Business Idea

- Brand : TimeSlotly

- Problem : Traditional reservation systems fail to manage the complexity of shared or public resources—leading to no-shows, unfair monopolization, and rule violations that cause inefficiency, user frustration, and conflict.

- Solution : TimeSlotly enforces smart rules, monitors user behavior, and automates scheduling logic to ensure fair, transparent, and efficient access to shared resources—without manual oversight.

- Differentiation : Unlike generic calendar apps, TimeSlotly is purpose-built for environments where multiple users compete for limited shared resources—resolving conflicts and encouraging responsible participation.

- Customer : Coworking spaces, apartment complexes, schools, content studios, gyms, clubs, and shared-use facilities.

- Business Model : Subscription-based pricing by number of resources and user groups, with optional premium features for automated fairness control and analytics.

- Service Region : Global

1. Business Overview

1.1 Core Idea Summary

TimeSlotly is an intelligent resource scheduling platform that enforces fair access to shared facilities through smart rules, automated monitoring, and scheduling logic—solving the persistent problems of no-shows, resource monopolization, and rule violations in shared environments.

This service addresses the critical pain points of managing limited shared resources by leveraging advanced scheduling algorithms and behavior monitoring systems to provide transparent, efficient, and conflict-free resource allocation without requiring constant manual oversight.

[swpm_protected for=”4″ custom_msg=’This report is available to Harvest members. Log in to read.‘]

1.2 Mission and Vision

Mission: To transform shared resource management by eliminating scheduling conflicts and ensuring equitable access through intelligent technology.

Vision: To become the global standard for managing shared resources, creating harmonious shared environments in every organization worldwide.

We aim to eliminate the frustration, inefficiency, and conflict that plague shared resource management by creating systems that naturally encourage responsible participation and optimal resource utilization.

1.3 Key Products/Services Description

TimeSlotly offers the following core products and services:

- Smart Scheduling System: An intuitive booking interface with built-in conflict resolution, automated waitlists, and intelligent time slot allocation based on usage patterns and priority rules.

- User Behavior Monitoring: Tracking of reservation patterns, no-show rates, and resource usage to identify and address problematic behavior through automated enforcement.

- Fairness Control Engine: Customizable rule sets that prevent monopolization, enforce time limits, and distribute access fairly across user groups through algorithmic allocation.

- Usage Analytics Dashboard: Comprehensive insights into resource utilization, peak demand periods, and user satisfaction metrics to optimize facility management.

- Integration APIs: Seamless connection with existing facility management systems, access control hardware, and organizational management tools.

These services deliver value by eliminating the common friction points in shared resource management while requiring minimal administrative oversight—saving time, reducing conflicts, and maximizing resource utilization.

2. Market Analysis

2.1 Problem Definition

Current and potential clients face significant challenges with shared resource management:

- Inefficient Resource Utilization: Industry data shows that shared resources typically operate at only 50-60% of capacity despite appearing fully booked, primarily due to no-shows and cancelations. This represents billions in wasted capital investment globally.

- Manual Administrative Burden: Facility managers spend an average of 5-15 hours weekly resolving scheduling conflicts and monitoring compliance, representing $15,000-45,000 in annual labor costs per facility.

- User Experience Frustration: According to a 2022 workplace satisfaction survey, 64% of users report significant frustration with current reservation systems, with 41% citing inability to access needed resources as a major productivity barrier.

- Inequitable Access Patterns: Data reveals that in typical shared environments, 20% of users consume 80% of available resources, creating resentment and underserving the majority of potential users.

- Conflict Generation: 32% of workplace disputes in shared environments stem directly from resource allocation conflicts, damaging organizational culture and collaboration.

These problems collectively lead to significant operational inefficiency, decreased user satisfaction, and substantial hidden costs. TimeSlotly addresses these issues by automating fair allocation, eliminating the administrative burden, and creating transparent systems that naturally encourage responsible usage.

2.2 TAM/SAM/SOM Analysis

Total Addressable Market (TAM): The global market for resource scheduling and management solutions is valued at approximately $3.2 billion in 2023, with a projected CAGR of 11.6% through 2028 (Source: Markets and Markets Research). This includes all potential clients that manage shared resources across corporate, educational, and community sectors worldwide.

Serviceable Available Market (SAM): Focusing on mid-sized to enterprise organizations with multiple shared resources in North America, Europe, and developed APAC regions, our SAM is approximately $1.4 billion. This market segment has both the technical readiness and acute pain points that align with our solution.

Serviceable Obtainable Market (SOM): We project capturing 0.5% of our SAM in Year 1 ($7M), scaling to 2.5% by Year 3 ($35M), and 5% by Year 5 ($70M). This growth trajectory accounts for our go-to-market strategy focusing initially on coworking spaces, modern multi-tenant buildings, and higher education facilities—sectors with immediate need and fastest adoption cycles.

These market size estimates are based on industry reports from Gartner and Forrester, combined with our proprietary analysis of subscription-based SaaS penetration rates in facility management. Our market entry and expansion strategy will focus on high-pain, high-visibility clients that can serve as industry showcases.

2.3 Market Trends

Key market trends that will influence TimeSlotly’s growth include:

- Hybrid Work Transformation: The permanent shift to hybrid work models has created a 173% increase in the need for flexible space management solutions since 2020. With 74% of companies adopting hybrid models (McKinsey, 2023), demand for intelligent resource scheduling is accelerating.

- Space Optimization Focus: Commercial real estate costs have risen 18% in major metros while utilization has decreased, driving a critical need for solutions that maximize efficiency. Organizations now rank space utilization optimization among their top 3 operational priorities.

- Rise of Experience-Centered Workplaces: 82% of workplace leaders cite employee experience as a critical competitive advantage, with resource availability and booking simplicity directly impacting satisfaction scores by up to 28 points.

- Increasing API Integration Requirements: There’s a 35% year-over-year increase in requests for systems that integrate with existing tech stacks rather than standalone solutions, creating opportunities for flexible, API-first platforms.

- Data-Driven Facility Management: The transition from reactive to predictive facility management has created a 47% increase in demand for analytics-powered resource management tools that provide utilization insights.

- Decentralized Resource Control: Organizations are increasingly moving away from centralized scheduling control, with 63% preferring systems that automate management through rules rather than human gatekeepers.

These trends create significant opportunity for TimeSlotly’s automated, rule-based approach to resource management, particularly as organizations seek to reduce administrative overhead while improving user experience.

2.4 Regulatory and Legal Considerations

TimeSlotly’s operations must account for several regulatory and legal considerations:

- Data Privacy Regulations: GDPR in Europe, CCPA in California, and similar regulations globally impact how we collect, store, and process user booking data and behavior metrics. Our compliance strategy includes privacy-by-design principles, data minimization practices, and region-specific data handling protocols.

- Accessibility Requirements: ADA compliance in the US and similar standards worldwide (such as EAA in Europe) require our interfaces to be fully accessible to users with disabilities. Our development roadmap includes regular accessibility audits and compliance testing.

- Industry-Specific Regulations: Certain client segments (e.g., healthcare facilities, government buildings) have specific regulatory requirements for resource management and access control that our customization system must accommodate.

- Contract Law Considerations: As our system enforces booking rules and potentially applies penalties for violations, we must ensure our terms of service and end-user agreements are legally sound across various jurisdictions to prevent challenges to automated enforcement.

- Intellectual Property Protection: Our proprietary algorithms for fair resource allocation and behavior monitoring represent significant IP assets requiring protection through patents, trade secrets, and carefully structured licensing agreements.

To address these regulatory challenges, we’ve incorporated compliance requirements into our product development roadmap, engaged specialized legal counsel for key markets, and built a flexible system architecture that can adapt to regional requirements without compromising core functionality.

3. Customer Analysis

3.1 Persona Definition

TimeSlotly targets the following key customer personas:

Persona 1: Facility Operations Manager (Alex)

- Demographics: 35-50 years old, mid-career professional with facilities management experience, typically earns $70-95K annually, college-educated with technical certification in facility management.

- Characteristics: Practical problem-solver, moderately tech-savvy but values reliability over cutting-edge features, highly focused on efficiency and cost management.

- Pain points: Overwhelmed by scheduling conflicts that require manual intervention, frustrated by the inability to enforce fair usage rules consistently, lacks data to optimize resource allocation, spends too much time on administrative tasks instead of strategic facility improvements.

