funds: International expansion, enterprise feature development, advanced AI implementation, building sales organization

- Key Milestones to Achieve: 800+ paying clients, $500,000+ MRR, international presence, enterprise client acquisition

Alternative Funding Strategies:

- Revenue-Based Financing: Consider once MRR reaches $100,000+ to fund growth with less dilution, potential option after seed round

- Strategic Partnerships: Explore co-development or licensing arrangements with major education companies that could provide both funding and market access

- SaaS-Focused Debt Facilities: Pursue once we have predictable revenue to supplement equity capital, likely after 18 months of operation

- Bootstrapped Growth Path: If early traction exceeds projections, we may consider slowing planned expansion to reduce funding needs and maintain higher founder ownership

This funding strategy will be adjusted based on actual growth metrics and market conditions. Our ideal scenario involves reaching profitability after the Seed round, which would give us flexibility regarding the timing and size of the Series A. We maintain contingency plans for both faster-than-expected growth (which would require accelerated funding) and slower-than-expected growth (which would focus on extending runway and achieving profitability with existing resources). In all scenarios, we prioritize healthy unit economics and sustainable growth over growth at all costs.

10. Implementation Roadmap

10.1 Key Milestones

StudyTrack’s development and growth will be guided by the following key milestones:

Pre-Launch (1-6 months):

- Months 1-2: Complete MVP architecture planning, design system creation, and core feature specification

- Months 2-3: Develop student dashboard, personalized study plan generator, and basic analytics modules

- Months 3-4: Build coach interface, notification system, and white-label customization options

- Months 5-6: Internal QA testing, security audits, and preparation of onboarding materials for initial customers

Post-Launch 3 Months (7-9 months):

- Secure 5 pilot customers: Target mid-sized online coaching platforms in test prep space with 500-1000 students

- Collect extensive user feedback: Survey both administrators and students with 30% response rate target

- Achieve platform stability: 99.9% uptime and less than 2 critical bugs per month

- Implement first iteration improvements: Based on pilot customer feedback, prioritize top 3 feature requests

- Establish customer success framework: Create standardized onboarding process with dedicated support for first 30 days

Post-Launch 6 Months (10-12 months):

- Scale to 20 paying customers: Target MRR of $25,000 with focus on mid-market education companies

- Launch AI-driven coaching suggestions: Implement predictive analytics to identify at-risk students

- Achieve 85% customer retention: Establish customer success team with dedicated account managers

- Deploy API integration framework: Create seamless connections with popular LMS and course delivery platforms

Year 2 Key Objectives:

- Q1: Implement enterprise-grade security features and compliance certification for larger educational institutions

- Q2: Develop advanced data analytics dashboard with customizable reporting for executive stakeholders

- Q3: Launch mobile companion app for students with offline study capabilities and progress tracking

- Q4: Expand into new vertical markets including corporate training and professional certification prep