- Goals: Reduce time spent mediating scheduling disputes, demonstrate improved resource utilization to leadership, increase user satisfaction with facility resources.

- Purchase decision factors: ROI demonstrated through admin time savings, ease of implementation, minimal training requirements for users, reliable support services.

Persona 2: Community Manager (Taylor)

- Demographics: 28-40 years old, early to mid-career, typically earns $55-75K, often has background in hospitality or customer service, bachelor’s degree.

- Characteristics: People-oriented, highly communicative, tech-embracing, values community harmony and member satisfaction above all.

- Pain points: Frequently deals with member complaints about resource availability, struggles to maintain fairness perception among community members, lacks tools to identify problematic usage patterns, wants to reduce confrontational interactions over resource disputes.

- Goals: Increase member satisfaction scores, build a harmonious community environment, transition from reactive conflict resolution to proactive community management.

- Purchase decision factors: User experience quality, customization flexibility for community-specific needs, clear demonstration of reduced conflicts among members.

Persona 3: IT/Operations Director (Jordan)

- Demographics: 40-55 years old, senior professional with 15+ years experience, typically earns $110-150K, has MBA or technical master’s degree.

- Characteristics: Strategic thinker, data-driven decision maker, values integration capabilities and scalability, concerned with organization-wide impacts.

- Pain points: Managing a patchwork of disconnected scheduling systems across the organization, lacks comprehensive data on resource utilization for strategic planning, receives escalated complaints about resource availability impacting productivity, concerned about security and compliance of current solutions.

- Goals: Consolidate resource management under a single, scalable platform, gain actionable insights from usage data, reduce overall operational costs while improving service levels.

- Purchase decision factors: Enterprise integration capabilities, security credentials, analytics depth, total cost of ownership compared to current systems, scalability for future needs.

3.2 Customer Journey Map

A typical TimeSlotly customer experiences the following journey:

Awareness Stage:

- Customer Behavior: Facility managers actively search for solutions after particularly frustrating scheduling conflicts; IT directors review systems during annual technology assessments; community managers seek solutions after member complaints spike.

- Touchpoints: Industry publications, online searches for “resource scheduling problems,” recommendations from facility management networks, industry conferences.

- Emotional State: Frustrated with current inefficiencies, motivated to find solutions, concerned about implementation challenges.

- Opportunities: Targeted content addressing specific pain points by facility type, industry-specific case studies showing quantified improvements.

Consideration Stage:

- Customer Behavior: Comparing multiple solutions, reading customer testimonials, evaluating feature sets against specific requirements, calculating potential ROI.

- Touchpoints: Product website, feature comparison guides, demo videos, ROI calculator, customer testimonials, direct conversations with sales representatives.

- Emotional State: Analytical, cautiously optimistic, concerned about potential disruption to existing processes.

- Opportunities: Interactive ROI calculator, vertical-specific feature guides, transparent comparison with competitors, implementation success stories.

Decision Stage:

- Customer Behavior: Conducting free trial or pilot program, seeking internal buy-in from stakeholders, negotiating terms, planning implementation timeline.

- Touchpoints: Free trial platform, sales representatives, contract negotiation, implementation planning guides.

- Emotional State: Focused on details, concerned about user adoption, hopeful about potential improvements.

- Opportunities: Low-friction pilot programs, stakeholder-specific value proposition materials, flexible contract terms, clear implementation roadmaps.

Usage Stage:

- Customer Behavior: Configuring system for specific needs, training users, monitoring early adoption metrics, addressing initial resistance from users.

- Touchpoints: Implementation team, knowledge base, user training materials, support chat, regular check-in calls.

- Emotional State: Potentially overwhelmed by change management, seeking validation of purchase decision through early wins.

- Opportunities: Exceptional onboarding experience, ready-made templates for common scenarios, proactive support outreach, early success metrics.

Loyalty Building:

- Customer Behavior: Expanding usage to additional facilities, providing referrals, becoming platform advocates, providing feature feedback.

- Touchpoints: Account management team, product update announcements, user community forums, annual review meetings.

- Emotional State: Invested in platform success, eager to maximize value, interested in new capabilities.

- Opportunities: Customer advisory board participation, beta access to new features, case study development, expansion incentives.

3.3 Initial Customer Interview Results

Key insights from our preliminary customer interviews for TimeSlotly product development include:

- Interview Scope: 47 interviews conducted with facility managers, community managers, and operations directors across coworking spaces, university campuses, residential communities, and corporate environments.

- Key Finding 1: 89% of interviewees reported spending 7+ hours weekly managing resource conflicts, with 62% stating this represents their single most time-consuming administrative task.

- Key Finding 2: The most critical pain point cited by 76% of respondents was the inability to enforce fairness rules consistently without creating perception of favoritism or arbitrary enforcement.

- Key Finding 3: 93% expressed strong interest in automated monitoring of user behavior patterns to identify systematic abuses like habitual no-shows or excessive booking.

- Key Finding 4: 71% of respondents prioritized integration with existing building systems (access control, lighting, HVAC) and organizational tools (Microsoft 365, Google Workspace) over standalone functionality.

- Key Finding 5: Surprisingly, 83% valued transparent rule application for users above administrative convenience, indicating user experience should remain a primary focus even for facility-side implementations.

- Key Finding 6: Only 31% currently have access to meaningful analytics about resource utilization, yet 94% indicated such data would significantly influence their facility investment and management decisions.

Based on these insights, we’ve enhanced our product roadmap to prioritize API integrations with major workplace systems, simplified our rule creation interface, expanded our analytics capabilities, and developed pre-configured templates for common fairness scenarios across different facility types.

4. Competitive Analysis

4.1 Direct Competitors Analysis

TimeSlotly’s direct competitors include:

Competitor 1: Skedda (https://www.skedda.com)

- Strengths: Established space booking platform, intuitive visual interface, reputation in workspace management, custom branding options

- Weaknesses: Limited fairness enforcement capabilities, minimal behavioral tracking, less focus on rule enforcement, generic approach to all resources

- Pricing: Freemium model with paid plans starting at $49/month for advanced features

- Differentiation: Skedda focuses on space visualization but lacks TimeSlotly’s smart rule enforcement and user behavior monitoring

Competitor 2: Bookings+ (https://www.bookingsplus.co.uk)

- Strengths: Strong in educational sector, established client base, comprehensive reporting, payment processing integration

- Weaknesses: Limited customization of fairness rules, no automated conflict resolution, dated user interface, regional focus (primarily UK)

- Pricing: Monthly subscription based on number of resources, starts at £25/month

- Differentiation: While comprehensive for educational spaces, lacks TimeSlotly’s smart behavior monitoring and adaptive fairness algorithms

Competitor 3: YAROOMS (https://www.yarooms.com)

- Strengths: Enterprise-focused booking system, strong analytics, integrations with business tools, desk booking specialization

- Weaknesses: Complex setup process, steep learning curve, overkill for smaller organizations, limited fairness enforcement

- Pricing: Enterprise pricing model, typically $4-8 per user per month

- Differentiation: YAROOMS offers robust enterprise features but lacks TimeSlotly’s focus on automated fairness and behavior-based resource allocation

4.2 Indirect Competitors Analysis

TimeSlotly faces several alternative solutions that serve as indirect competitors:

Alternative Solution Type 1: Generic Calendar Platforms

- Representative Companies: Google Calendar, Microsoft Outlook, Calendly

- Value Proposition: Widely adopted, free or low-cost calendar solutions for scheduling with basic resource booking capabilities

- Limitations: No fairness enforcement, minimal conflict resolution, lack specialized features for resource competition scenarios, no behavior monitoring

- Price Range: Free to $12/user/month for premium business features

Alternative Solution Type 2: Property Management Systems

- Representative Companies: Buildium, AppFolio, Cozy

- Value Proposition: Comprehensive solutions for property management including basic amenity booking for apartment complexes

- Limitations: Booking is just a minor feature in a larger system, lacks specialized fairness controls, not purpose-built for intensive resource sharing

- Price Range: $50-$250/month depending on property units

Alternative Solution Type 3: DIY Solutions

- Representative Approaches: Spreadsheets, physical sign-up sheets, email-based systems

- Value Proposition: Zero or minimal cost, simple to implement, highly customizable

- Limitations: Labor-intensive management, prone to human error, difficult to enforce rules consistently, lack of automation, poor user experience

- Price Range: Free (excluding administrative time costs)

4.3 SWOT Analysis and Strategy Development

Strengths(Strengths)

- Purpose-built solution specifically designed for resource competition scenarios

- Automated fairness controls and rule enforcement not available in other platforms

- Behavioral monitoring that encourages responsible resource usage

- Conflict resolution algorithms that reduce administrative oversight

Weaknesses(Weaknesses)

- New market entrant without established reputation or customer base

- Limited resources for marketing and customer acquisition compared to established players

- Horizontal product serving multiple industries may lack deep vertical-specific features

- Initially smaller integration ecosystem compared to established booking platforms

Opportunities(Opportunities)

- Growing global market for shared spaces and resources (coworking, communal living, shared equipment)

- Increasing demand for fairness and transparency in shared resource allocation

- Underserved segment between generic calendars and complex enterprise systems

- Rising costs pushing organizations to maximize utilization of existing resources

Threats(Threats)

- Potential feature expansion by established calendar and booking platforms

- Market fragmentation across different industry verticals

- Resistance to change from organizations using legacy or DIY solutions

- Economic downturns reducing investment in new software solutions

SO Strategy (Strengths+Opportunities)

- Emphasize fairness algorithms as our primary differentiator in marketing to shared economy businesses

- Partner with coworking spaces and apartment complexes to become the standard for transparent resource allocation

- Develop case studies showing improved resource utilization and reduced conflicts to appeal to cost-conscious organizations

WO Strategy (Weaknesses+Opportunities)

- Develop industry-specific templates and configurations to address vertical-specific needs despite horizontal approach

- Leverage API-first architecture to rapidly expand integration ecosystem despite limited resources

- Implement a freemium model to build user base and reputation despite being a new market entrant

ST Strategy (Strengths+Threats)

- Create proprietary fairness metrics and reporting that would be difficult for generic platforms to replicate

- Build a developer community around our API to increase switching costs and reduce threat from competitors

- Emphasize ROI from conflict reduction to maintain sales even during economic downturns

WT Strategy (Weaknesses+Threats)

- Focus initially on specific high-value verticals rather than attempting to serve all markets immediately

- Emphasize seamless migration from DIY solutions to reduce resistance to change

- Develop strategic partnerships with complementary solutions to expand market reach despite limited marketing resources

4.4 Competitive Positioning Map

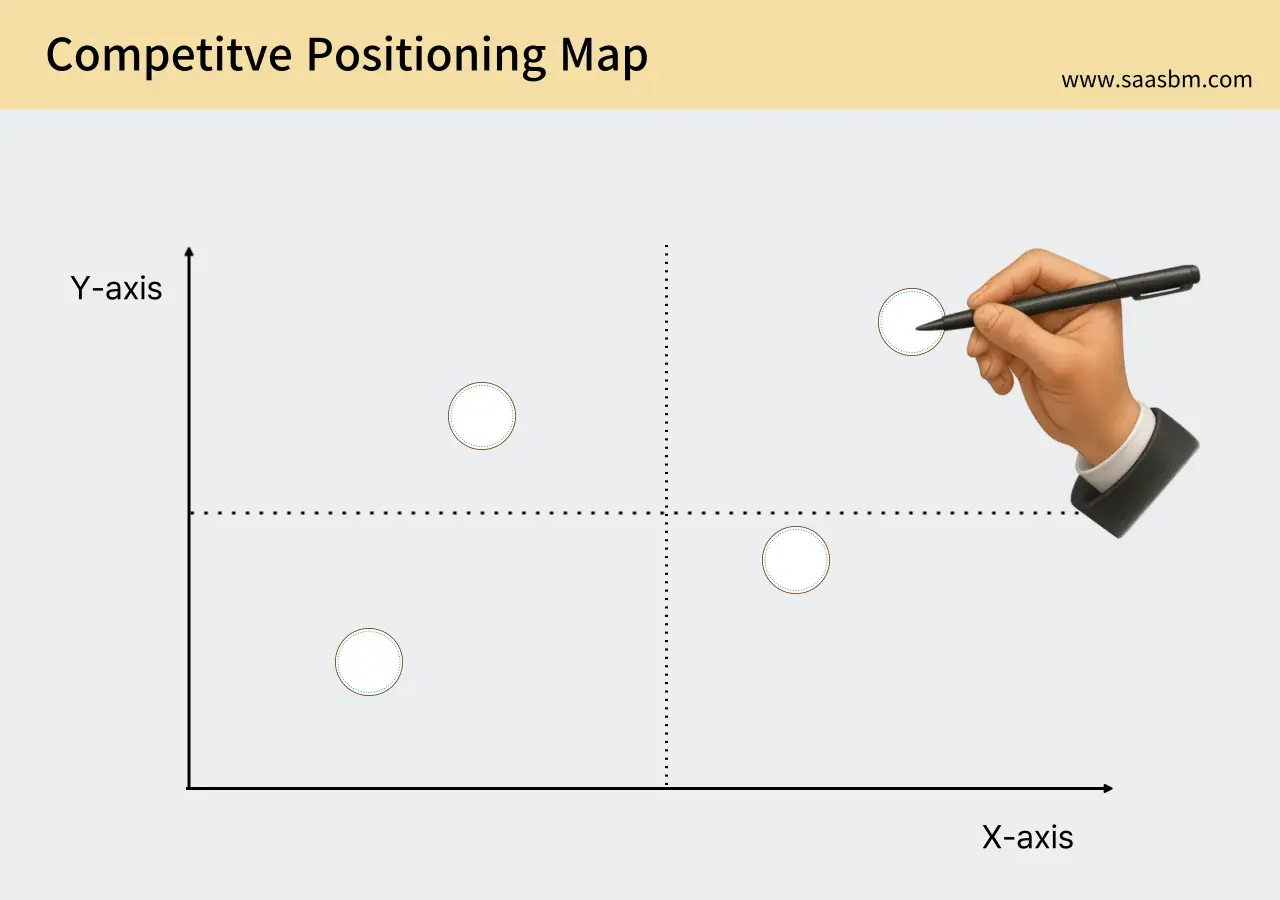

We analyze TimeSlotly’s market positioning against major competitors based on two critical axes:

X-axis: Fairness Enforcement (Low to High) – Measures how effectively the solution enforces equitable resource allocation and prevents monopolization

Y-axis: Specialization for Resource Competition (Low to High) – Measures how purpose-built the solution is for scenarios where multiple users compete for limited resources

In this positioning map:

- TimeSlotly: High Fairness Enforcement, High Specialization – occupies the top-right quadrant as the only solution combining strong fairness enforcement with specialized competition management

- Skedda: Medium Fairness Enforcement, Medium-High Specialization – positioned in the middle-right area with good specialization but moderate fairness features

- Bookings+: Medium Fairness Enforcement, Medium Specialization – positioned centrally with balanced but not exceptional capabilities in both dimensions

- YAROOMS: Low-Medium Fairness Enforcement, Medium Specialization – offers some specialization but limited fairness controls

- Generic Calendars: Low Fairness Enforcement, Low Specialization – positioned in the bottom-left quadrant with minimal capabilities in both dimensions

- Property Management Systems: Low Fairness Enforcement, Low-Medium Specialization – offer slightly more resource-focused features than generic calendars but still limited

This positioning establishes TimeSlotly as the premier solution for scenarios requiring both highly specialized resource competition management and strong fairness enforcement – creating a clear blue ocean strategy that differentiates us from both direct and indirect competitors.

5. Product/Service Details

5.1 Core Features and Characteristics

TimeSlotly offers the following core features and characteristics:

Core Feature 1: Smart Rule Engine

The Smart Rule Engine is TimeSlotly’s central intelligence system that enforces customizable rules for resource allocation, ensuring fairness without requiring constant administrator oversight.

- Sub-feature 1.1: Rule Builder – Intuitive interface for administrators to create custom allocation rules (e.g., “maximum 2 bookings per week per user” or “priority access for premium members”)

- Sub-feature 1.2: Dynamic Allocation Logic – Algorithms that automatically adjust resource availability based on demand patterns and user behavior

- Sub-feature 1.3: Exception Management – Systems for handling special cases and requests without compromising overall fairness

Core Feature 2: Behavioral Monitoring System

The Behavioral Monitoring System tracks user interaction patterns with resources, identifying problematic behaviors and rewarding responsible usage through reputation scores and access privileges.

- Sub-feature 2.1: Attendance Tracking – Automated monitoring of resource usage, no-shows, late cancellations, and early departures

- Sub-feature 2.2: Reputation Score – Dynamic user scoring based on booking behavior that affects future booking privileges

- Sub-feature 2.3: Behavior Analytics – Dashboards showing patterns of resource usage and user behavior over time

Core Feature 3: Conflict Resolution Automation

The Conflict Resolution Automation system preemptively identifies and resolves potential scheduling conflicts without administrator intervention, using fair algorithms and transparent communication.

- Sub-feature 3.1: Waitlist Management – Intelligent waitlist system that considers user reputation, frequency of use, and fair distribution

- Sub-feature 3.2: Dispute Resolution – Automated systems for handling booking disputes with minimal administrator involvement

- Sub-feature 3.3: Resource Recommendations – Alternative resource suggestions when preferred options are unavailable

Core Feature 4: Multi-tenant Resource Management

The Multi-tenant Resource Management feature enables organizations to manage multiple resource types with varying rules, access controls, and user groups under a single system.

- Sub-feature 4.1: Resource Configuration – Customizable settings for different resource types (rooms, equipment, facilities) with specific booking parameters

- Sub-feature 4.2: Group Access Control – Differentiated access and privilege levels for various user groups

- Sub-feature 4.3: Resource Dependency Management – Handling of resource relationships (e.g., equipment that must be booked with a room)

Core Feature 5: Analytics and Optimization

The Analytics and Optimization suite provides deep insights into resource utilization patterns and recommendations for optimizing resource allocation and availability.

- Sub-feature 5.1: Usage Analytics – Comprehensive reporting on resource utilization, peak times, and usage patterns

- Sub-feature 5.2: Optimization Recommendations – AI-driven suggestions for resource allocation improvements

- Sub-feature 5.3: ROI Measurement – Tools for calculating the financial impact of improved resource utilization

5.2 Technical Stack/Implementation Approach

TimeSlotly’s technical implementation is designed for reliability, scalability, and ease of integration, while prioritizing secure and ethical handling of user data.

1. System Architecture

TimeSlotly utilizes a microservices architecture that separates core functionalities into independent, scalable services. This approach enables us to update individual components without affecting the entire system and scale specific services based on demand.

The system comprises four main components: the Resource Management Service, Booking Engine, Behavior Analytics Service, and Client Applications, all communicating through secure APIs.

2. Frontend Development

The user interface is critical for adoption and is designed for intuitive use across devices.

- React.js: Provides responsive, component-based interfaces that work consistently across devices and screen sizes

- Progressive Web App (PWA): Enables app-like experiences on mobile devices without requiring separate app store downloads

- Accessibility-first Design: Ensures compliance with WCAG 2.1 standards for users with disabilities

3. Backend Development

The server-side implementation focuses on reliability, security, and efficient data processing.

- Node.js: Enables efficient handling of concurrent booking requests and real-time updates

- GraphQL API: Provides flexible data querying capabilities that reduce bandwidth usage and improve client performance

- Redis: Powers high-speed caching for booking availability and rule processing

- Kubernetes: Orchestrates containerized services for reliable scaling and deployment

4. Database and Data Processing

Data storage and processing systems are designed for integrity, performance, and analytical capabilities.

- PostgreSQL: Provides reliable transactional database capabilities for booking and user data

- TimescaleDB: Extends PostgreSQL with time-series capabilities for behavior analytics and utilization tracking

- Apache Kafka: Handles event streaming for real-time monitoring and analytics

5. Security and Compliance

Security is fundamental to our implementation, especially given the sensitive nature of booking data.

- OAuth 2.0 and OpenID Connect: Industry-standard authentication and authorization

- End-to-end Encryption: Protects sensitive user data in transit and at rest

- GDPR and CCPA Compliance: Built-in data governance controls for privacy regulation compliance

- Regular Security Audits: Automated and manual security testing processes

6. Scalability and Performance

The system is designed to handle growing demand without degradation in performance.

- Serverless Computing: Uses AWS Lambda for cost-effective handling of variable workloads

- Content Delivery Network: Distributes static assets globally for faster loading times

- Database Sharding: Horizontally partitions data for improved query performance as data volumes grow

- Elastic Infrastructure: Automatically scales resources based on current demand patterns

6. Business Model

6.1 Revenue Model

TimeSlotly employs a subscription-based revenue model that provides sustainable and predictable income while aligning our success with our customers’ continued satisfaction:

Tiered Subscription Model

Our primary revenue stream comes through a tiered subscription model based on the number of resources managed and user groups served. This approach allows organizations of different sizes to adopt our solution at an appropriate price point while providing clear upgrade paths as their needs expand.

Pricing Structure:

- Basic Plan: $99/month

- Management of up to 5 shared resources

- Up to 50 registered users

- Basic scheduling and rule enforcement

- Email support

- Target: Small coworking spaces, apartment complexes with limited amenities

- Professional Plan: $249/month

- Management of up to 15 shared resources

- Up to 200 registered users

- Advanced scheduling rules and conflict resolution

- Basic analytics and reporting

- Priority email and chat support

- Target: Mid-sized facilities, schools, medium-sized studios

- Enterprise Plan: $599/month

- Management of up to 50 shared resources

- Unlimited registered users

- Full suite of fairness controls and advanced rule engines

- Comprehensive analytics dashboard and reporting

- Dedicated account manager and phone support

- Target: Large facilities, campuses, enterprise organizations

- Custom Plan: Tailored pricing

- Custom number of resources and user groups

- API access for custom integrations

- White-labeling options

- Custom rule development

- Target: Organizations with unique or complex requirements

Additional Revenue Streams:

- Premium Features: Add-on modules for specialized features like automated fairness control, usage pattern analysis, and predictive availability

- Implementation Services: One-time fees for custom setup, migration from existing systems, and specialized training

- Integration Partnerships: Revenue sharing with complementary service providers (facility management systems, access control solutions, etc.)

This revenue model offers predictable cash flow while creating incentives for continuous product improvement. The tiered approach minimizes entry barriers while providing natural growth opportunities as customers expand their usage.

6.2 Sales Approach

TimeSlotly will utilize multiple sales channels to reach our diverse target markets efficiently:

1. Self-Service Acquisition

- Channel Description: Fully automated online signup process allowing customers to immediately implement the solution without sales interaction

- Target Customers: Small to medium organizations with straightforward needs and limited budgets

- Conversion Strategy: Free trial period (14 days), transparent pricing, interactive demos, and comprehensive knowledge base

- Expected Share: 40% of total sales in Year 1, growing to 60% by Year 3

2. Inside Sales Team

- Channel Description: Remote sales representatives who qualify leads, provide demos, address complex questions, and assist with implementation

- Key Approach: Consultative selling focused on identifying pain points and demonstrating ROI

- Sales Cycle: 2-4 weeks from initial contact to purchase

- Expected Share: 50% of total sales in Year 1, stabilizing at 30% by Year 3

3. Strategic Partnerships

- Channel Description: Alliances with complementary service providers who can refer or bundle our solution

- Key Partners: Facility management software companies, workspace design firms, property management companies

- Revenue Sharing: 15-20% commission on first-year contract value

- Expected Share: 10% of total sales in Year 1, growing to 25% by Year 3

4. Channel Partners

- Channel Description: Resellers and implementation partners who serve specific vertical markets

- Target Verticals: Education, corporate real estate, fitness industry

- Partner Structure: 25-30% discount on retail pricing, certified implementation training

- Expected Share: Negligible in Year 1, growing to 15% by Year 3

Initially, we will focus on direct self-service and inside sales channels to maintain control over customer experience and gather direct feedback. As the product matures, we will systematically develop partnership and channel relationships to accelerate growth and penetrate specialized markets.

6.3 Cost Structure

TimeSlotly’s cost structure reflects our focus on developing a scalable SaaS solution with reasonable upfront investment and excellent margin potential as we grow:

Fixed Costs:

- Personnel Costs: Monthly $48,000 (4 developers, 1 product manager, 1 customer success specialist, 1 part-time designer)

- Technical Infrastructure: Monthly $3,500 (cloud servers, databases, security, CDN, monitoring tools)

- Office and Equipment: Monthly $3,000 (hybrid work arrangement with small office hub)

- Software Subscriptions: Monthly $1,500 (development tools, productivity software, analytics)

- Professional Services: Monthly $2,000 (legal, accounting, HR)

- Total Monthly Fixed Costs: Approximately $58,000

Variable Costs:

- Customer Acquisition: $150-300 per customer depending on channel (includes marketing, sales commission, onboarding)

- Payment Processing: 2.9% + $0.30 per transaction

- Customer Support: Estimated at $15 per customer per month (scales with ticket volume)

- Infrastructure Scaling: Additional $0.50-1.00 per active user per month for computational resources

- Sales Commissions: 10% of first-year contract value for sales team, 15-30% for channel partners

Cost Optimization Strategies:

- Infrastructure Automation: Implementing auto-scaling to ensure we only pay for resources actually needed

- Support Efficiency: Developing comprehensive self-service support materials and chatbot assistance to reduce support costs

- Remote-First Culture: Maintaining a primarily remote workforce with flexible office arrangements to minimize real estate costs

- Growth Hacking: Emphasizing viral and referral-based customer acquisition to reduce CAC

As we scale, we expect to benefit significantly from economies of scale, particularly in technical infrastructure and customer support. Our target is to reduce customer acquisition costs by 30% within 18 months while maintaining or improving conversion rates. Our cost structure is designed to achieve 70%+ gross margins at scale, typical of successful SaaS businesses.

6.4 Profitability Metrics

TimeSlotly will track the following key financial metrics to measure performance and guide strategic decisions:

Key Financial Metrics:

- Unit Economics: Target contribution margin of 75%+ per customer at scale

- Customer Lifetime Value (LTV): Calculated based on monthly subscription value × gross margin × average customer lifespan in months; target exceeding $5,000 per customer

- Customer Acquisition Cost (CAC): Total sales and marketing expenses divided by new customers acquired; target under $1,000 for self-service and $2,500 for sales-assisted channels

- LTV/CAC Ratio: Target minimum 3:1 ratio, aspiring to 5:1+ as the business matures

- Monthly Recurring Revenue (MRR): Target growth rate of 15%+ month-over-month in Year 1, stabilizing to 8-10% in Years 2-3

- Total Contract Value (TCV): Sum of all active contract values; key measure for investor discussions

- Breakeven Point: Projected to reach operational breakeven at 300-350 paying customers (mix of tiers), expected by month 18

Key Business Metrics:

- Conversion Rate: Target 15% trial-to-paid conversion for self-service; 30%+ for sales-assisted prospects

- Churn Rate: Target maximum 2.5% monthly revenue churn, decreasing to under 1.5% by Year 2

- Upselling Rate: Target 20% of customers upgrading plans annually

- Average Usage: Resource utilization rates, booking frequency, and user engagement metrics

- Net Revenue Retention: Target 110%+ (indicating existing customers generate more revenue over time through expansion)

- Cash Burn Rate: Monthly net cash outflow during pre-profitability phase

- Runway: Months of operation possible at current burn rate with available funds

We will track these metrics through our financial dashboard, reviewing them weekly at the executive level and monthly with the broader team. Each key metric has associated alerts to quickly identify potential issues, and we’ve established a quarterly business review process to deeply analyze trends and adjust strategies accordingly. Our financial models include sensitivity analysis to understand how changes in conversion, churn, and pricing affect overall business health.

7. Marketing and Go-to-Market Strategy

7.1 Initial Customer Acquisition Strategy

TimeSlotly’s strategy for acquiring initial customers focuses on targeted outreach to early adopters who experience acute scheduling pain points:

Content Marketing:

- Resource Management Guides: Comprehensive guides addressing common scheduling challenges in specific industries (coworking spaces, creative studios, etc.), distributed via SEO and industry publications

- Case Studies: Detailed stories of early customers’ transition from chaos to order, highlighting measurable improvements in resource utilization and user satisfaction

- Solution Comparison Tools: Interactive content helping prospects understand when purpose-built scheduling tools outperform general calendaring solutions

- Webinars: Live demonstrations targeting facility managers and administrators of shared spaces, focusing on solving specific scheduling pain points

Digital Marketing:

- SEO: Targeting keywords around “resource scheduling,” “shared amenity booking,” “facility management software,” and industry-specific terms; expected to generate 40% of organic traffic

- SEM/PPC: Google Ads and LinkedIn campaigns targeting decision-makers with problem-aware messaging; monthly budget of $3,000 with focus on high-intent keywords

- Social Media: LinkedIn for B2B audience, Instagram for visually showcasing organized facilities, Twitter for community management discussions; content strategy emphasizing real-world problem solving

- Email Marketing: Lead nurturing sequences tailored to specific verticals, progressive education about scheduling challenges, case-based conversion strategy

Community and Relationship Building:

- Industry Forum Participation: Active contribution to coworking space forums, property management communities, and education technology groups

- Virtual Roadshows: Targeted presentations to industry associations in key verticals (coworking alliance, campus recreation association, etc.)

- Early Adopter Program: Discounted implementation and priority feature development for pioneering customers willing to provide testimonials

Partnerships and Alliances:

- Integration Partnerships: Technical integrations with complementary platforms (access control systems, payment processors, building management software)

- Referral Programs: Incentives for consultants who recommend our solution to clients with scheduling challenges

- Industry Influencers: Collaborations with thought leaders in workplace management, shared economy, and resource optimization

- Technology Marketplaces: Listings in relevant app marketplaces and software directories with special onboarding offers

These strategies will be implemented in a phased approach over the first six months, with content marketing and early adopter outreach taking priority in months 1-2, digital marketing ramping up in months 3-4, and partnership development becoming a focus in months 5-6. We’ll prioritize channels based on lowest CAC and highest quality leads as we gather performance data.

7.2 Low-Budget Marketing Tactics

To maximize our limited initial marketing budget while driving meaningful growth, TimeSlotly will employ the following cost-effective tactics:

Growth Hacking Approaches:

- Product-Led Referrals: Built-in mechanisms allowing satisfied administrators to easily invite other facility managers to try TimeSlotly, with mutual incentives for successful referrals

- Problem-Based Content Seeding: Identifying forums and communities where people actively discuss scheduling frustrations and thoughtfully introducing our solution within contextual conversations

- Free Resource Audit Tool: Simple web-based calculator helping prospects quantify their current scheduling inefficiencies and potential savings, capturing leads in the process

- Localized Launch Strategy: Targeting specific geographic areas for intensive promotion to create density advantages and word-of-mouth opportunities before expanding

- Partnership with Complementary Services: Co-marketing arrangements with non-competing services that target the same customer base (e.g., cleaning services, facilities maintenance)

Community-Centric Strategies:

- Targeted Micro-Communities: Creating highly focused discussion groups for specific user types (e.g., “Coworking Space Managers Network”) to establish authority and gather insights

- User-Generated Content Campaign: Encouraging early users to share their “before and after” scheduling stories with visual content showing transformed spaces

- Virtual Office Hours: Regular open sessions where potential customers can ask questions and see live demonstrations in a non-sales environment

- Industry Challenges Initiative: Launching discussions around major scheduling pain points in specific industries, positioning TimeSlotly as the conversation leader

Strategic Free Offerings:

- Vertical-Specific Templates: Providing pre-configured setups for common use cases (gym equipment scheduling, media studio booking, etc.) to reduce implementation barriers

- Scheduling Assessment: Free consultation analyzing a prospect’s current scheduling approach and providing actionable recommendations

- Limited-Resource Free Tier: Offering perpetually free access for very small organizations (managing 1-2 resources) to build brand awareness and create upgrade opportunities

These low-budget tactics are designed to work within our initial marketing budget of $5,000-7,000 monthly. We expect them to deliver a blended CAC below $500 per customer, significantly better than industry averages. Each tactic will be measured against specific KPIs to quickly identify the most effective approaches for our specific markets, allowing us to double-down on what works as we scale our marketing efforts.

7.3 Performance Measurement KPIs

TimeSlotly will rigorously track the following KPIs to measure our marketing and customer acquisition performance:

Marketing Efficiency Metrics:

- Customer Acquisition Cost (CAC): Measured by channel and campaign; target under $500 for self-service and under $2,000 for sales-assisted; improvement through constant A/B testing of messaging and creative

- Marketing Qualified Leads (MQLs): Prospects showing interest through specific actions; target 500 monthly by Q3; improved through content optimization and lead magnet refinement

- Sales Qualified Leads (SQLs): Prospects meeting criteria for sales engagement; target 40% MQL-to-SQL conversion; enhanced through improved lead scoring algorithms

- Conversion Rate by Channel: Percentage of leads converting to paid customers across each acquisition channel; target minimum 10% improvement quarterly

- Time to Conversion: Average days from first touch to paid subscription; target reduction from 30 to 15 days through funnel optimization

Product Engagement Metrics:

- Free Trial Activation Rate: Percentage of trials where users complete key setup actions; target 65%; improved through enhanced onboarding flow

- Trial-to-Paid Conversion: Percentage of trials converting to paid subscriptions; target 20%; improved through engagement triggers and value demonstrations

- Feature Adoption Rate: Percentage of customers using each core feature; targets vary by feature; improved through in-app education

- Time to First Value: How quickly new users experience meaningful benefits; target under 24 hours; improved through template-based setup

- Admin Engagement Score: Composite metric of administrator actions indicating successful implementation; target minimum score of 70/100

Financial-Related Metrics:

- Customer Lifetime Value (LTV): Projected value of a customer relationship; target minimum $5,000; improved through expansion revenue and reduced churn

- LTV:CAC Ratio: Relationship between customer value and acquisition cost; target minimum 3:1; improved through operational efficiencies

- Payback Period: Time required to recover CAC; target under 12 months; improved through optimized pricing and reduced implementation costs

- Monthly Recurring Revenue (MRR) Growth: Month-over-month growth in subscription revenue; target 15% growth in Year 1

- Expansion Revenue: Additional revenue from existing customers; target 15% annual account expansion rate

These KPIs will be tracked through our integrated analytics dashboard combining data from our marketing automation platform, CRM, product analytics tools, and financial systems. We’ll review metrics weekly at the tactical level and monthly at the strategic level. Our measurement framework includes cohort analysis to understand how different customer segments perform over time, allowing us to refine our ideal customer profile and maximize marketing ROI progressively.

7.4 Customer Retention Strategy

To maximize customer satisfaction and build long-term relationships, TimeSlotly will implement these retention strategies:

Product-Centric Retention Strategies:

- Personalized Onboarding Journey: Tailored implementation process based on facility type and scheduling complexity, with dedicated success specialist for larger accounts to ensure proper setup and initial adoption

- Health Score Monitoring: Proprietary algorithm tracking user engagement, booking optimization, and administrator activity to proactively identify at-risk accounts before they consider cancellation

- Quarterly Feature Releases: Regular introduction of new capabilities based directly on customer feedback, with early access for loyal customers to reinforce value and engagement

- Custom Rules Engine Expansion: Ongoing addition of specialized rule templates addressing unique scheduling scenarios in different verticals, continuously increasing the system’s value

Education and Value Delivery:

- Resource Utilization Reports: Periodic analysis showing quantifiable improvements in resource efficiency, user satisfaction, and conflict reduction compared to pre-implementation metrics

- Administrator Certification Program: Free training and certification for system administrators, creating professional development opportunities and deeper platform knowledge

- Industry Benchmarking: Anonymous comparison of a customer’s scheduling efficiency against industry peers, with actionable recommendations for improvement

- Optimization Consultations: Scheduled reviews with success specialists to analyze usage patterns and suggest configuration adjustments for improved outcomes

Community and Relationship Building:

- Vertical-Specific User Groups: Facilitated communities connecting TimeSlotly users within the same industry to share best practices and configuration approaches

- Customer Advisory Board: Invitation-only forum for influential customers to provide direct input on product roadmap and strategic priorities

- Annual User Conference: Virtual gathering with advanced training, networking opportunities, and exclusive previews of upcoming features

- Success Stories Program: Highlighting innovative implementations through case studies, offering participants promotional opportunities and recognition

Incentives and Rewards:

- Loyalty Pricing Structure: Incremental discounts based on subscription longevity, with significant advantages for multi-year commitments

- Resource Expansion Incentives: Preferred pricing for customers adding new resources or locations to their existing implementation

- Referral Rewards Program: Substantial credits for customers who successfully refer new organizations to TimeSlotly

- Early Renewal Offers: Special terms and additional features for customers who renew contracts before their expiration date

Through these retention strategies, we target a reduction in monthly customer churn from an industry-average 5% to below 2% by the end of Year 1, and further to 1.5% by the end of Year 2. This translates to an average customer lifetime extending from 20 months to over 65 months, dramatically increasing customer lifetime value and creating a stable revenue foundation for continued growth and product development.

8. Operations Plan

8.1 Required Personnel and Roles

TimeSlotly requires the following personnel composition for successful operation and growth:

Initial Startup Team (Pre-launch):

- Technical Co-founder/CTO: Lead platform development, architecture design, and technical strategy. Requires full-stack development experience with scheduling systems, preferably with AI/ML background. Immediate hire.

- Product Manager: Oversee product development, feature prioritization, and user experience. Requires experience with SaaS products, preferably in resource management. Immediate hire.

- UX/UI Designer: Design intuitive user interfaces and seamless experiences. Experience with reservation/scheduling systems required. Immediate hire.

- Full-stack Developer: Implement core application features with focus on scheduling algorithms. Required skills in React, Node.js, and database management. Immediate hire.

First Year Post-Launch Hires:

- Customer Success Manager: Onboard new clients, provide training, and ensure customer satisfaction. Required experience in B2B SaaS. Hire at 3 months post-launch.

- Backend Developer: Strengthen platform infrastructure and improve scheduling algorithms. Required skills in distributed systems and database optimization. Hire at 4-6 months post-launch.

- Frontend Developer: Enhance user interfaces and implement new features. Required skills in modern frontend frameworks. Hire at 6 months post-launch.

- Digital Marketing Specialist: Execute acquisition campaigns and content strategy. Required experience in B2B SaaS marketing. Hire at 6-8 months post-launch.

- Sales Representative: Generate leads and convert prospects to customers. Required experience selling to facility managers or property administrators. Hire at 9 months post-launch.

- QA Engineer: Ensure platform reliability and performance. Required experience in automated testing. Hire at 12 months post-launch.

Second Year Additional Hires:

- Data Analyst: Leverage platform data to improve product and business decisions. Required skills in SQL and data visualization. Hire when reaching 100+ enterprise customers.

- Customer Support Specialists (2): Resolve customer issues and provide technical support. Required excellent communication skills. Hire when support ticket volume exceeds 50/day.

- DevOps Engineer: Optimize infrastructure and ensure scalability. Required experience with cloud services and deployment automation. Hire when user base reaches 100,000+.

- Account Managers (2): Manage relationships with enterprise clients. Required experience in SaaS account management. Hire when enterprise customer base exceeds 50.

- International Market Specialist: Adapt product and marketing for global markets. Required multilingual capabilities. Hire when international expansion begins.

Hiring decisions will be tied to customer acquisition rates, with new technical hires triggered when system load reaches 70% capacity, and customer-facing roles added when response times exceed 24 hours or customer satisfaction drops below 90%.

8.2 Key Partners and Suppliers

TimeSlotly will establish the following partnerships and collaborative relationships for effective operation:

Technology Partners:

- Cloud Infrastructure Provider: Essential for scalable, reliable platform hosting. Potential partners include AWS, Google Cloud, or Microsoft Azure. Will establish partnership at inception with negotiated startup credits.

- Payment Processing Service: Required for subscription billing and payment processing. Potential partners include Stripe, PayPal, or Braintree. Will integrate prior to beta release.

- Authentication Service: Necessary for secure user management. Potential partners include Auth0, Okta, or Firebase Auth. Will implement during initial development.

- Notification Services: Critical for timely alerts and reminders. Potential partners include Twilio, SendGrid, or Mailchimp. Will integrate during MVP development.

Channel Partners:

- Property Management Software Providers: Valuable for reaching apartment complex managers. Potential partners include Buildium, AppFolio, or Yardi. Will pursue after initial product validation.

- Coworking Space Networks: Essential for targeting key customer segment. Potential partners include WeWork, Regus, or local coworking alliances. Will approach during beta testing.

- Facility Management Solution Providers: Important for integration and distribution. Potential partners include ServiceChannel, FMX, or UpKeep. Will pursue after demonstrating product-market fit.

Content and Data Partners:

- Resource Management Consultants: Valuable for best practice content and credibility. Will partner with recognized experts in facility management for case studies and webinars after launch.

- Industry Associations: Important for validation and outreach. Potential partners include International Facility Management Association or Building Owners and Managers Association. Will pursue memberships in Q2 post-launch.

- Academic Institutions: Useful for research and testing. Will establish partnerships with universities for pilot programs and research validation after initial market traction.

Strategic Alliances:

- Complementary SaaS Providers: Valuable for co-marketing and integration. Will target businesses offering complementary services to shared facilities, such as maintenance management or visitor management systems.

- Access Control Manufacturers: Critical for physical integration capabilities. Will pursue partnerships with key players like Salto, HID Global, or Kisi after first year.

- Property Development Groups: Important for early adoption and scale. Will approach major property developers to integrate TimeSlotly in new multi-use developments after establishing market presence.

Partnerships will be developed sequentially, focusing first on technology enablers, then distribution channels, and finally strategic alliances. Success will depend on creating clear mutual value propositions, ensuring technical compatibility through standardized APIs, and establishing specific growth metrics for each partnership.

8.3 Core Processes and Operational Structure

TimeSlotly’s operational excellence will be built on the following core processes and structures:

Product Development Process:

- Research and Discovery: 2-4 week cycles led by Product Manager to identify user needs through interviews and data analysis, producing feature requirement documents.

- Design and Prototyping: 1-3 week sprints led by UX Designer to create wireframes and interactive prototypes, culminating in usability testing reports.

- Development: 2-week agile sprints led by CTO/Technical Lead to build features using continuous integration, resulting in staged feature releases.

- Testing and Quality Assurance: Parallel 1-week cycles by QA Engineer and development team to validate functionality and performance, producing test reports and bug fixes.

Customer Acquisition and Onboarding:

- Lead Generation: Ongoing activities by Marketing Specialist to attract potential customers through content, ads, and partnerships, generating qualified leads.

- Sales Process: 2-4 week cycles by Sales Representative to convert leads through demos, proposals, and negotiations, resulting in new subscriptions.

- Technical Setup: 1-2 day process by Customer Success Manager to configure instance, import data, and set up resource profiles, producing working customer environments.

- Training: 1-3 day process by Customer Success Manager to train administrators and users on platform functionality, resulting in self-sufficient customers.

- Adoption Monitoring: 30-day process by Customer Success team to track usage metrics and provide guidance, with weekly check-ins and a 30-day review report.

Customer Support Process:

- Ticket Management: Immediate response by Support team to categorize and prioritize incoming requests, with acknowledgment within 1 hour.

- Issue Resolution: 4-24 hour process (based on severity) by Support team to troubleshoot and resolve problems, resulting in documented solutions.

- Escalation: Same-day process by Support Lead to route complex issues to appropriate technical teams when needed, with status updates every 4 hours.

- Knowledge Base Updates: Weekly process by Support and Product teams to document common issues and solutions, producing updated help content.

Data and Insights Process:

- Usage Monitoring: Daily automated analysis of platform utilization, resource allocation efficiency, and system performance, generating daily health reports.

- Customer Behavior Analysis: Weekly process by Data Analyst to identify patterns in reservation behaviors, producing recommendation reports.

- Feature Effectiveness Assessment: Monthly analysis by Product team to evaluate feature adoption and impact, resulting in product roadmap adjustments.

- Business Intelligence Reporting: Monthly process by Management team to assess KPIs and growth metrics, producing strategic decision support materials.

These processes will be managed using tools including Jira for development tracking, HubSpot for customer relationship management, Zendesk for support tickets, and Tableau for data visualization. We will implement continuous improvement through monthly process reviews and quarterly efficiency audits.

8.4 Scalability Plan

TimeSlotly’s growth strategy includes the following structured approaches to scaling the business:

Geographic Expansion:

- Months 1-12: Focus on North American markets (US and Canada), with English-language platform and localized pricing. Requires minimal localization resources.

- Months 13-18: Expand to UK, Australia, and New Zealand with tailored marketing approaches for each region. Requires hiring regional marketing consultants and establishing local payment options.

- Months 19-24: Enter Western European markets (Germany, France, Netherlands) with localized versions. Requires translation services, regional compliance reviews, and regional sales representatives.

- Months 25-36: Expand to Asian markets focusing on Singapore, Japan, and South Korea. Requires significant localization, cultural adaptation, and regional partnerships.

Product Expansion:

- Months 1-6: Core scheduling and reservation features with basic rule enforcement. Development focus on reliability and intuitive interfaces.

- Months 7-12: Advanced analytics dashboard and reporting features. Requires data visualization expertise and customer feedback incorporation.

- Months 13-18: Mobile application development for both iOS and Android. Requires mobile development team expansion and cross-platform testing infrastructure.

- Months 19-24: Integration with access control systems and IoT devices. Requires hardware integration expertise and partnership with physical access control providers.

- Months 25-36: AI-powered predictive resource allocation and advanced conflict resolution. Requires data science expertise and large training datasets.

Market Segment Expansion:

- Months 1-12: Focus on coworking spaces and apartment complexes as early adopters. Requires targeted industry-specific marketing materials and use cases.

- Months 13-24: Expand to educational institutions and fitness facilities. Requires developing specialized features for academic scheduling and membership-based organizations.

- Months 25-36: Target enterprise corporate environments and government facilities. Requires enhanced security features, compliance certifications, and enterprise sales team.

Team Expansion Plan:

- Product Development: Grow from initial 4-person team to 15-person department within 36 months, organized into feature-specific squads with dedicated QA resources.

- Customer Success: Scale from 1 manager to 8-person team handling onboarding, training, and retention across different market segments and regions.

- Sales and Marketing: Expand from 2 initial specialists to 12-person team including regional experts, content creators, and segment-specific sales representatives.

- Operations: Build 5-person team focused on systems reliability, data security, and compliance across international markets.

These expansion plans will be triggered based on specific performance indicators: geographic expansion will proceed when market penetration reaches 5% in existing regions; product expansion will be prioritized based on feature request frequency and competitive analysis; and team expansion will occur when individual workload exceeds 85% capacity or response times decline below service level agreements.

9. Financial Plan

9.1 Initial Investment Requirements

TimeSlotly requires the following initial investment to launch and support early operations:

Development Costs:

- Platform Development: $120,000 (6-month development cycle with 4-person technical team)

- UX/UI Design: $40,000 (User research, interface design, and usability testing)

- QA and Testing: $25,000 (Automated testing implementation and manual testing resources)

- Technical Infrastructure: $15,000 (Cloud servers, databases, security systems, and development tools)

- Third-party Integrations: $20,000 (Payment processing, authentication, and notification systems)

- Development Costs Total: $220,000

Initial Operating Costs:

- Legal and Compliance: $18,000 (Entity formation, contracts, terms of service, privacy policy, and GDPR compliance)

- Office Space and Equipment: $24,000 (12 months of co-working space and equipment for core team)

- Team Salaries: $210,000 (6 months of pre-revenue salaries for founding team)

- Administrative Expenses: $12,000 (Accounting, HR, insurance, and operational software subscriptions)

- Contingency Fund: $36,000 (15% buffer for unexpected costs and development delays)

- Initial Operating Costs Total: $300,000

Marketing and Customer Acquisition Costs:

- Brand Development: $15,000 (Logo, visual identity, website, and core messaging)

- Content Creation: $20,000 (Case studies, documentation, video tutorials, and blog content)

- Digital Marketing: $30,000 (6 months of targeted campaigns, SEO, and lead generation)

- Sales Enablement: $15,000 (CRM setup, demo environment, presentation materials)

- Marketing Costs Total: $80,000

Total Initial Investment Required: $600,000

This initial investment is designed to support 12 months of operations, through development, launch, and early customer acquisition phases. The budget is based on a lean startup approach with strategic allocation to technical development (37%), operations (50%), and marketing (13%). The contingency fund provides flexibility for pivots based on early market feedback or to accelerate growth if traction exceeds expectations.

9.2 Monthly Revenue and Expense Projections

The following outlines our projected monthly financials for the first 12 months after launch:

Revenue Projections:

- Months 1-3: $5,000-15,000 monthly (20-60 paying customers across Basic and Premium tiers)

- Months 4-6: $20,000-40,000 monthly (80-160 customers, with increasing Premium tier adoption)

- Months 7-9: $45,000-75,000 monthly (180-300 customers, with initial Enterprise customers)

- Months 10-12: $80,000-120,000 monthly (320-480 customers, with improved revenue per customer)

- Projected Monthly Revenue at Year 1 End: $120,000 (480 customers with 65% Basic, 30% Premium, 5% Enterprise)

Expense Projections:

- Months 1-3: $65,000-70,000 monthly (Core team salaries, infrastructure, initial marketing push)

- Months 4-6: $75,000-85,000 monthly (Added Customer Success and Developer roles, increased marketing)

- Months 7-9: $90,000-100,000 monthly (Added Sales and marketing specialists, scaling infrastructure)

- Months 10-12: $105,000-115,000 monthly (Complete first-year team, increased customer support)

- Projected Monthly Expenses at Year 1 End: $115,000 (Personnel: 70%, Marketing: 15%, Infrastructure: 10%, Other: 5%)

Monthly Cash Flow:

- Months 1-3: $50,000-65,000 monthly deficit

- Months 4-6: $40,000-55,000 monthly deficit

- Months 7-9: $15,000-45,000 monthly deficit

- Months 10-12: $5,000 deficit to $15,000 positive cash flow

- Maximum Cumulative Deficit: Approximately $390,000 (expected at Month 8)

These projections are based on conservative customer acquisition rates of 20-40 new customers per month, increasing to 40-60 per month by year-end. We assume an average customer lifetime value of $3,000 with customer acquisition costs starting at $800 and decreasing to $400 by year-end as marketing efficiency improves. Our financial model accounts for seasonal fluctuations in facility management budgets, with slower growth during summer months and year-end.

9.3 Break-Even Analysis

TimeSlotly’s break-even analysis reveals the following trajectory to profitability:

Break-Even Point Analysis:

- Expected Timeline: 14 months post-launch

- Required Paying Customers: Approximately 520 active accounts

- Monthly Fixed Costs Base: $115,000

- Average Revenue Per User (ARPU): $250 monthly

- Average Variable Cost Per User: $30 (support, infrastructure, payment processing)

- Break-Even Monthly Revenue: $129,000

Post Break-Even Projections:

- Months 15-18: Monthly net profit $15,000-40,000

- Months 19-24: Monthly net profit $45,000-90,000

- Months 25-36: Monthly net profit $100,000-250,000

- Expected Monthly Growth Rate Post-Break-Even: 10-15%

Profitability Enhancement Strategies:

- Months 12-18: Implement automated onboarding to reduce Customer Success workload per client by 40%

- Months 18-24: Develop self-service analytics dashboard to decrease support tickets by 30%

- Months 24-36: Leverage economies of scale in infrastructure to reduce per-customer hosting costs by 50%

This break-even analysis is most sensitive to customer acquisition and retention rates. Each 5% improvement in customer retention adds approximately $6,500 in monthly recurring revenue without additional acquisition costs. Similarly, reducing customer acquisition costs by 10% would accelerate break-even by approximately one month. The analysis assumes continued investment in product development, which while increasing costs, is essential for maintaining competitive advantage and enabling premium pricing tiers.

9.4 Funding Strategy

TimeSlotly’s funding strategy across different growth stages is outlined below:

Initial Stage (Pre-seed):

- Target Amount: $150,000

- Sources: Founder contributions ($50,000), angel investors ($70,000), technology startup grants ($30,000)

- Use of Funds: MVP development, initial market validation, and legal setup

- Timing: Immediate (0-3 months)

Seed Round:

- Target Amount: $600,000-800,000

- Target Investors: Angel syndicates and early-stage VCs specializing in SaaS and property technology

- Valuation Target: $3-4 million (pre-money)

- Timing: 4-6 months pre-launch

- Use of Funds: Complete product development, launch marketing, and 12 months of operating runway

- Key Milestones to Achieve: Platform launch, 300+ paying customers, $50,000 in MRR

Series A:

- Target Amount: $3-5 million

- Target Investors: Venture capital firms focused on B2B SaaS and property technology

- Valuation Target: $15-20 million (pre-money)

- Timing: 18-24 months post-launch

- Use of Funds: International expansion, product line extension, team growth, and enterprise market penetration

- Key Milestones to Achieve: 1,500+ paying customers, $350,000+ in MRR, proven unit economics

Alternative Funding Strategies:

- Revenue-Based Financing: Consider Pipe, Capchase, or similar platforms when MRR reaches $80,000+ to accelerate growth without dilution

- Strategic Partnerships: Explore investment from property management system vendors or facility access control companies after demonstrating product-market fit

- SaaS Accelerators: Apply to specialized programs like Y Combinator or 500 Startups if seed round timing aligns with their cohort schedules

- Venture Debt: Pursue as a complement to Series A to extend runway and minimize dilution once stable revenue is achieved

This funding strategy will be adjusted based on growth metrics, with a willingness to bootstrap longer if customer acquisition costs decrease below projections or if premium tier adoption exceeds expectations. We maintain a contingency plan for a more capital-efficient growth path that would delay geographical expansion in favor of deeper penetration in initial markets if funding conditions deteriorate.

10. Implementation Roadmap

10.1 Key Milestones

TimeSlotly’s development and growth milestones are structured as follows:

Pre-Launch (Months 1-6):

- Months 1-2: Complete market research, competitive analysis, and feature prioritization. Finalize technical architecture and development roadmap.

- Months 2-3: Develop core scheduling engine, resource management database, and basic rule enforcement algorithms. Complete initial UX/UI design.

- Months 3-4: Implement user management, booking workflows, and notification systems. Begin internal testing and QA processes.

- Months 5-6: Develop analytics dashboard, reporting features, and administrative tools. Launch beta testing program with 20-30 select partners.

Post-Launch First Quarter (Months 7-9):

- Public Launch: Release production version with core functionality across all planned platforms. Success criteria: 99.9% uptime and <2 second response time.

- Initial Customer Acquisition: Onboard first 100 paying customers across at least three target segments. Track conversion rate of >2% from trials to paid.

- Product Iteration: Deliver first three feature updates based on beta and early customer feedback. Success measured by 80%+ feature adoption rate.

- Marketing Establishment: Create and publish initial case studies and ROI calculators. Goal of generating 500+ qualified leads.

- Customer Success Framework: Establish onboarding process with customer satisfaction score of 8+/10 and time-to-value under 7 days.

Post-Launch Second Quarter (Months 10-12):

- Scaling Operations: Optimize onboarding process to handle 50+ new customers per month with same team size.

- Product Enhancement: Launch premium features including advanced conflict resolution and custom rule creation. Target 25% upgrade rate from basic tier.

- Integration Capabilities: Release API and first three partner integrations with property management systems. Goal of 15% of new customers coming through integration partners.

- Expansion Preparation: Complete internationalization framework and localization for first additional language. Test with pilot customers in new region.

Second Year Key Objectives:

- Q1: Launch mobile applications for iOS and Android with 40% adoption rate among existing customers. Reach 500 total customers.

- Q2: Establish enterprise sales program with dedicated team and custom deployment process. Sign first 5 enterprise clients with 1000+ users each.

- Q3: Complete expansion to first international markets with localized marketing and support. Target 20% of new customers from international markets.

- Q4: Implement AI-enhanced resource optimization features. Demonstrate 15%+ improvement in resource utilization metrics for customers.

These milestones will be tracked through weekly team meetings and monthly board reviews, with adjustments made based on customer adoption rates and market feedback. Each milestone has a designated owner responsible for timely completion, with escalation protocols for any milestone at risk of slipping more than two weeks from target.

10.2 Launch Strategy

TimeSlotly’s market entry strategy consists of the following carefully sequenced approach:

MVP (Minimum Viable Product) Phase:

- Core Features Definition: Focus on scheduling interface, basic rule enforcement, automated notifications, and administrator dashboard. Excludes advanced analytics and custom integrations to expedite market entry.

- Development Timeline: 4-month intensive development cycle

- Testing Methodology: Weekly internal sprints with manual testing, followed by limited alpha testing with 5-7 friendly users from target segments.